Author: Tom Addison AIA C.Act

FOR PROFESSIONAL INVESTORS ONLY

This article is a financial promotion and has been approved on 30/09/2025 by Gallagher (Administration & Investment) Limited, who is authorised and regulated by the Financial Conduct Authority.

Life insurers rarely get to be the stars of financial headlines. They are the financial industry's slow-burning giants: stable, cautious, and designed to endure. Yet their half-year results tell a bigger story — offering a snapshot of how well they're balancing promises to policyholders against the realities of volatile markets, rising long-term interest rates, and shifting demographics.

H1 2025 results versus prior year

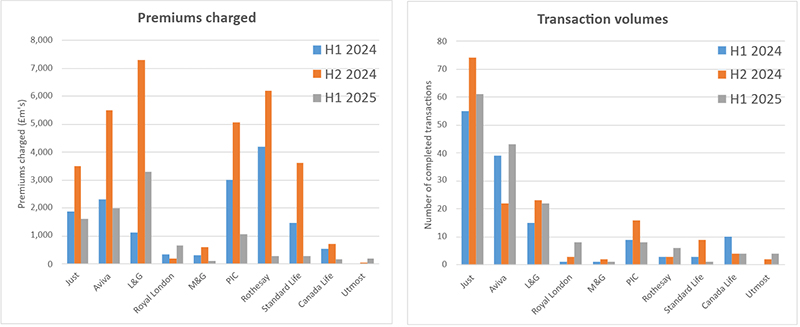

All of the insurers that were active in the market throughout the first half of this year have announced their results. In the first half of 2025 nearly 160 transactions were completed — an increase of c.20% from the number completed by insurers in H1 2024.

It is clear from the published results that H1 2025 has been driven by a high number of smaller schemes approaching the market, with very few 'large' (£500m+) transactions.

The charts below show that, overall, there was an increase in the number of deals transacted by insurers active in the market throughout the first half of 2025, with a number of the insurers seeing meaningful increases in transaction volumes. However, only L&G and Royal London received higher premiums overall (and it should be noted that Royal London's transaction in H1 2024 was with an in-house scheme).

Source: Data sourced directly from insurers and publicly available information. Figure quoted for Utmost is based on the SCR reported for Utmost Life and Pensions. Canada Life excluded as no SCR published as at 30 June 2025.

Could the second half of the year see some 'mega transactions', as was the case last year? L&G noted in their results that they "are actively pricing on £17bn of new deals" and expect a further £27bn to all transact before the curtains close on the 2025 financial year. Nine of these possible transactions are for schemes with liabilities over £1bn. Trustees, insurers and risk brokers are all set to be busy then — but we think it's unlikely that total premiums in 2025 will surpass 2023's record and breach the £50bn mark. Aviva agrees, noting in their results they anticipate overall market "volumes for 2025 to be lower than 2024".

The advent of capital-light BPA

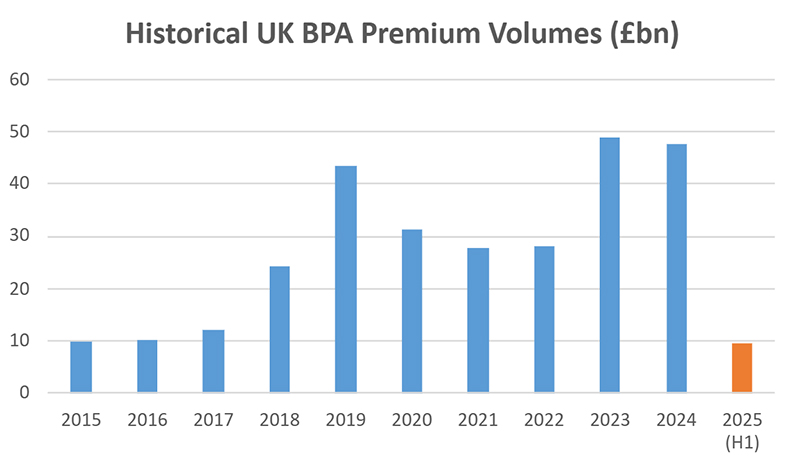

As insurers have seen higher demand for BPA transactions, the efficiency of their quotation processes has improved, and this has been a major factor in historical premium volumes increasing over the past decade (as shown by the chart below).

Source: Data sourced directly from insurers and publicly available information. Figure quoted for Utmost is based on the SCR reported for Utmost Life and Pensions. Canada Life excluded as no SCR published as at 30 June 2025.

Indeed L&G's Flow, Just's Beacon, Aviva's Clarity and PIC's Mosaic processes are designed to make transacting with schemes quicker, easier and more consistent from scheme to scheme. Across 2023, it was human capital that was the limiting constraint, and many insurers invested heavily in increasing their teams and capacity. It's perhaps no surprise that this investment has begun to show in the numbers.

But we think the results show something more interesting that isn't getting much attention – the strength of insurer balance sheets.

;

;

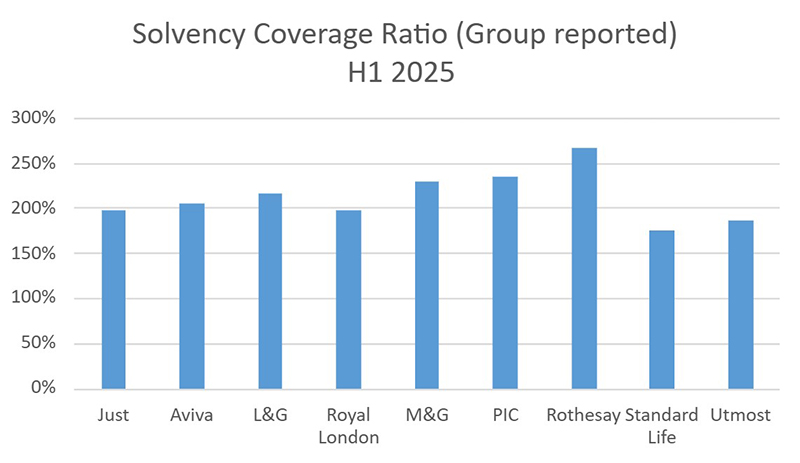

Source: Data sourced directly from insurers and publicly available information. Figure quoted for Utmost is based on the SCR reported for Utmost Life and Pensions. Canada Life excluded as no SCR published as at 30 June 2025.

Insurers hold capital significantly in excess of what they are required to under the Solvency II regulations. This is demonstrated in the chart above - all insurers can be seen to be well capitalised with Solvency Capital Ratios ranging between 175% and 266%. Whilst a high Solvency Capital Ratio (SCR) is great news for the security of members receiving their pensions, for an insurer it may mean that capital isn't being deployed as efficiently as it otherwise could be. Could this lead to more aggressive insurer pricing in the second half of the year if insurers look to deploy excess capital on their balance sheets?

Historically, bulk annuities have been thought of as a capital-intensive product by insurers, but several insurers have driven their business towards "capital-light BPA".

New business strain is the additional 'capital' insurers are obliged to set aside to meet regulatory requirements when they write new policies to ensure there is a 99.5% chance that they can meet their obligations over a 1-year time horizon. If the capital insurers are required to set aside to meet regulatory requirements is lower, then the cost of writing new business is lower. In their H1 2025 results, Just Group announced their new business strain had reduced to 1.1% (from 1.5%) and L&G reported they were transacting at c. 1% new business strain.

The shift towards capital-light BPA and writing business at a low level of new business strain has been made possible through the availability, and purchasing, of 'better' assets (i.e. assets which give a higher yield with the same level of risk), the use of longevity reinsurance and selective asset reinsurance. Solvency UK reforms have reduced the risk margins that regulations require to be held, along with the freedom to make certain 'accounting judgements' (since new business strain is not defined in the accounting standards).

We draw three key insights from this shift to capital-light BPA:

- The first is that there are no regulatory and capital constraints preventing insurers from continuing to write high volumes of BPAs whilst the demand exists in the market. Where capital requirements may have caused issues historically, capital-light BPA means any impact of writing new business on solvency and capital requirements is now less pronounced.

- Second, assuming the level of 'profit' from transacting remains unchanged, then lower new business strain levels lead to a higher return on equity for the insurer. It will be interesting to see where the floor on new business strain is and whether a difference emerges between publicly listed companies (whose shareholders are often focused on short-term volatility in capital needs, low strain and quicker returns) and privately held providers who are traditionally less concerned by these factors.

- Thirdly, insurer asset origination teams are succeeding in finding 'good' assets to hold to support the liabilities being taken on. By finding assets that are Matching Adjustment (MA) eligible, give higher returns for the same level of risk and are a good match to their liabilities, insurers can hold less capital as a 'buffer' to protect against worse than expected experience, thereby reducing new business strain. It is probably little surprise then that insurers and alternative investment managers are combining to take advantage of this — with Royal London announcing it has agreed to acquire Dalmore capital (May 2025) and Just announcing its Board has recommended an offer from Brookfield to take the company private (July 2025).

The future for insurer pricing and profits

The UK BPA market remains competitive and innovative. Clara (the UK's first superfund to complete The Pensions Regulator's assessment process) has continued its momentum from 2024 into 2025, penning a deal using Clara's connected covenant feature and marking its fourth transaction to date.

Overall, market sentiment through the first half of 2025 has been that insurers have improved pricing for transacting schemes due to increased competition, and this is coming through in the decreasing new business margins (expected future profits) in the results of insurers. These margins remain healthy, and we will be keeping a close eye on how this develops through the remainder of 2025 and into 2026. Our view is that this shift is being driven less by underlying market conditions (schemes continue to be well-funded against a high gilt yield backdrop) and more by commercial choices and the capital dynamics set out above.

Competitive pressures have pushed insurers to prioritise premiums and market share by 'winning' transactions at lower margins. However, gains in capital efficiency act to reduce the effective 'cost' of writing new business and allows providers to accept tighter pricing whilst still meeting their internal return hurdles. Improved capital efficiency and the lower levels of new business strain mean these thinner margins can still generate attractive returns on equity and make the trade-off more acceptable. In combination, this has created a strategic willingness to write deals at lower new business margins. The implication for pension schemes is that transaction pricing is likely to continue to be favourable, creating a window of opportunity for schemes to secure attractive de-risking terms. Could your scheme be one that benefits from the dynamics at play?

For more information on how Gallagher could help with your Risk Transfer journey, please contact us.

Important notice: This article is for Professional investors only; it is generic in nature and should not be regarded as providing specific advice or a recommendation of suitability. No action should be taken without seeking appropriate advice. There can be no guarantee that the opinions expressed in this article will prove correct.