Authors: Stephen Tench Joel Phipps

The Challenge:

Catastrophe fund Le Fond de Solidarité contre les Evènements Catastropiques (the FSEC) sought a more comprehensive Earthquake model, which would quantify the property damage of the uninsured residences from earthquake (EQ) perils, including claims related to the “uninhabitability” or “deprivation of enjoyment” of a property - an additional payout to an uninsured owner or tenant of a residence rendered uninhabitable by an earthquake, which covers the rental value of the property. It also sought a structure which would allow for faster payment of claims, helping the FSEC to meet its liabilities to the uninsured population of Morocco following an earthquake.

The Solution:

The Gallagher Re Middle East and North Africa (MENA) team initially modelled the property damage of uninsured residences in the region, using a fully probabilistic uniform risk and loss modelling methodology to provide a cross-correlated view of the seismic risk. This Gallagher Re MENA Earthquake Model was developed in collaboration with Gallagher Research Center.

Working alongside research partners such as NASA, GEM and University College London, the team then developed tailor-made vulnerability curves for residential buildings based on their occupancy type, e.g. rural housing, villas and apartments, to take into account the client request to account for the “uninhabitability” or “deprivation of enjoyment” of a property payouts.

This enhancement used the latest science and research to provide FSEC with the best solution available to quantify risk in Morocco, and completed the Gallagher Re View of Risk for FSEC.

In a typical property insurance cover a premium is paid to cover the actual loss and indemnify the insured against a named peril or incident. The loss payment is made only after a loss assessor and investigation has taken place. In contrast, a parametric product covers the probability of a pre-defined event happening, with an agreed pay-out.

The key difference is that no assessment of the loss is required, only confirmation that the event has occurred. The event can be defined by the magnitude (e.g. earthquake moment magnitude) or the experienced hazard (e.g. shaking intensity).

For the FSEC, a parametric solution allows transparent settlements of claims, without the need to assess the physical damage done, providing faster capital to the organization and ensuring FSEC can meet its liabilities as they are assessed.

In addition, a parametric solution is highly customizable, allowing FSEC to tailor the product to their needs.

In Detail: The FSEC’s Parametric Design

When designing a parametric cover there are two key components: the trigger(s) and the payout mechanism.

The cover is triggered if an event occurs, or is exceeded, and is measured using an objective parameter that can be correlated to a specified risk and in turn a financial loss to the insured. For FSEC, the trigger is any earthquake event with a magnitude (Mw) equal to or greater than 4.5, a Modified Mercalli Intensity scale (MMI) equal to or greater than 5.0 in any commune, and an epicenter within a defined geographical region in Morocco.

MMI is a seismic intensity scale describing and measuring the perceived damage, impact and shaking resulting from an earthquake. The lower part of the scale focuses on “felt perception” whilst the higher part of the scale focuses on the damage done to buildings. Gallagher Re believes that MMI is a suitable trigger for FSEC as MMI best represents the “ground-truth” of an event as this is based on what the population experiences. The MMI and the magnitude are provided using the USGS (US Geological Survey) ShakeMap product providing an independent verification of an event.

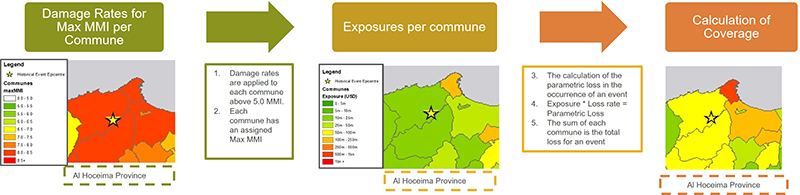

The second element of a parametric product is the pay-out mechanism. The parametric loss is the exposure value multiplied by a predetermined loss rate, bucketed by the maximum MMI felt in a commune. A maximum MMI value is recorded for every commune in Morocco after an event. The higher MMI recorded, the higher the loss rate and thus the compensation paid. For example, an earthquake event with an MMI of 6.5 in a commune will have a set pay-out. In contrast, any earthquake event with a max MMI below 5.0 will not lead to any pay-outs as the parametric trigger has not been sufficiently satisfied.

The sum of the individual commune losses determines the overall parametric loss for an event. As previously mentioned, the pre-agreed pay-outs of the parametric solution offers rapid compensation for FSEC, helping them meet their liabilities to the uninsured population of Morocco following an earthquake.