MARKET FACTORS FOR PUBLIC COMPANY D&O

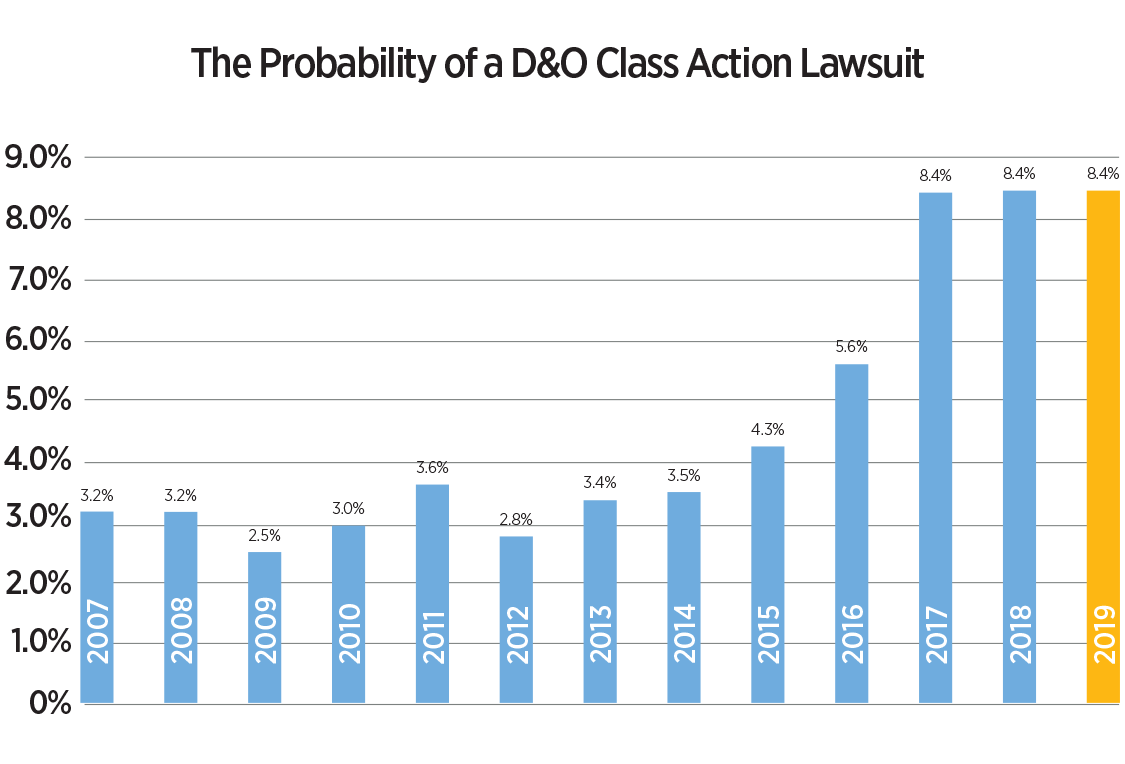

A number of factors continue to be relevant to the state of the market, namely record-high frequency, heightened severity, and rate of litigation (i.e., probability of a securities class action filing). Each one presents consternation for underwriters of public company D&O.

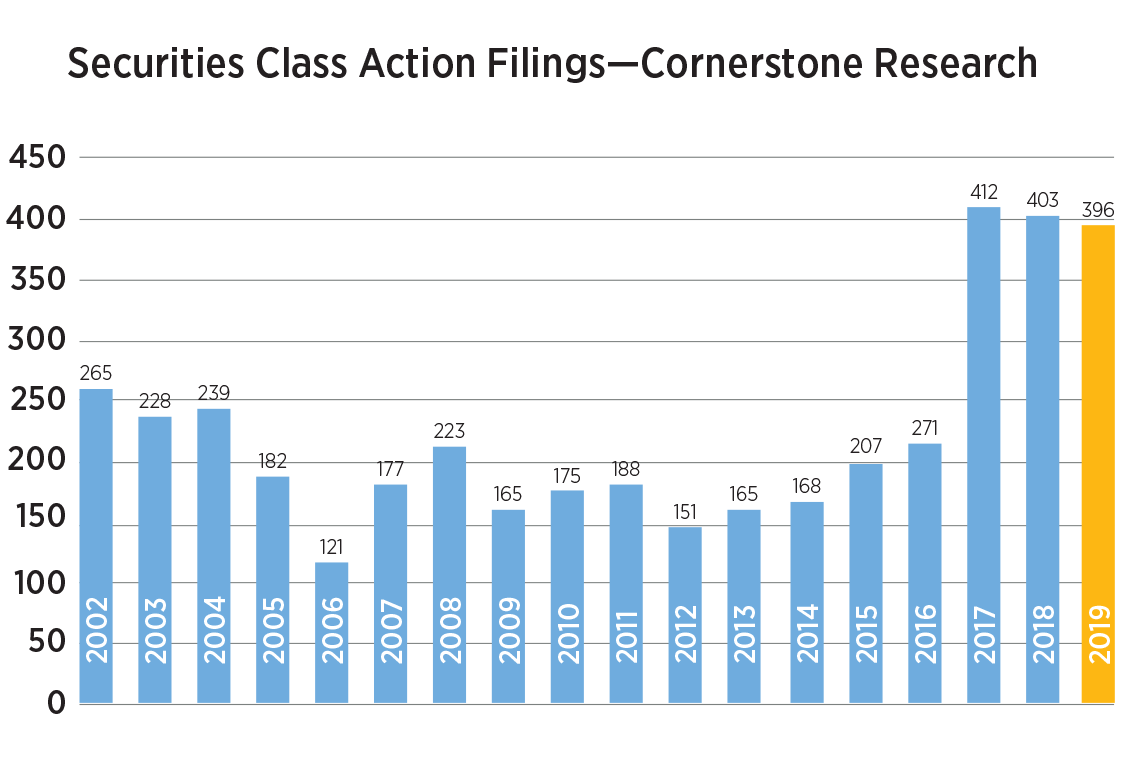

As often referenced, 2017 reported a record high in securities class action frequency with 412 filings and 2018 close behind at 403 filings. Unfortunately, the numbers for the first half of 2019 suggest another year of near-record levels, assuming a similar pace of filings continues for the second half of the year. Specifically, Cornerstone’s analysis for the first half of 2019 reports 198 filings. If annualized to a projected 396 filings for this year, 2019 would fall just below 2017’s record high. To put this in perspective, 2019 is projected to be 87% higher than the 20-year semiannual historical average.1

The severity of securities class action filings is also a concern. Cornerstone reports for the first half of 2019 the disclosure dollar loss (DDL) was $180 billion.2 The DDL is the aggregate market capitalization drop for firms with securities class action filings. While it is not a direct measure of ultimate severity, it does provide insight into the impact of information on stock price and an overall sense for the size of the filings. Generally, the larger the market capitalization drop, the larger the ultimate settlement will be. With a DDL for the first half of 2019 measuring $180 billion, it is the highest on record and approximately three times the historical average.3 Cornerstone attributes this to more megafilings (i.e., DDL greater than $5 billion).

This, compounded with the heightened DDL from the prior two years, creates a significant pipeline of securities class action severity. The news does not improve when evaluating the rate of litigation. With fewer publicly traded companies and increased frequency of litigation, approximately 8.4% of all public companies are subject to securities class action filings each year compared with the 20-year historical average of 2.99%. Cornerstone expects 8.4% for 2019 as well.4

Certain industries appear to be targeted by the plaintiff’s bar. The Consumer noncyclical sector experienced the highest frequency with 47 filings.5 Drilling down further within the sector, 32 of the 47 were against biotechnology, pharmaceuticals, or healthcare companies. There are a few explanations for why these sectors face continually heightened claims frequency. First, they continue to be active in IPOs, allowing the plaintiff’s bar a lower pleading standard. Second, the plaintiff’s bar is also changing. Over the last few years newer law firms are entering the securities class action arena. These emerging law firms contribute to increased frequency, but also shift the plaintiff’s bar’s focus to now include smaller issuers and smaller damages cases. Finally, based on operational risk, these sectors are more likely to have non-accounting cases brought against them arising out of their misstatements or disclosures surrounding clinical trials or products.

The Supreme Court’s Cyan decision in March 2018 held that the Securities Litigation Uniform Standards Act of 1998 (SLUSA) does not eliminate state courts’ jurisdiction over claims brought solely under the Securities Act of 1933 and that those claims cannot be removed to federal court. At the time of the decision, there was much speculation about jurisdictional shifts of these cases. We are only now getting a sense of the ruling’s impact on filing behavior. Cornerstone reports that almost half of post-Cyan 1933 filings (26 of 61), were filed solely in state court. While 26 filings in just over a year might not seem overly concerning in terms of absolute numbers, Cornerstone’s data suggests that state filings will outstrip federal filings for Section 11 claims. Therefore, many are concerned about increased defense costs, forum shopping, and an overall unpredictability of results.

CURRENT STATE OF THE MARKET

With increased frequency, severity, rate of litigation, and jurisdictional problems post-Cyan, how is the public D&O market responding? On the spectrum, the market is certainly hardening with respect to pricing, retentions, and capacity. However, terms and conditions remain relatively stable, which leads many to refrain from calling it a “hard market”—yet. Primary and lower excess layers continue to be the most difficult. Increases of 10%–25% are typical and even the best risks are receiving increases, although most likely single digits. Higher excess layers are not immune from market pressures, and we are beginning to see a shift in their “minimum” rate per million metrics.

There is an upward pressure on retentions as well. Retentions have been viewed by many as a pricing mechanism set at a level to encompass the motion to dismiss. With the rise of defense costs, retentions continue to be part of the renewal negotiations. Biotech and pharma companies continue to be challenging placements with increasing retentions and reduced capacity, paired with pricing increases.

For all renewals, an early start to the renewal process will be paramount. Underwriting meetings continue to be particularly effective in getting your message across and building rapport with your D&O insurers, especially in this hardening market.

1https://www.cornerstone.com/Publications/Reports/Securities-Class-Action-Filings-2019-Midyear-Assessment

2Ibid.

3Ibid.

4Ibid.

5Ibid.

About the Author: Natalie Douglass, Esq. is the Chief Legal Director in Gallagher’s Management Liability Practice. This group focuses on risk management services, including insurance placement related to executive and management liability issues. Her responsibilities include development of intellectual capital, negotiating enhanced coverage terms for Gallagher’s book of business, and assisting in best practices for coverage and exposure analysis.