The provision of a workplace pension is only the start of financial wellbeing. To truly engage employees with saving and help ensure financial resilience across a diverse workforce, employers need to get creative and tap into employees’ needs.

How much can and should employers do when it comes to financial wellbeing? They could be forgiven for thinking what once was simply selecting a generic pension has turned into a huge, scientific marketing exercise.

While encouraging pension saving is still vital, if organisations want to be destination employers, they need to offer financial education and tailored support.

This may appear a bit daunting, but in reality, providing tailored support is a fairly straightforward task: tap into employee motivation via communications targeted to needs, direct employees towards good financial advice, and make full use of the government’s pensions advice allowance and tax exemptions.

Benefits to the business

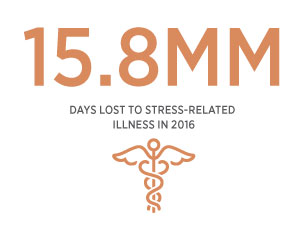

Helping employees become financially resilient has proven advantages — in particular, it helps reduce worries, stress, absence and presenteeism. Around 15.8 million days were lost to stress-related illness in 2016, according to figures from the Office for National Statistics (ONS).1 About 32% of these were related to money worries — in other words, nearly 5 million days.

It’s not surprising then that nine in 10 employers agree that financial concerns have an impact on workplace performance, according to research by the Financial Conduct Authority (FCA).2

Mounting student debt and other vulnerabilities

Satisfying everyone’s needs can be tough when considering the different priorities of employees. An increasing number of older employees are delaying retirement because they can’t afford to stop working, while younger employees are focused on more immediate issues such as mounting student debt and high housing costs.

Students in England are graduating with average debts of £50,800 when interest rates on student loans are factored in, according to the Institute for Fiscal Studies.3

A report last year by the FCA found that half of UK — 25.6 million people — may be financially vulnerable.4 This is due to several reasons, such as heavy debt; inability to cope with a small financial shock (e.g., an unexpected £50 rent increase); and the inability to cover living expenses for even a week if they lose their main source of income.

More financial stability for women

Meanwhile, this year’s inaugural gender pay-gap reporting has paved the way for more transparency, recognition and equality. Various industry bodies and organisations are promoting, educating and creating awareness about financial stability and protection for women.

For example, according to the Insuring Women’s Futures, the Chartered Insurance Institute’s programme of awareness raising, about one-third of women in their 30s say their money wouldn’t last a month without their main source of income.5

Trouble ahead for cohabitees?

Cohabitation represents the fastest growing family type in the UK, with the number of cohabiting couples rising from 1.5 million in 1996 to 3.3 million in 2017, according to 2017 data from the Office for National Statistics.6

Few in cohabiting partnerships have considered how they’d pay the bills, if they were cut off from the main source of household income through job loss or breakdown of the relationship. And, unlike married couples, cohabitees are not entitled to receive the state pension or bereavement allowance for deceased partners.

In addition, there may be complications in some pension schemes paying out to the surviving unmarried partner in the event of the other’s death, especially when it comes to occupational schemes. While most schemes deal with married couples, they will not necessarily account for cohabiting partners.

Meaningful and targeted communications

Clearly, the traditional one-size-fits-all, pension-focused approach to financial wellbeing cannot meet the needs of today’s diverse workforce. Employees want more relevance and choice in financial benefits.

But where do organisations start? How do employers know what their employees need? When do they need it? And how do they measure the effectiveness of your efforts? For answers, look to employee experience (EX).

The concept of EX was born out of the need to answer these questions: not just for financial wellbeing or HR purposes, but for all business departments. Understanding EX helps explain why financial wellbeing — as part of an overall employee wellbeing strategy — is worth the time and investment.

Put simply, EX is the sum of everything an employee experiences in regards to the employer, from the perception of an organisation pre-employment, the onboarding experience, employment and everyday life to rewards and recognition, learning and development, exit and retirement.

EX drives employee engagement throughout an individual’s working life. And it’s attracting board-level support. Why? Because it’s now possible to demonstrate tangible value to a company’s productivity and profitability through true, analytics-based measurements of ROI.

Using behavioural insights, EX can provide the foundation for employee communications that help ensure engagement with financial wellbeing products, benefits and services.

Financial advice: the ultimate in tailoring

Once communications are launched, the next step is to assess whether they’re directing employees to relevant benefits and services. The FCA found that 57% of employees want financial advice and one-third would pay for an employer-provided, in-house financial adviser.² In light of this, it’s worthwhile for employers to consider offering access to advice that is regulated, due-diligence checked and scheme-specific.

Such advice could be funded by the government’s Pension Advice Allowance, permitting up to three £500 tax-free withdrawals from the employee’s pension pot during their lifetime. Another option is the Tax Exemption for Employer- Arranged Pensions Advice that allows an employee up to £500 per tax year towards financial and tax advice. The latter allowance is available via a salary sacrifice arrangement, and also includes instances in which an employer reimburses an employee for pensions advice.

A question of employee advocacy

In the face of financial insecurity for younger and older employees alike, a focus on financial wellbeing is more important than ever. What’s more, tailoring plans and advice to needs is essential.

This exercise can be as complex or as straightforward as an organisation desires. The important thing? Do something.

1 Office for National Statistics, ‘Total

of 137 million working days lost to sickness and injury in 2016’, March

2017

2 Financial Conduct Authority,

‘Financial Well-being in the Workplace: A Way Forward’, March 2017

3 Institute for Fiscal Studies, ‘The 2012

tuition fee reforms made the poorest graduates £1,500 better off, but reforms

since have more than wiped out this gain’, July 2017

4 Financial Conduct Authority, ‘Understanding the financial

lives of UK adults: Findings from the FCA’s Financial Lives Survey 2017’,

October 2017

5 Chartered Insurance

Institute, ‘Securing the financial future of the next generation’, February

2018

6 Office for National

Statistics, ‘Families and households in the UK 2017’, November 2017