How quickly things change. In our January 2020 market conditions report, we ended on a hopeful note that the firming we were seeing would be short-lived. We outlined the factors that contributed to the need for “market correction,” but had hoped that after 18–24 months of firming pricing, we would begin to see relief in the second half of 2020. Instead, we are seeing a hard Directors’ & Officers (D&O) market that rivals that of the mid-1980s thanks to COVID-19’s effect on virtually everything: economic impact on insureds, a deteriorating D&O claim pipeline, and reductions in carrier surplus.

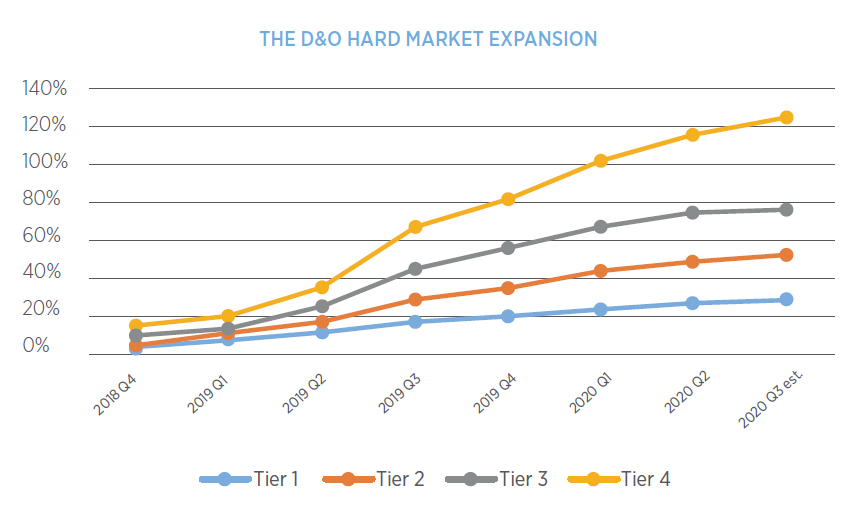

In January, we were hesitant to say the market was hard and used words like “firm,” “firming” or “hardening” to describe what was happening. A true hard market doesn’t exist until every aspect is impacted: premium, retention, capacity, attachment, and terms and conditions. In late April or early May we began to see a contraction in terms and conditions, which was the last shoe to drop.

The Impact of Securities Class Actions Filings

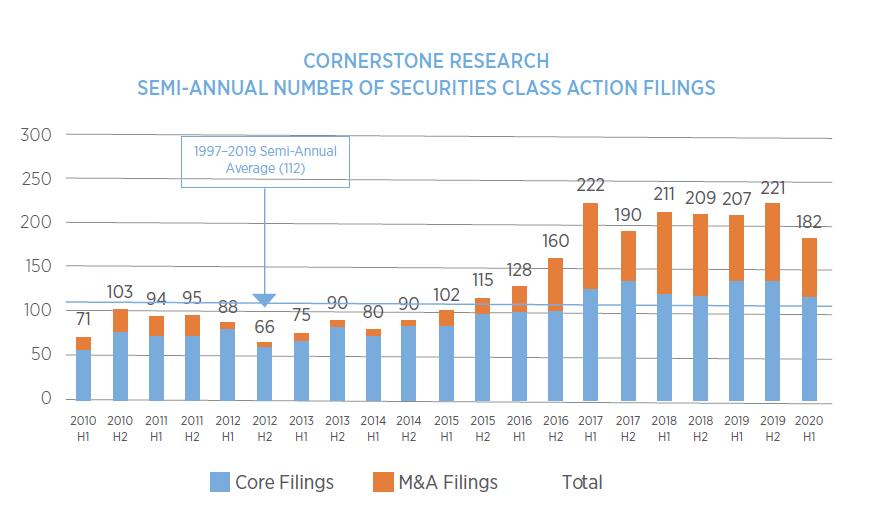

Frequency of securities class actions filings are often cited as an underlying factor to D&O market conditions and, interestingly, filings in the first half of 2020 are down 18% from the second half of 2019.1 Note, though, that the numbers are still higher than the historical average. Cornerstone Research’s mid-year report suggests that COVID-19 depressed M&A activity, which, in turn, reduced the filing of M&A-related claims.2

Cornerstone Research also reports that Section 11 insurance claims are also down significantly, “despite recent [IPOs] trading below offering levels.”3 In the press release accompanying the report, Professor Grundfest argues “[t]he Section 11 litigation decline calls for more data to explain. COVID-19-induced volatility can create a damage challenge for plaintiffs because defendants can easily point to the pandemic as a confounding factor and explain that price declines were caused by larger market forces, and not by any alleged misrepresentation.”4

On the subject of Section 11 claims, in March, the Delaware Supreme Court decided in the Sciabacucchi case that federal forum selection clauses in corporate charters were facially valid. While this was certainly a win for issuers in order to avoid the complications of concurrent state jurisdiction resulting from the U.S. Supreme Court’s Cyan holding, it is not likely a direct cause of the reduced Section 11 claims we saw in the first half of 2020. In fact, the Sciabacucchi case may not impact frequency of Section 11 litigation; rather, we anticipate it will assist with the severity of concurrent Section 11 claims by reducing extraneous defense expenses and discovery costs.

While overall filings are down for the first half of 2020, Cornerstone Research also reports that filings against non-U.S. issuers are tracking at an all-time high if current filing rates hold for the second half of 2020. Driving the non-U.S. activity are claims relating to cryptocurrency and cannabis.

Key Mid-Year Market Insurance Trends

NERA’s mid-year report states that settlements have increased, specifically cases that settled the first half of this year. The average settlement was $65 million, which was more than double the average settlement for 2019 but below 2018’s average of $70 million.5 However, once outliers (settlements over $1 billion) are removed, the average settlement for the first half of 2020 was $37 million and the median was $13.4 million, which is the highest median in the past 10 years.6

Unfortunately, even though some trends are promising — notably, dismissal rates and the reduced frequency of securities class actions — we will not see favorable impact on the D&O insurance and risk management market. Insurers are still concerned with anticipated COVID-19 bankruptcies, impact-related D&O claims (whether stock drop cases or derivative actions), as well as SEC investigations. This is compounded by the robust pipeline of event-based D&O claims that was already in existence before COVID-19 relating to opioids, natural disasters, #MeToo, and cyber breaches, among others.The State of the Public Company D&O Market

Many insurers have pulled back field authority and in many cases are not providing quotes more than 30 days before renewal, causing friction when building large D&O towers with many excess layers. Underwriters are asking many more questions, particularly related to COVID-19’s impact on business Being proactive with that information and having well-supported answers can not only assist the renewal process, but also assist in driving underwriting interest.

Tier 3 represents slightly more difficult industries, such as established pharmaceuticals, biotech, technology, homebuilders, and some retailers. This tier is seeing 50%–85% premium increases. Capacity is very often reduced and retentions are increasing. Terms and conditions have more pressure than Tier 1 and 2. We anticipate Q3 premiums to range from 65%–85%.

Changes in insurance coverage that we see most frequently include:

- Reduced capacity for shareholder derivative demand investigative costs, most notably in excess layers

- Removal or reduction of limit reinstatement provisions in Side A DIC policies

- Restricting pre-negotiated extended reporting provisions (“ERP”), especially for anything longer than one year

Lastly, it is worth mentioning Side A DIC pricing. In prior years and in “softer” markets, these layers were priced very competitively, especially when looking at premium on a rate per million of limit basis. It was not uncommon to see $2,500–$3,000 per million on some risks. Today, insurers are re-evaluating their minimum rates, often resulting in significant percentage increases at renewals.

Preparing for Your Next Insurance Policy Renewal

For all of these reasons, we find ourselves communicating a difficult but necessary message to our clients. Your next insurance policy renewal will be challenging. We anticipate significant premium increases, retention increases are likely, and there may be changes to terms and conditions. Capacity reductions in some layers of your D&O insurance program are to be expected and, though more rare, non-renewals may also occur. Notwithstanding the fact that these projections are based on an insurance and risk management market that is still evolving, our forecast could change depending on when your insurance program renews. Regardless, for many clients, underwriters will be slower than usual to respond as well and your D&O insurance renewal will likely come down to the wire on timing.