FOR PROFESSIONAL INVESTORS ONLY

This article is a financial promotion and has been approved on 19/01/2026 by Gallagher (Administration & Investment) Limited, who is authorised and regulated by the Financial Conduct Authority.

What can trustees take from the results of LIST 2025?

What is LIST, and what's different about LIST 2025?

LIST is a stress-testing exercise conducted by the PRA to evaluate the resilience of the life insurers under its regulation. It serves as a supervisory tool to assess the sector's ability to withstand 'severe but plausible' events and to identify potential vulnerabilities in risk management practices.

The 2025 iteration of LIST focused on the largest BPA insurers1 and introduced three primary objectives:

- To assess sector and individual firm resilience to 'severe but plausible' events

- To strengthen market understanding and discipline through the publication of individual firm results

- To improve insight into risk management vulnerabilities

This is the first LIST exercise conducted under the new Solvency UK regulatory framework and the first to include individual firm-level results. The 2025 exercise consisted of two main components: a core scenario and two exploratory scenarios. The aggregate results of the core scenario were published on 17 November 20252, with the individual firm results released on 24 November 20253.

The exploratory scenarios aim to assess what the PRA views as emerging risks — namely 'asset type concentration' and 'FundedRe'. However, the results of these exploratory scenarios were not disclosed at an individual level due to the challenges in consistently assessing and quantifying these risks.

Looking ahead, the PRA intends to conduct LIST exercises every two years, with in-scope insurers being notified 12 months in advance.

The core scenario: a severe stress test

The core scenario was designed to simulate a severe stress, broadly equivalent to a 1-in-100 year risk event. This stress test unfolded in three stages:

- Stage 1 represents an immediate financial markets shock as risk-free interest rates decline, credit spreads widen, and equity values fall sharply. This stage tested insurers' ability to absorb a sudden repricing of risk across their portfolio.

- Stage 2 develops the market stress with a wave of credit rating downgrades, large scale defaults and delinquencies alongside both residential and commercial property values falling. This stage simulates the effect of the prolonged market stress and deteriorating credit asset quality on solvency positions and Matching Adjustment (MA) portsfolios.

- Stage 3 sees markets starting to stabilise and liquidity beginning to improve, with firms given the option to implement management actions from a pre-defined list.

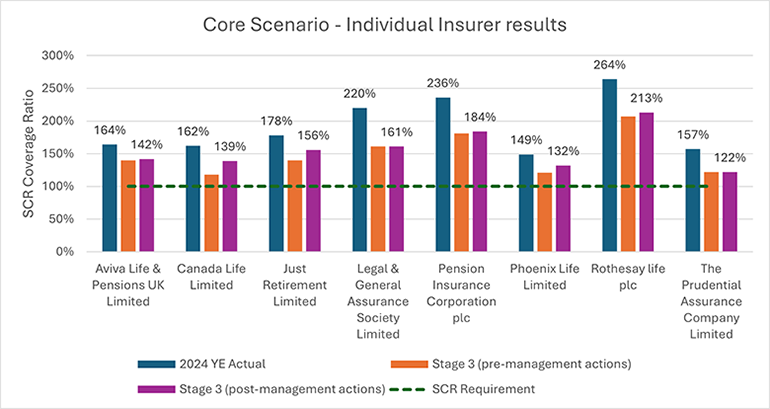

Results from the core scenario

Combined together, in this financial market stress scenario firms experience the following outcomes:

- An £8.6 billion reduction in capital surplus above regulatory requirements

- £12.9 billion of assets downgraded to below sub-investment grade

- The aggregate Solvency Capital Requirement (SCR) coverage ratio falling from a strong starting point of 185% to 154% post-stress

PRA noted that "Despite this deterioration, participating firms maintain sufficient capital resources, all firms continue to meet their regulatory capital requirements, underscoring the sector's robust starting position and ability to absorb significant shocks of the kind tested in the exercise."

Whilst LIST 2025 - like previous stress tests - is not a pass-fail exercise, the fact that all insurers maintained an SCR coverage ratio of over 100% is testament to the resilience of the sector.

The impact of the stress test varies across individual firms due to differences in business mix (i.e. monoline or multi-line insurer), risk profiles (i.e. the composition of assets in the MA portfolio) and other factors. Some key drivers of the results include:

- Use of management actions: Insurers were allowed to implement a standard set of management actions. Not all firms elected to use the management actions available to them, and the list of available actions may not incorporate the full set of actions that might have been available to individual insurers.

- Downgrades and defaults: Credit rating downgrades act to reduce the MA benefit and lower own funds. Simultaneously, defaults reduce the value of the asset and increase the SCR due to higher capital charges.

- Interest rates: Lower interest rates act to reduce discount rates and increase the present value of assets and liabilities - whilst raising capital requirements.

- Property stress: A sharp fall in residential property values (particularly acute for equity release mortgage assets which were subject to one of the largest stresses) in the core scenario also acted to reduce own funds and lower SCR coverage.

- With-profits funds: Since these arrangements are ring-fenced they cannot be used to absorb losses elsewhere. This is reflected in the SCR coverage by excluding surplus eligible own funds above the SCR and consequently the impact of the stress test depends on how substantial with-profits funds are within the firm.

- Starting position: Insurers with the highest starting SCR coverage ratios are the ones that see the largest reduction; this is a direct result of the nature of the calculation.

The LIST exercise was performed at operating company level by Aviva Life & Pensions UK Limited ('Aviva'), Canada Life Limited ('Canada Life'), Just Retirement Limited ('Just'), Legal & General Assurance Society Limited ('L&G'), Pension Insurance Corporation plc ('PIC'), Phoenix Life Limited ('Standard Life'), Rothesay life plc ('Rothesay') and Prudential Assurance Company Limited ('M&G').

Limitations of LIST 2025

The PRA has acknowledged there are limitations that arise from simplifications within LIST 2025's design. To this end, trustees should recognise that LIST 2025 is not an all-encompassing benchmark of insurer financial strength and resilience, and the results should not be viewed in isolation. Trustees should be aware that the core scenario is just one possible scenario, and even under this scenario, risks may evolve differently in reality.

LIST 2025 excludes several key material factors that BPA providers are exposed to — most notably, longevity risk.

Public disclosures in respect of the two exploratory scenarios were limited, and trustees may need to seek additional information to understand how the exposure to these emerging risks (and how they are managed) varies across insurers.

Nonetheless, LIST 2025 provides insight into the financial resilience of the BPA sector and the public disclosure of the individual results represents a positive step towards greater transparency.

Disclaimer:

Please note that Gallagher does not act as a counterparty risk adviser for insurer covenants. If you have any concerns or require specific advice regarding insurer covenants, we strongly recommend seeking guidance from a qualified and independent covenant adviser.

If you find this insight useful, you may enjoy our Risk Transfer webinar series in February 2026, for which you can now register here. As part of this, our team will be reflecting on published results, providing insight on how the market dynamics have evolved through to Q1 2026 and explaining how Gallagher has helped its clients to benefit from our market-leading understanding of the BPA insurance landscape. Alternatively, for more information on how Gallagher could help with your Risk Transfer journey, please contact us.