Author: Shannon Gunderman

Litigation funding has emerged as a significant force in the legal field. According to reports, third-party litigation funders invested $15.2 billion in the US in 2023, a figure that could reach $31 billion in the next five years.1 While traditionally associated with private sector disputes, its influence is increasingly being felt within the public sector.

This article reviews the impact of litigation funding on public entities and the strategies you can employ to effectively manage this risk.

What is litigation funding?

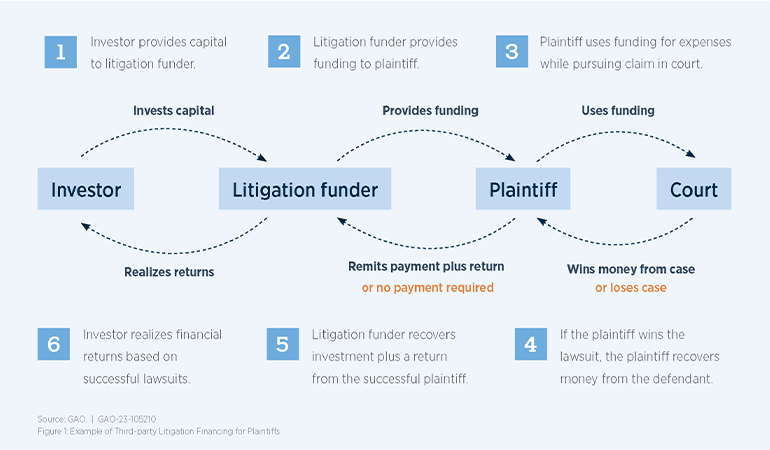

Litigation funding is a financial arrangement in which a third-party funder provides monetary support to a plaintiff or law firm to pursue a legal case. This funding covers various expenses, including attorney fees, court costs and expert witness fees. In return, the funder receives a share of the financial recovery if the case is successful.

Here's how litigation funding works:

Key characteristics of litigation funding

- Non-recourse financing: The funder recovers their investment only if the case is successful.

- Risk management: Funders perform due diligence to assess the merits and potential returns of a case.

- Access to justice system: Plaintiffs have the financial means to pursue legal action they might otherwise be unable to afford.

Impact of litigation funding on the public sector

Imagine an inmate dies in a county jail. The decedent, a 35-year-old male, was arrested for a minor offense and was awaiting trial. During his incarceration, the inmate reportedly suffered from a medical condition that the jail staff allegedly ignored or inadequately treated. The family of the deceased believes that the jail's negligence and failure to provide proper medical care caused his untimely death. They seek the advice of a local attorney who specializes in civil rights and wrongful death cases. After reviewing the case, the attorney determines that it has merit but would require significant resources to litigate effectively due to its complex nature. The attorney recommends partnering with a litigation funding company.

The litigation funding company analyzes the case and agrees to fund the litigation. A wrongful death claim is filed, alleging violations of the inmate's constitutional rights. The family seeks compensation for emotional distress and loss of companionship, in addition to punitive damages.

With the financial backing of the litigation funder, the attorney pursues an aggressive litigation strategy that includes hiring top-tier experts, conducting extensive discovery and filing motions that prolong the case. Since the county is self-insured and has a high self-insured retention, it has to bear substantial costs to defend the case.

The wrongful death claim and the subsequent litigation also attract media attention, leading to public scrutiny of the county jail's operations and a notable increase in public records requests from media outlets and community activists. The litigation funder and the attorney also work to highlight systemic issues within the jail to strengthen the plaintiff's position, further amplifying the case's visibility and reputational damage to the county.

The foregoing scenario highlights some of the challenges that litigation funding presents for the public sector. Here are some additional risks to consider:

Increased litigation

- Accessibility: By lowering the financial barriers to litigation, funding enables the filing of more lawsuits against public entities, which could increase the volume of cases that an entity has to defend.

- Complex cases: Public entities may face more complex and high-stakes litigation, as funders are willing to invest in cases with significant potential returns. As case complexity increases, there may be a need to hire outside counsel that has the specific expertise and experience to handle the case, which often increases the overall costs to defend the case.

Financial strain

- Budgetary impact: Increased litigation can strain public sector budgets, diverting resources from essential services to legal defense and settlements.

- Insurance costs: Public entities may experience increases in insurance premiums due to the heightened risk of litigation and significant losses.

Strategic considerations

- Risk management: Increased costs to develop robust risk management strategies that mitigate the impact of litigation funding.

- Policy development: Additional time is spent developing policy changes to address the challenges posed by litigation funding.

- Reputation management: Adverse litigation outcomes from high-profile cases can negatively affect a public entity's reputation with its citizens and embolden other litigation funders to identify and pursue future litigation opportunities.

Higher verdicts and settlements

- Resource allocation: Funded cases often have access to superior resources, including expert witnesses and comprehensive research, increasing the likelihood of higher verdicts.

- Aggressive strategies: Funders may encourage aggressive legal strategies to maximize returns, potentially leading to higher verdicts.

- Extended litigation: With financial backing, plaintiffs can sustain prolonged litigation, pressuring defendants into larger settlements.

Lack of transparency

Currently, the litigation funding industry isn't significantly regulated, resulting in a lack of transparency in the details of funding agreements and the identities of the investors funding the litigation. This lack of transparency raises concerns over conflicts of interest, undue and possibly inappropriate influence from third-party funders, and the potential weakening of trust in the legal system.

Protecting your entity from litigation funding exposures

Public entities can adopt several strategies to manage the risks associated with litigation funding.

- Comprehensive insurance: Invest in comprehensive insurance policies that cover a broad range of risks, including general liability insurance, professional liability insurance, and workers' compensation. Adequate coverage helps manage the financial risks associated with litigation, especially in cases where litigation funding might lead to larger settlements.

- Contract review: Ensure that legal professionals thoroughly draft and/or review all contracts, which will mitigate risks associated with ambiguous terms that could lead to disputes and a weak bargaining position should a dispute arise.

- Strengthen internal capabilities and resources: Hire skilled legal professionals and maintain appropriate budget to pay for legal expenses. Develop policies that improve legal strategies and create protocols for effectively defending cases that litigation funders finance.

- Promote efficient dispute resolution and collaboration: Encourage the use of mediation and arbitration to resolve disputes cost-effectively and avoid litigation. Develop strategic partnerships with other public sector entities and community organizations to share resources and expertise, reducing the financial burden of legal processes.

- Employee training: Implement training programs for employees regarding operational policies, protocols and procedures to reduce the likelihood of incidents that may lead to litigation. Evidence of a solid training and compliance program also helps the entity provide a stronger defense should a claim be filed.

- Stakeholder engagement: Engage with stakeholders to understand and address concerns related to litigation funding.

- Legislative monitoring: Monitor legislative and regulatory changes that could protect public entities from undue litigation funding pressures.

The rise in litigation funding necessitates a strategic response from public entities to effectively manage this risk. As litigation funding continues to evolve, public entities need to be proactive in adapting their risk management strategies to ensure they're well-equipped to handle the complexities and demands of this growing trend.