In this first interview of the Luminaries series, the GRC catches up with Dickie Whitaker (cofounder of open catastrophe modelling initiative, the Oasis Loss Modelling Framework and Lighthill Risk Network) to know about the importance of research and development (R&D) investment.

Having set up a number of initiatives aimed at driving greater innovation and collaboration within the industry, how do you see the role of independent research within reinsurance?

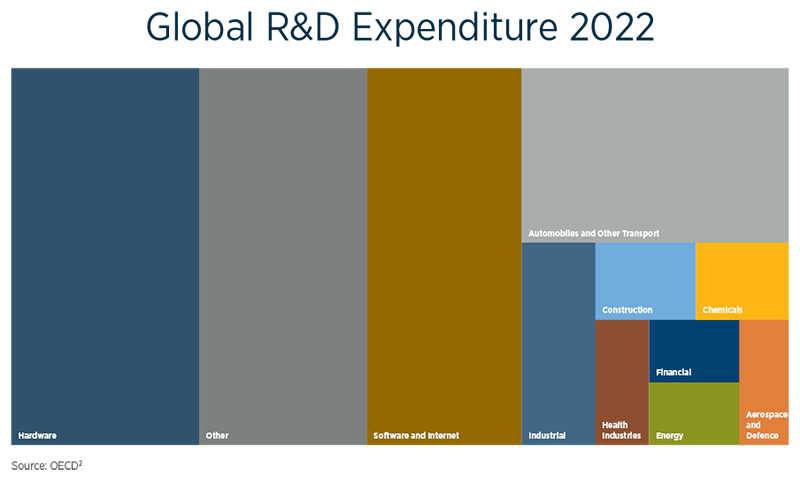

Research and development forms the backbone of productivity and innovation for society. Over the years, R&D has increasingly been at the centre of the evolution in risk management, but from a low base. One of the more recent drivers of this was the influx of talent moving from academia into the reinsurance industry. With that came a different way of looking at the risk(s) — it brought a different discipline, more independence and objectivity, and more expertise. While research has brought minor improvements to the main models, I don’t think we’ve gone far enough. As it stands, the insurance sector still has one of the lowest rates of R&D investment compared to other sectors, and we need a broader and deeper integration with current areas of research.