By Jamia Canlas, CFA, Eric Elbell, CFA, CAIA and John Regan

The Yield Curve 101

The yield curve is a graphic representation of corresponding yields on U.S. Treasury bonds across various maturities at any given time. Normally, the yield curve slopes upward, meaning that longer-maturity bonds have higher yields than shorter-maturity bonds (for example, see the line in the chart below depicting the yield curve as of 6/29/2018).  The shape and steepness of the yield curve (i.e., the spread between longer-term and shorter-term rates) reflect bond market investors’ collective expectations for factors such as economic growth, inflation, future interest rates and monetary and fiscal policies.

The shape and steepness of the yield curve (i.e., the spread between longer-term and shorter-term rates) reflect bond market investors’ collective expectations for factors such as economic growth, inflation, future interest rates and monetary and fiscal policies.

Inverted Yield Curve and Recessions

On occasion, yields on the shorter end of the curve rise above yields on the longer end of the curve, producing what is called an inverted yield curve. This phenomenon has occurred in recent periods, as reflected in the yield curve shown above as of 6/28/2019, when yields on intermediate-term bonds had fallen below short-term yields. A widely-followed measure of the yield curve’s steepness, the 10 year/2 year Treasury yield spread, has also fallen to multi-year lows and turned negative, or inverted, on the morning of August 14, 2019.

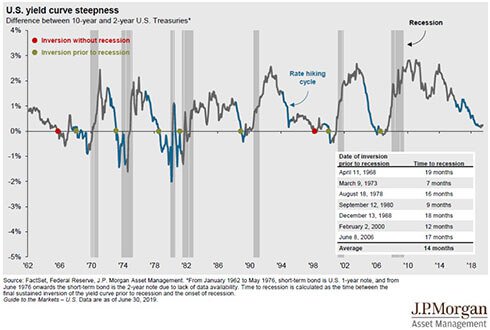

Investors closely watch this relationship between shorter- and longer-maturity bond yields given that an inverted yield curve has often preceded an economic recession. As illustrated in the chart prepared by J.P. Morgan shown to the left, this relationship has held for each of the last seven recessions since the 1960s.

Recession Looming?

Given this historical pattern, does the current shape of the yield curve mean a U.S. recession is looming right around the corner? Perhaps, but not necessarily. For one thing, as also seen in the chart above, there have been two “false positives” over the past 50 years―that is, cases where the yield curve inverted but a recession didn’t subsequently develop. In addition, in the cases where an inverted curve has preceded a recession the duration of time between the start of the inversion and the start of the recession was anywhere from 7 months to 19 months, so even if the relationship holds this time around it could still take some time for a recession to unfold.

We also believe it’s important to consider various forces impacting the current market environment. For instance, yields on the shortest portion of the curve are typically related to Federal Reserve policy, and until very recently the Fed was in a tightening mode, having increased the federal-funds target rate range seven times over a three-year period through the end of 2018. At the same time, U.S. Treasuries, despite their low yields, remain more attractive compared to government bonds in other countries, such as Germany and Japan, some of which even offer negative yields. This has driven demand from foreign investors for relatively higher-yielding U.S. Treasuries, thereby pushing U.S. Treasury bond prices higher and yields lower (bond yields move inversely with prices) across the intermediate and long ends of the U.S. Treasury curve.

In addition, as previously mentioned, the shape and steepness of the yield curve reflect market expectations of, among other factors, future interest rates. As such, the shape of the curve since late 2018 could be an indication that the market has been “pricing in” future Fed rate cuts―which, in fact, the Fed subsequently enacted in late July.

What the Experts are Saying

To gain further insight on the importance of the yield curve, we surveyed some bond managers on Gallagher’s Manager Focus List. Following are their respective comments as of August 13, 2019:

BlackRock

“It is not necessarily the yield curve inversion itself that brings about the recession, but rather that it can reflect excessively tight monetary policy, which is the real underlying cause of the downturn.

The below chart plots the gap between the real Fed funds rate and our estimate of neutral; the shaded areas show U.S. recessions and periods when the Treasury yield curve has inverted. Every recession has been preceded by tight monetary policy, with the real Fed funds rate comfortably above neutral."

Currently U.S. monetary policy still looks like it is in accommodative territory (or at most close to neutral). The fact that policy is not excessively tight and indeed that the yield curve inversions have followed a series of dovish Fed surprises, suggests that this in and of itself is not a recession harbinger.”

Loomis Sayles

“We agree that inverted yield curves tend to occur prior to periods of economic recession, but the date of inversion and start of recession can be near or can be far apart. The US yield curve should steepen, and moderate curve inversions should reverse course, as the Fed eases policy by cutting short term rates throughout the remainder of 2019. We believe the Fed overtightened in 2018 while fiscal stimulus and corporate tax cuts were temporarily boosting economic activity. As a result parts of the Treasury yield curve inverted, but we believe Fed rate cuts will lead to steeper curves and reverse those inversions.”

PIMCO

“The PIMCO Investment Committee doesn’t think a recession is imminent. In fact, we still see general positive growth across the globe and we see the US economy growing in the 2% range as well. Certainly, as the yield curves flatten we want to take notice. We want to understand what’s going on and we do think that there’s more uncertainty on a go forward basis. In fact, we have a quite consequential and highly uncertain, US presidential election in this country, and we still have considerable uncertainty around global trade in particular China. We think that it is also premature to suggest that a recession is right around the corner simply because we’ve seen some inversion in a portion of the US Curve.”

Conclusion

Although a yield curve inversion has been a fairly reliable predictor of a recession in the past, it does not cause a recession or always signal impending doom for the economy; rather, it is only one of many warning signs to be mindful of. We believe the different circumstances outlined above have contributed to the recent inversion of the U.S. yield curve, making it difficult to predict that the inversion signals an imminent recession. Despite the recent slowdown in global growth, the U.S. economy remains solid, with muted inflation, a strong job market and a healthy consumer backdrop. Furthermore, the Fed‘s recent pivot to a more dovish stance increases the likelihood that the yield curve will eventually revert to its normal shape.

This material was created to provide accurate and reliable information on the subjects covered, but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation.

Investment advisory, named and independent fiduciary services are offered through Gallagher Fiduciary Advisors, LLC, an SEC Registered Investment Adviser. Gallagher Fiduciary Advisors, LLC may pay referral fees or other remuneration to employees of AJG or its affiliates or to independent contractors; such payments do not change our fee. This document contains confidential and proprietary information that belongs to Gallagher Fiduciary Advisors, LLC and is protected by copyright, trade secret and other State and Federal laws. Any copying, redistribution or retransmission of any of the contents without the written consent of Gallagher Fiduciary Advisors, LLC is expressly prohibited. Gallagher Fiduciary Advisors, LLC is a single-member, limited-liability company, with Gallagher Benefit Services, Inc. as its single member. Neither Arthur J. Gallagher & Co., Gallagher Fiduciary Advisors, LLC nor their affiliates provide accounting, legal or tax advice.

Consulting and insurance brokerage services to be provided by Gallagher Benefit Services, Inc. Gallagher Benefit Services, Inc. is a licensed insurance agency that does business in California as Gallagher Benefit Services of California Insurance Services and in Massachusetts as Gallagher Benefit Insurance Services. Neither Arthur J. Gallagher & Co., nor its affiliates provide accounting, legal or tax advice.