Protectionist measures are reshaping international trade, exposing Nordic businesses to economic headwinds and market volatility. For instance, Sweden's Ministry of Finance predicts a 0.15-0.4 percent dip in overall GDP due to export slumps1. The evolving interplay between global economic policies and regional business strategies highlights the critical need for adaptability to remain resilient in an unpredictable market.

Contributing factors

The following factors are contributing to the current economic and trade uncertainties facing Nordic businesses:

- Lingering economic downturn and inflation: While some sectors are still navigating the financial recovery from the post-COVID economic fallout, the added pressure of inflation has posed further challenges. According to a recent report, the risk of insolvency in Sweden is still rising in several sectors, including hospitality, manufacturing and construction2. However, with inflation showing signs of stabilisation, these sectors may find opportunities to accelerate their recovery.

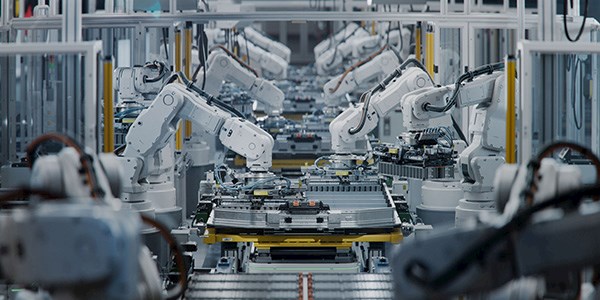

- Rising material costs and resource scarcity: The manufacturing, construction and technology sectors are feeling the pressure of higher input costs, which are further intensified by global economic uncertainty and shifting trade policies.

- Tariffs and trade uncertainty: The rise of tariff-based protectionism is a major contributor to market volatility. US tariffs on steel, aluminum and automobiles, and the potential for EU retaliatory measures are raising fresh concerns for the Nordic region's export-reliant industries. According to a Nordea Bank report, while the direct impact of tariffs on the Nordic economies remains sizable but manageable, the indirect impact — driven by reduced business confidence and heightened uncertainty — poses greater risks3.