Why is water damage such a big deal?

Water damage is consistently a common and severe cause of loss to homeowners. It is amazing to see the damage that water can do. Water carved the Grand Canyon—just think what it does to drywall or plaster!

The good news is that water damage losses can be prevented or mitigated by a properly installed automatic water shut-off device.

MANY SOURCES OF WATER DAMAGE ARE IN A TYPICAL HOME, INCLUDING:

- Water line failures that supply washing machines, sinks, toilets, ice makers and wet bars.

- Plumbing or appliance failures to items such as ice makers, washing machines, dishwashers, water softeners or water filtration systems.

- Burst pipes due to freezing, age, lack of maintenance or improper installation.

- Water heater failures and leaks due to corrosion, typically within eight to 10 years. They may show no outward signs of a problem prior to failure.

- Overflow of plumbing fixtures

- Faulty construction

While any home can sustain damage from a water leak, the costs are even higher to a luxury home with high-end interior finishes or those containing fine arts, expensive appliances or other valuable articles.

Imagine the scenario if a water supply line to a second-floor bidet fails in such a home:

- Water leaks on and damages the Carrara marble flooring in the bathroom.

- Then water makes its way downstairs, where it destroys the gold-leaf-trimmed ceiling support for an antique crystal chandelier.

- It then goes down the wall and damages the Venetian plaster wall covering, chair rails and wainscoting, while also taking out a painting or other fine art along the way.

- It finally makes its way down to the Brazilian walnut hardwood flooring, while also taking out a 16th-century Chinese rug.

The potential for water supply line failure is multiplied in a typical high-end home with four bedrooms and four bathrooms. Here’s the math:

- One hot water line, one cold water line, one toilet water line = three water supply lines

- Multiply that by four bathrooms = 12 water supply lines

- If there is a dual sink in the master bathroom, add two more

- If there is a bidet in the master bathroom, add one more

- Hot and cold water lines to the washer and utility sink in the laundry room = 4 lines

- Ice maker lines for refrigerator and wet bar = 2 lines

- Total = 21 water supply lines for a typical four-bedroom, four-bath home, each of which is a potential source of water loss.

And water damage is an equal opportunity offender. Water damage can and does occur in:

- Large and small homes

- Primary and secondary homes

- New homes and old homes

- Historic homes

- Condos

- All regions of the country

- All seasons—not just winter

Many water losses could be prevented or mitigated if an automatic water shut-off device had been installed in the home. Automatic water shut-off devices provide the best level of protection from water loss. They require no human interaction; they automatically turn off the water to the home when a leak is detected, preventing further damage.

Some insurance carriers will provide discounts for water shut-off devices, and in some cases, may offer funding toward the installation of qualified devices after a covered loss. This makes the decision to invest in protecting your home from water damage even easier!

Consider the water damage risks in your home, and arm yourself with knowledge to prevent the hassle and costs that come with a leak. While not every water loss can be prevented many water losses could have been.

Be prepared and contact your Gallagher advisor to discuss a proactive risk management plan against water damage for your primary residence and any other properties you own.

Protect your holiday gifts

As the holiday season approaches, it is important to think about ways to protect your valuables.

No one wants to consider the unthinkable—like theft, damage or loss—happening to a prized possession, but the reality is that these things happen. Whether you own fine art, jewelry, antiques or even classic cars, having a current appraisal is an important component of collection care.

To learn more, read “A Collector’s Guide to Appraisals,” from Tema McMillion, Fine Art & Collection Specialist & Senior Risk Specialist with Chubb Personal Risk Services.

Remember to contact your Gallagher Advisor to review your collections coverage to determine whether you need updated appraisals, or need to secure blanket or itemized coverage to protect your collectibles.

8 ways to safely travel abroad

Traveling abroad for the holidays can be stressful. U.S. citizens face all kinds of risks and challenges in foreign countries due to the differences in language, culture, politics and economics. To help you travel safely and confidently this holiday season, we’ve compiled a quick list of things to think about as you plan your next trip:

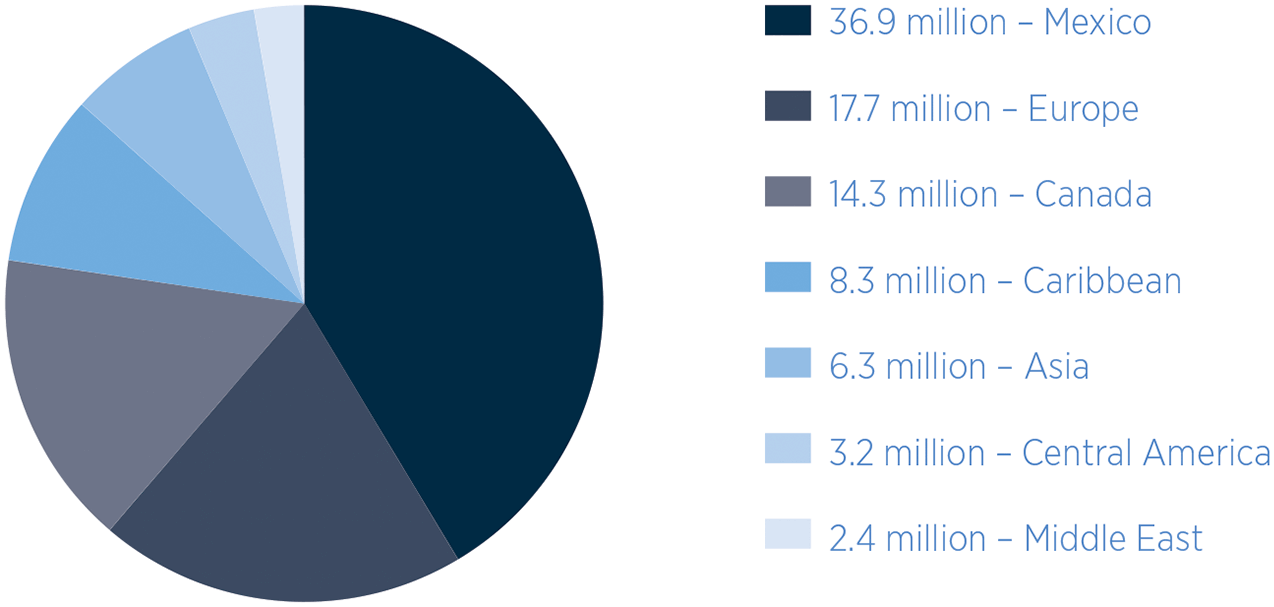

WHERE DID AMERICANS TRAVEL IN 2018?

Source: https://travel.trade.gov

- Stay small. When it comes to international hotels, bigger isn’t always better. Instead of booking a large and highly visible hotel, consider staying in a smaller boutique hotel, which may be less conspicuous and offer similar five-star amenities.

- Dress for the culture. When you’re traveling to a foreign country, it’s best to blend in with the crowd. Keep cultural differences in mind when choosing what clothing or jewelry to wear and bring. This will ensure you avoid drawing attention to yourself, your family and your wealth.

- Leave copies of your documents behind. Scan important documents, including your passport, driver’s license, visa and travel itinerary, and leave copies of them with a trusted friend or family member prior to departing. If something happens to your documents while you’re traveling, you’ll be able to get copies with a quick phone call.

- Only rent a car if you’re familiar with the terrain. Navigating a foreign country can be hard enough without having to think about driving rules and regulations. You may face additional risks, as well as costs, if you’re in an accident while traveling. Make sure your auto and liability insurance will cover you overseas if you plan on renting a car.

- Don’t post or geotag on social media. When you or your kids post or geotag pictures or comments on social media, you’re letting burglars know that you’ll be away from home, and you’re telling a wide world of thieves and criminals where you are. Instead, wait until you’re back home to share your adventures online.

- Consider purchasing medical and travel assistance. According to a recent study, 81% of Americans consider 24-hour emergency travel assistance very important.1 Familiarize yourself with your destination’s conditions that could impact your health, such as high altitude or pollution, as well as the types of medical facilities available.

- Stay away from hot spots. We’re not talking about sunshine here. By staying out of those destinations that the U.S. considers “hot” or unsafe, you can help your family experience a more enjoyable and relaxing time away from home. To see the most current travel advisories, visit Travel.State.Gov.

- When traveling overseas, we encourage you take the time to register with the U.S. State Department’s Smart Traveler Enrollment Program (STEP). This will make the State Department aware of your overseas travels and allows it to send you travel alerts if necessary. If a crisis were to break out, the department knows who is in the region to offer help. You should also download the U.S. State Department’s Smart Traveler app on your smartphone. Once registered in the STEP program, you’ll get alerts right to your phone. If you need the location of the U.S. embassy or consulate, their information is right in your phone. This app also includes destination descriptions, travel and health advisories, local laws, and security information.

The Smart Traveler Smartphone App is free and can be downloaded here:

Apple: https://itunes.apple.com/us/app/smart-traveler/id442693988

Android: https://play.google.com/store/apps/details?id=gov.state.apps.smarttraveler&hl=en

Before you take your next trip, contact your Gallagher advisor to ensure you’ve secured the proper protection, such as trip insurance, kidnap and ransom coverage, and worldwide allrisk protection for your valuables.

Safe and Happy Travels!

Gallagher in action

Each year, McLean Insurance Agency, a recent Gallagher merger partner, organizes the Carz Cruizin to Cure Cancer event to honor the memory of its founder, Henry C. Megill Jr., who battled a rare form of lymphoma. Doug Megill founded this annual event in 2010 to continue his father’s legacy and passion for making a difference in the community.

Funds raised by Carz Cruizin to Cure Cancer were donated to the Leukemia & Lymphoma Society, whose mission is to cure leukemia, lymphoma, Hodgkin’s disease and myeloma, and to improve the quality of life of patients and their families. This annual community and charity event featured classic, custom, foreign, sports, high-performance and hot-rod cars, trucks, and motorcycles in a parade and show, followed by juried entries, musical entertainment, raffles and great food!

This year, Carz Cruizin to Cure Cancer surpassed its 2019 goal of $50,000 and raised $53,000. This brings the total donations to the Leukemia & Lymphoma Society up to a little over $250,000 over the past nine years.

Kudos to our team members at McLean for making a difference in their community!

Visit www.carzcruizinforcancer.org for more information.

Client service spotlight

We are excited and proud to announce that Sheren Stoehr, a client service supervisor based in Whippany, New Jersey, was recently named the recipient of Gallagher’s 2019 Client Service Leader of the Year Award. This award was created to celebrate leaders who continue to innovate and drive the changes needed to deliver the best experience for our clients.

Sheren Stoehr supervises Gallagher’s personal service staff in New Jersey and plays an integral role in providing our clients with excellent service. As a leader, Sheren has the respect of her team and her peers. Her calm demeanor and witty humor have a way of disarming the most stressful situations. Sheren leads by example and pushes the Personal Lines team to achieve greater results, but also understands the importance of recognizing and celebrating their success. Congrats to Sheren!

1. http://trip.ustia.org/surveys/

The information contained herein is offered as insurance industry guidance and provided as an overview of current market risks and available coverages and is intended for discussion purposes only. This publication is not intended to offer legal advice or client-specific risk management advice. Any description of insurance coverages is not meant to interpret specific coverages that your company may already have in place or that may be generally available. General insurance descriptions contained herein do not include complete insurance policy definitions, terms, and/or conditions, and should not be relied on for coverage interpretation. Actual insurance policies must always be consulted for full coverage details and analysis.

Insurance brokerage and related services to be provided by Arthur J. Gallagher Risk Management Services, Inc. (License No. 0D69293) and/or its affiliate Arthur J. Gallagher & Co. Insurance Brokers of California, Inc. (License No. 0726293).