Employee wellbeing requires joined-up thinking. That’s easier said than done considering the routine lack of integration across business departments. The same applies to suppliers and consultants who traditionally offer discrete and specialist services. The upshot? Solutions are inevitably siloed and often ineffective.

Wellbeing can be described as a state of human comfort, health and happiness, in body and in mind. Several conditions converge that allow people to attain and sustain this state — including being fit, staying on top of work and home priorities, including financial concerns, and adding value in various aspects of life.

It’s not up to employers to create this equilibrium for their employees. But considering the impact of wellbeing on engagement and productivity — not to mention corporate image and reputation — it makes sense to put in place relevant and valued tools that support a healthy workforce. Giving employees access and choice enables them to make informed decisions.

This needn’t involve a huge spend. It’s likely that employers have the proper tools in place already. Most just need a helping hand to ensure current benefits and services are working in harmony. And from an employee experience standpoint, they should be well communicated, understood — and above all — utilised and valued.

Realise the potential of value-added services

Group income protection (GIP) is an example of untapped benefits and services potential. This traditional salary protection insurance comes with a vast array of standard, no-cost early intervention and rehabilitation services. Some common options are employee assistance programmes — including eldercare support — second medical opinion services, care pathway support in mental health, musculoskeletal and cardiovascular health, plus chronic pain and fatigue management.

Some providers even offer to match funds, or completely fund a wellbeing initiative where a specific need is identified. This could be anything from virtual general practitioners and health assessments, to cancer screening or first aid training for line managers.

Why do GIP insurers offer non-financial as well as financial support? Because they have a vested interest in helping employers shoulder the burden of physical and emotional health. This comes in addition to their role in filling the gap left by a constantly retreating welfare state.

Providers are well aware that proactive support leads to lower costs all-round, in terms of reduced claims for them and improvements in absence and presenteeism for employers. It’s a win-win. Or at least that’s the theory.

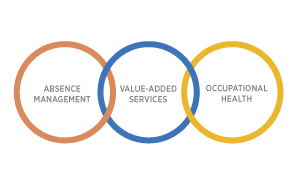

The trouble is, employer awareness of all these value-added services is low — whether a company has GIP in place or not. And even with awareness, the services aren’t being used to their full advantage. It’s safe to say the link to absence management and occupational health isn’t yet realised by many.

Get joined up

Insurers are ready, willing and able to work closely with employers, including their occupational health team if they have one, to help establish this link. Success stories are few, but this is because absence tracking is either non- existent or companies don’t feel ready to share such data despite confidentiality safeguards.

Employers hesitate because they probably can’t yet see the value. Third-party insights on combining software solutions and in-person support can provide perspective. It helps to understand how these resources can be effectively employed to capture absence data, ensure regular and confidential data sharing, enable robust analysis by all parties, and maximise the use of early intervention and rehabilitation services.

Assess needs

Once the core benefit and service aspects are in place, it’s time to look at what else the workforce needs and values. And this takes really getting to know employees as people. Unlocking that allimportant discretionary effort calls for communication, of course, but also a total wellbeing strategy.

Benefits need to align appropriately with the employee experience — created by engaging the whole person beyond the confines of the workplace. Wellbeing is influenced by rewarding personal and community connections, too.

The younger generations are driving the move towards a more flexible and socially responsible culture and ethos. Alongside the corporate need to control costs, this trend is ensuring a change in the very nature of employment practices.

Consider where the ‘untethered’ workers fit in

It seems that working for yourself in the UK — by accident or design — is de rigueur. The latest estimates from the Office for National Statistics put the number of self-employed in the UK at 4.8 million, or 15% of all workers, up from the 3.3 million who accounted for 12% at the start of the decade. These statistics include traditional freelance roles and contractors as well as gig workers.1

For all the flexibility and independence that contractors have, these workers are surprisingly time poor. And gig economy workers don’t necessarily have these same freedoms to the extent that other contractors do. This trend may well be the future of work, but it’s not without issues at the moment. A recent report raises questions around the lack of job security and lower pay, and suggests a new category of ‘dependent contractor’ with certain employment rights.2

In light of these changes, is wellbeing a consideration for these non-employee workers? There’s a growing incentive for employers to ensure their duty of care responsibilities are extended to contractors. But it seems this won’t involve just simply offering existing packages to more people. That would neither be feasible for employers nor relevant to contractors.

However, there is potential for organisations to leverage their scale and buying power to help give both employees and contractors access to benefits and services — on significantly better terms than they’d get as individual consumers.

Any voluntary or self-pay benefits and services offered should be suited to the lifestyles of contractors. These could include anything from life and health insurance, to discounts on household insurances such as home, motor and pet, as well as energy bills, petrol, cinema tickets and restaurants.

Offer help to look after the pennies

Financial wellbeing is an important pillar of any total wellbeing strategy. Man may not live by bread alone, but still needs to pay for whatever he or she consumes in life. And again, gaining insights into employees’ related financial needs and goals is key to putting in place the right resources.

This could be as simple as ensuring the government support for advice provision is utilised — the Pension Advice Allowance and taxexempt employer funded advice.

Employees who are middle aged and older need a lot of help these days to get their heads around saving — for what will hopefully be a longer, healthier retirement than their grandparents enjoyed. Thanks to pension freedoms, there’s the myriad options at retirement, and that’s another good reason to promote wellbeing through access to financial advice.

Learning how to protect savings from financial fraud represents one more learning curve, and education in this regard could be valued and productive. It’s also a good idea to at least consider something more radical, such as contributing to a house deposit scheme for younger employees — prior to switching to pension contributions.

The fact is, it’s difficult to find anyone in their 20s who cares much about a pension. But getting on the property ladder is likely to be a highly valued prize that contributes to attraction, engagement, retention, and altogether better total wellbeing.

Talk to Providers to Reap Big Rewards

- Integrated wellbeing depends on the support of suppliers as much as it does the organisation’s own business departments. Get help from them to ensure everyone is walking the talk.

- Look at maximising existing benefits to ensure wellbeing and manage absence. Work with providers to make the most of all added-value GIP benefits and services.

- Ensure duty of care responsibilities are extended to contractors as well as employees. Consider leveraging the organisation’s scale and buying power to offer competitive voluntary and self-pay benefits.

- Office for National Statistics, ‘Trends in self- employment in the UK’, February 2018

- Matthew Taylor, ‘Good Work: The Taylor Review of Modern Working Practices’, July 2017