A liquidity crisis in the U.S. overnight lending market. Short-term borrowing rates spiking rapidly. The Federal Reserve injecting billions into the banking system to stabilize financial markets. This scenario, infamously associated with the start of the global financial crisis in 2008, presented itself again in September of 2019. Was the recent disruption a harbinger of impending economic and market turmoil as seen in 2008, or merely a glitch in an otherwise well-oiled U.S. banking system? This update will examine recent events in a corner of the financial markets known as the “repo market,” and discuss the implications for the U.S. economy and whether these events should be a cause for investor concern.

The Repo Market – An Explanation

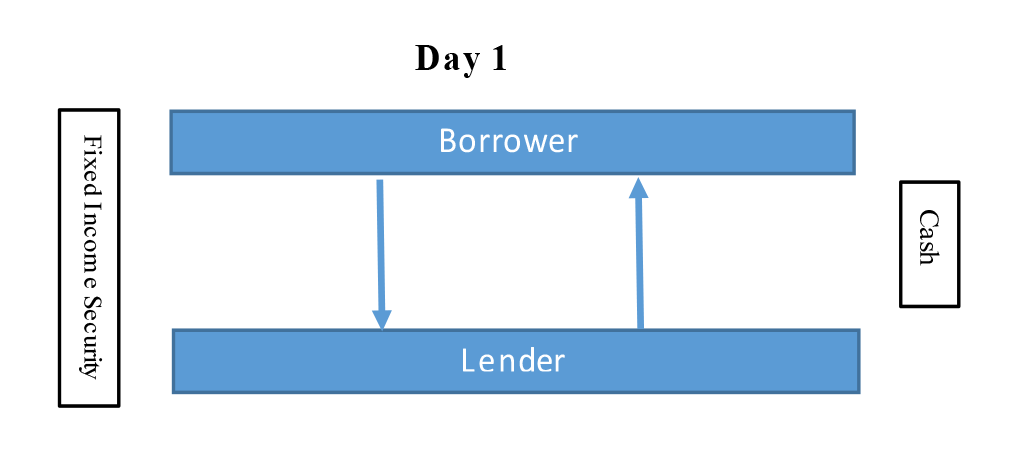

The repurchase, or repo, market is an inconspicuous but vital part of the U.S. financial system. In this market, short-term liquidity is provided between participants through a financial instrument known as a repurchase agreement. In such an agreement (Figure 1), a borrower that needs cash for a short period of time, typically overnight, will borrow the cash from another party; in exchange, the borrower lends a fixed income instrument (often a U.S. Treasury note) as collateral to the other party. On the following day, the borrower will repay the loan by buying back the security at a slightly higher price to compensate the lender for the loan. The spread between the original and marked-up price of the security is the implicit overnight interest rate.

Figure 1: Repurchase Agreement

Major participants in this space include central banks, commercial banks, security dealers, hedge funds, and insurance companies. This market serves as an important conduit in providing various participants access to capital for short-term funding needs.

Recent Events

On September 16th, the cash available to participants in the repo market dried up without warning as demand for short-term financing overwhelmed the available supply. As the shortage became apparent, the overnight repo rate, a rate that is typically held close to the federal funds rate, jumped from slightly more than 2% to over 9% on certain repo loans.

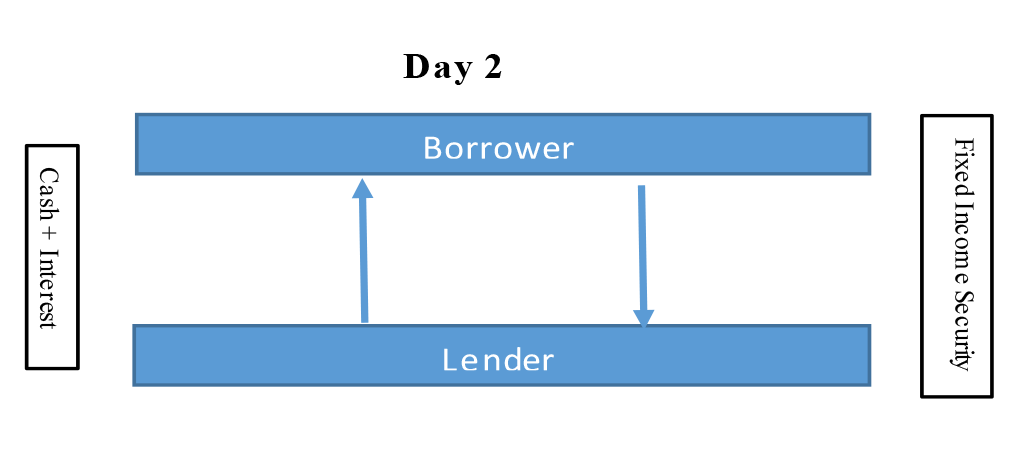

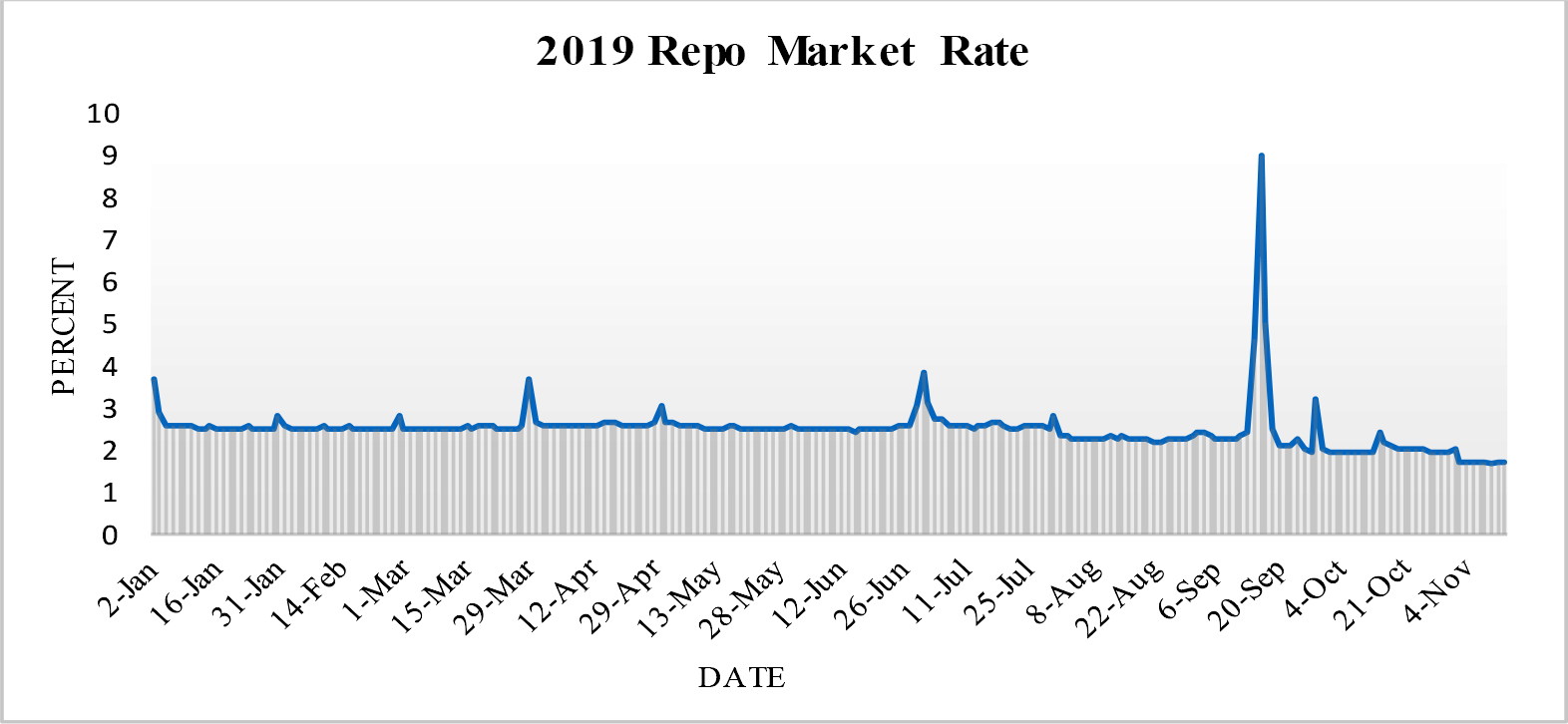

Figure 2: 2019 Repo Market Rate

Source: Federal Reserve Bank of New York. Rate represents the 99th percentile of loan rates measured by the Secured Overnight Financing Rate.

This marked the highest rate the repo market had experienced since the global financial crisis in 2009. On the following day, September 17th, the Federal Reserve injected $50 billion into the repo market to counter the liquidity crunch and stabilize rates. Over the subsequent two days the Fed continued to pump more money into the market until the repo rate finally normalized on September 20th. The Fed’s intervention in this market marked the first time in over a decade it had conducted operations in the repo market. Since the mid-September event, the Fed has been largely successful in suppressing any further rate flare-ups through additional liquidity injections into the market.

While the repo market turmoil appears to be contained for the moment, the root cause of the lending crunch continues to be a source of debate. U.S. Treasury officials and participants have pointed to a number of random events occurring simultaneously as the likely culprits of the problem. First, U.S. corporate tax payments came due on September 16th, necessitating large cash withdrawals from banks; this had the effect of pressuring banks to hold more cash reserves and lend less in the overnight market to ensure sufficient assets were on hand to meet regulatory requirements. Second, a large U.S. Treasury auction of securities totaling close to $80 billion occurred at the same time; buyers of such securities included major participants in the overnight market who might, again, have felt pressure to lend less and keep more cash in reserves at that time.

The timing of both of these events was known well in advance of the crisis, leading to concern that such bouts of repo market turmoil may become more frequent if the Fed doesn’t enact future measures to shore up the system. To that effect, the Fed recently pledged to grow its balance sheet via Treasury purchases to provide more liquidity and keep a lid on rates in the repo market. (Interestingly, the Fed’s actions in the repo market, combined with a number of other macro developments, have aided in steepening the U.S. Treasury yield curve over the last two months. The yield curve inversion that had concerned investors earlier this year has dissipated with short-term rates falling while intermediate to long-term rates have risen.)

The Bigger Picture

While recent events in the repo market may conjure up unsettling memories of the start of the great financial crisis, we believe it is likely that this instance is different. The recent disruption in the overnight lending system seems to have been driven by a random occurrence of technical factors rather than large scale macro and liquidity issues that were present in 2008. Further, it is evident that Fed is intent on managing the market by utilizing its balance sheet to keep overnight lending rates in check.

Nonetheless, the possibility of negative repercussions on the U.S. economy stemming from future interruptions in the repo market remains. First, concerns about the health of the banking system could spread to consumers and businesses, triggering worries of another financial crisis and discouraging consumer spending, corporate business expenditures and hiring. Another concern is the possibility that banks reduce their participation in the repo market and become more conservative in their lending practices; this could lead to less money flowing into the U.S. economy and pressuring borrowing rates upward.

Overall, large scale economic turmoil stemming from the recent overnight lending events is not our base case. The past and planned future actions the Fed has taken to manage the market should provide investors some piece of mind. To that end, U.S. equity markets have continued to move upward since the mid-September event. We do believe the episode was notable enough, however, for investors to monitor this market carefully going forward, as financial markets may be less willing to shrug off additional instances of turmoil.