Author: Glenn Drees

While agriculture, food, and grocery businesses are experiencing many of the same renewal challenges as other industries, there are a few nuances that need to be pointed out for our clients and those that are choosing to partner with Gallagher Food and Agriculture brokers.

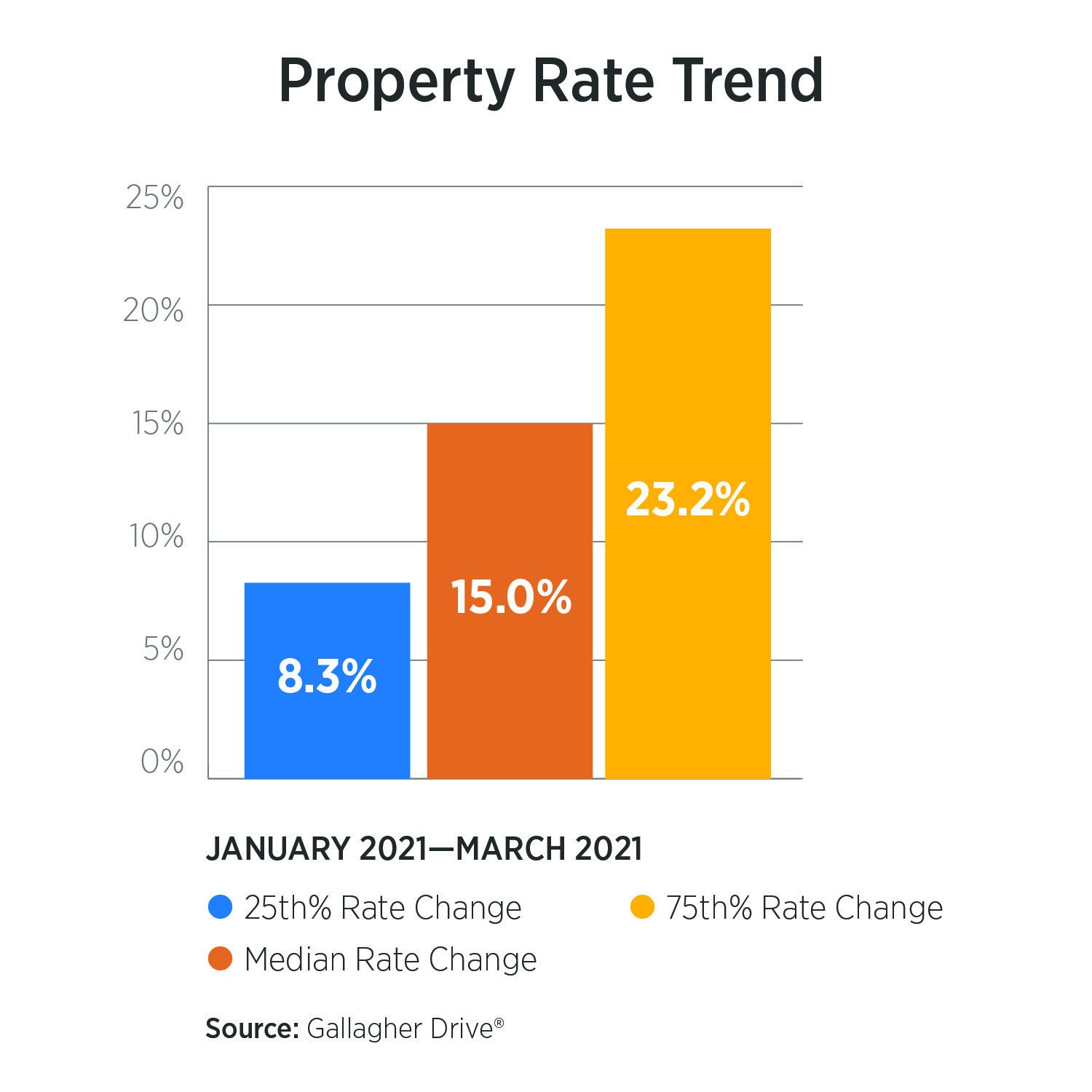

Property Insurance Rate Increases within Food and Agriculture

There are food and agriculture industry segments that are experiencing higher rate increases. They exhibit some of these attributes: a concentration of values in a single building or fire division, highly damageable stock, a lack of sprinkler systems or sprinkler systems that do not match the current occupancy, and older buildings.

It is imperative that insurance company recommendations are addressed. Accurate statements of value, business income worksheets, and detailed descriptions of the construction, occupancy and protection are a necessity for both renewal underwriters and underwriters that are considering offering quotations. When underwriters have more submissions than they can handle, they focus on the ones where they believe they have the greatest chance of success and that have all the data that they need.

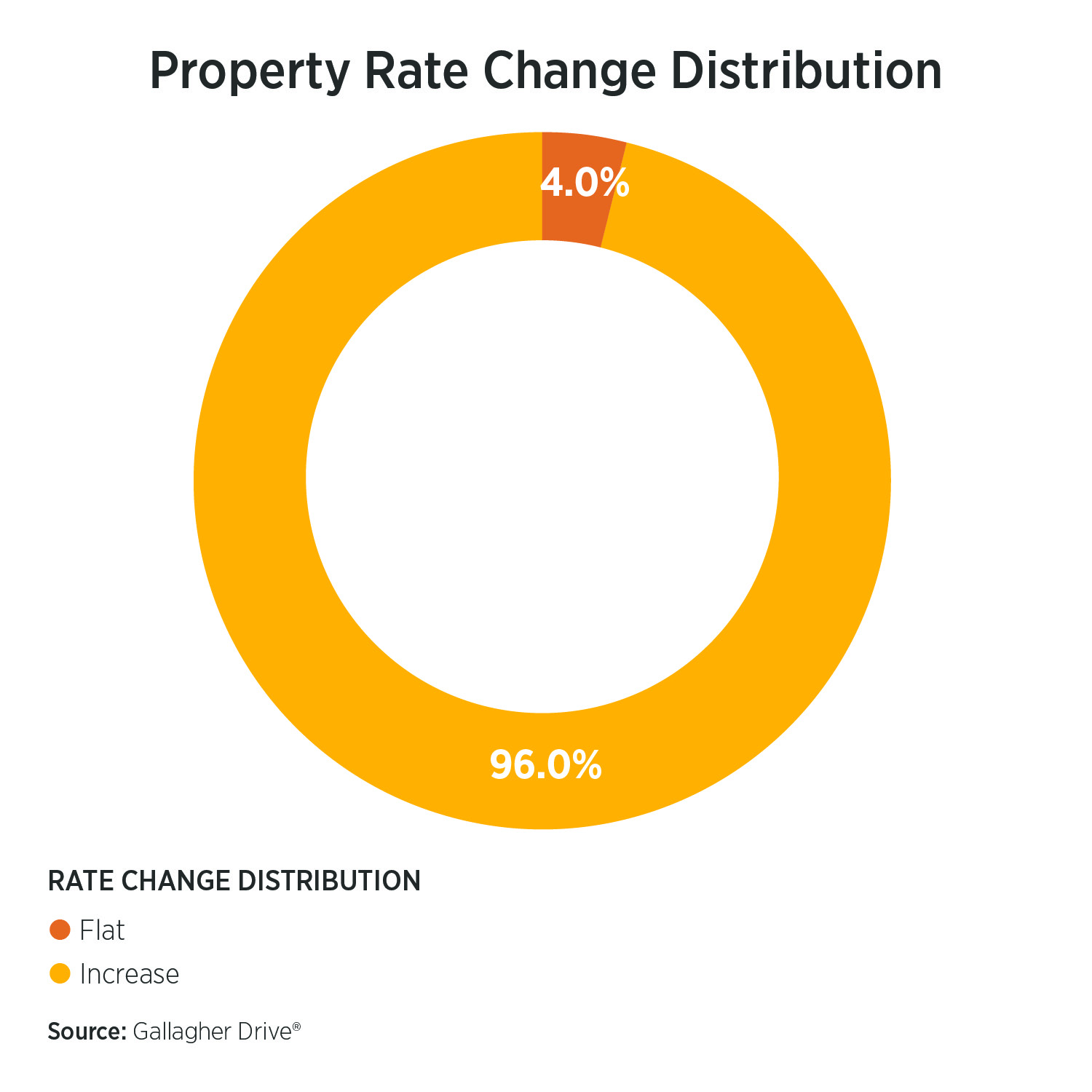

- In Q1 of 2021, 96% of Gallagher Food and Agriculture clients received a property rate increase. This fact alone highlights the broadness of the market increases.

- The median Gallagher property rate increase for Q1 2021 was approximately 15.0%.

- Our competitor's median property rate increase for Q1 2021 was approximately 23.3%.

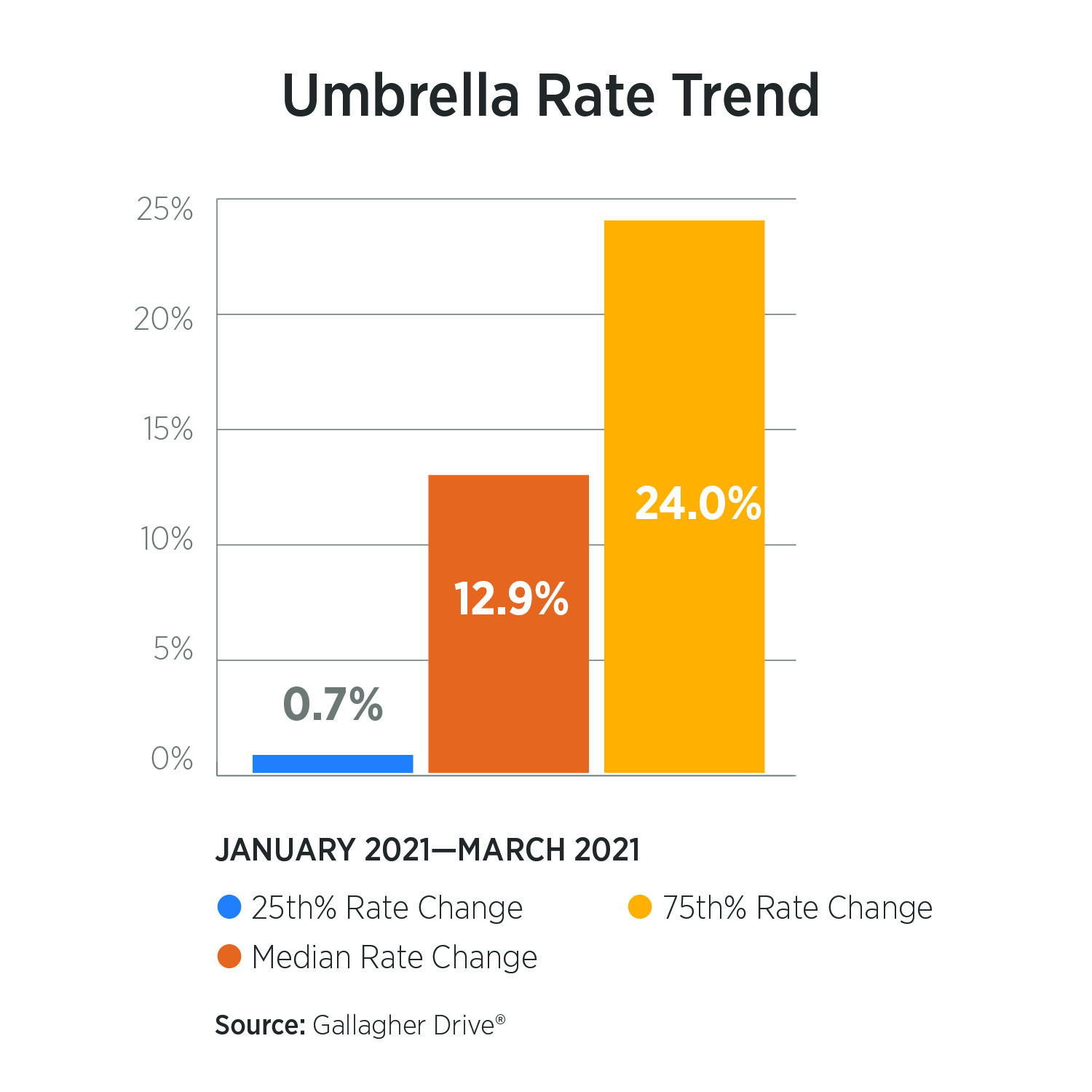

Umbrella/Excess Liability Insurance

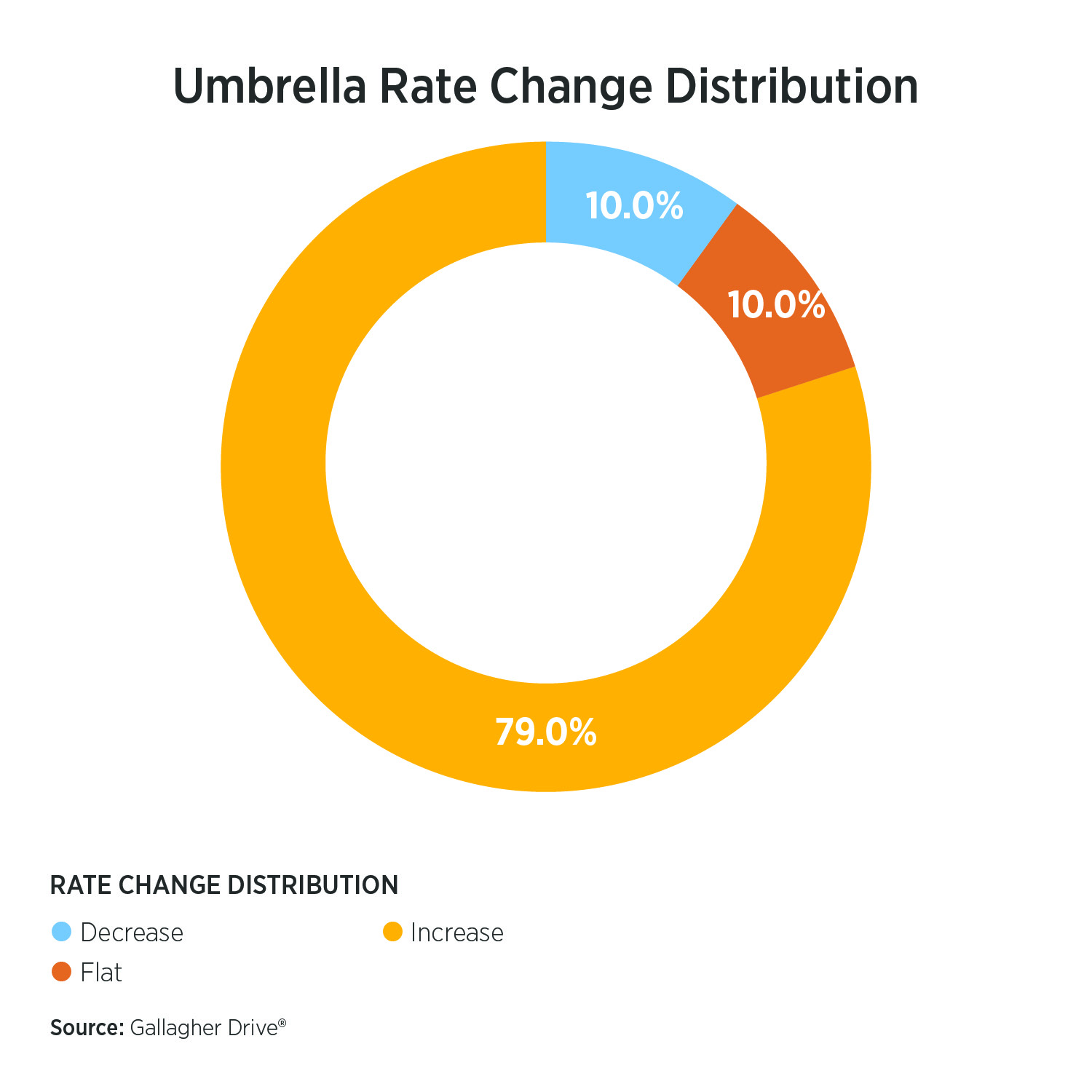

Food and Agriculture accounts often have large transportation fleets that provide ingredients that go into other food and agricultural products and liabilities assumed by contract. These attributes are viewed as higher risk by underwriters. Accordingly, they are reducing coverage limits, trying to move higher in umbrella towers, restricting terms of their coverage and charging more rate.

- 79% of our clients saw rate increases in Q1 2021

- The median Gallagher client rate change in Q1 2021 was 12.9% which shows to be better than our competitors results of 53.3%.

- This difference in rate increases could be driven by a variety of factors including better market access, market leverage, access to analytics, etc.

We are starting early on these renewals and leveraging our market relationships to get the best available results in this market.

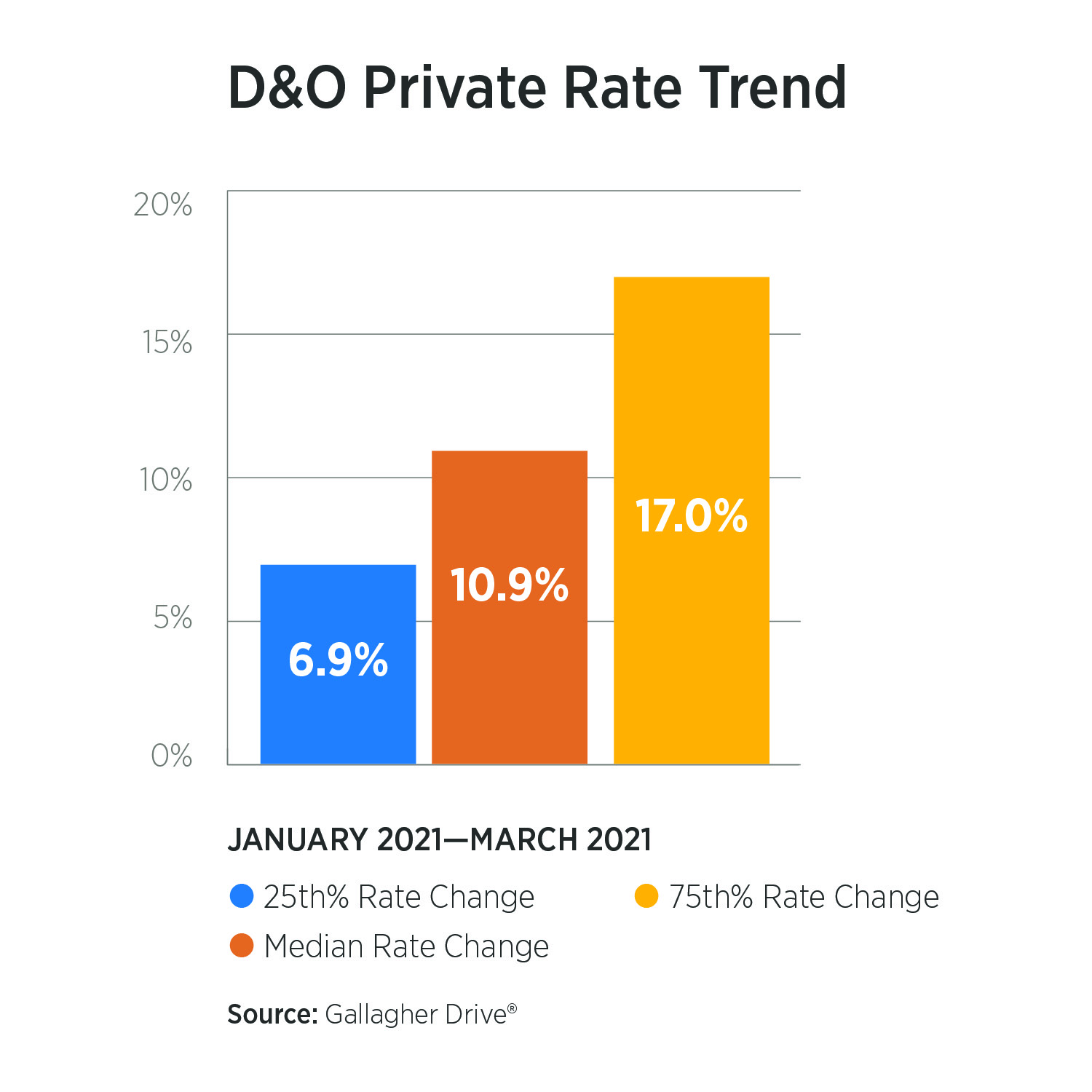

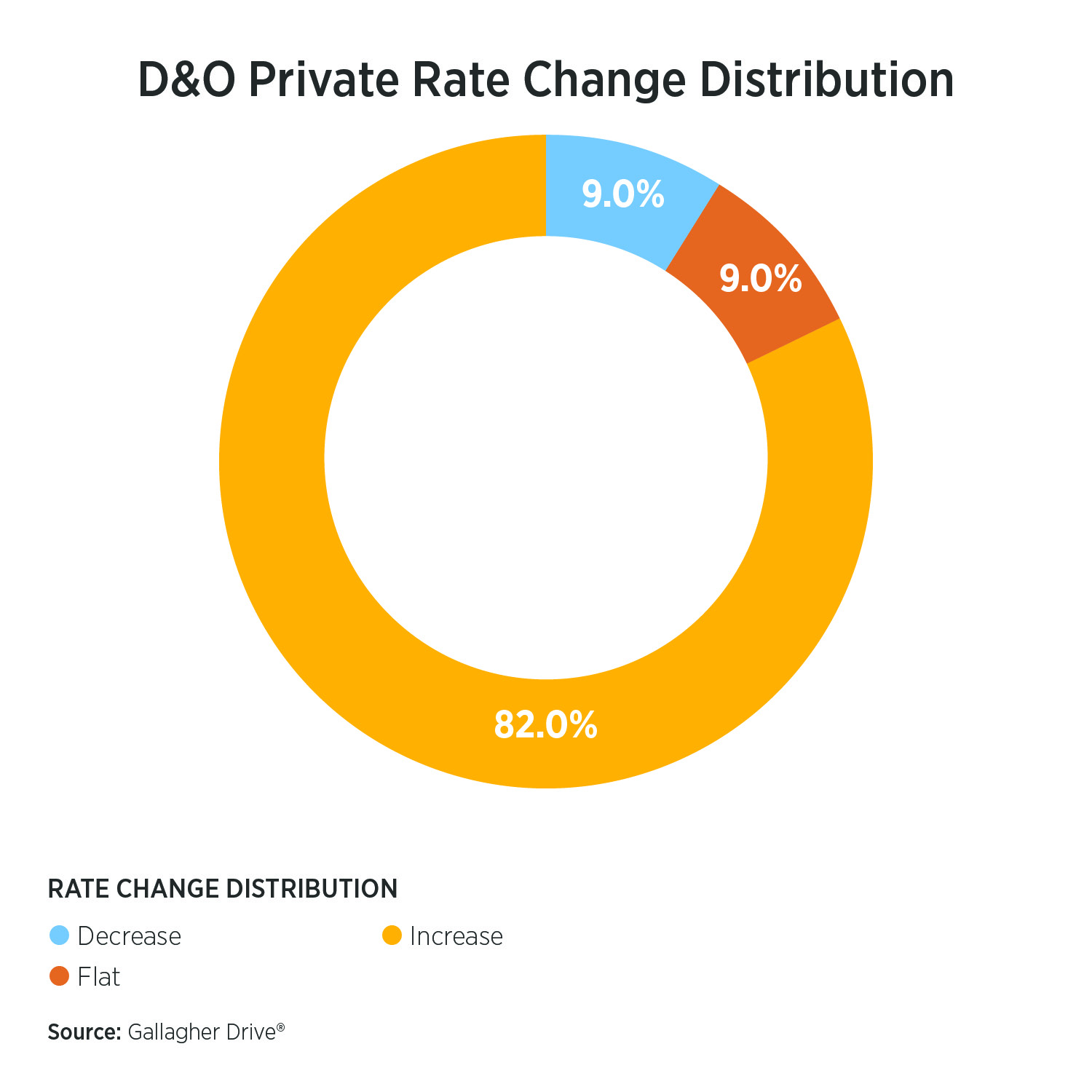

Management Liability Insurance for Food and Agriculture Businesses

Agribusinesses, food companies and grocers are experiencing many of the same market challenges that other industries are experiencing. Private company D&O placements, while challenging, are not as difficult as publically traded companies. Food and Agriculture companies that have 'shoulder to shoulder' type work are receiving more underwriting scrutiny regarding the protection of their employees from COVID-19.

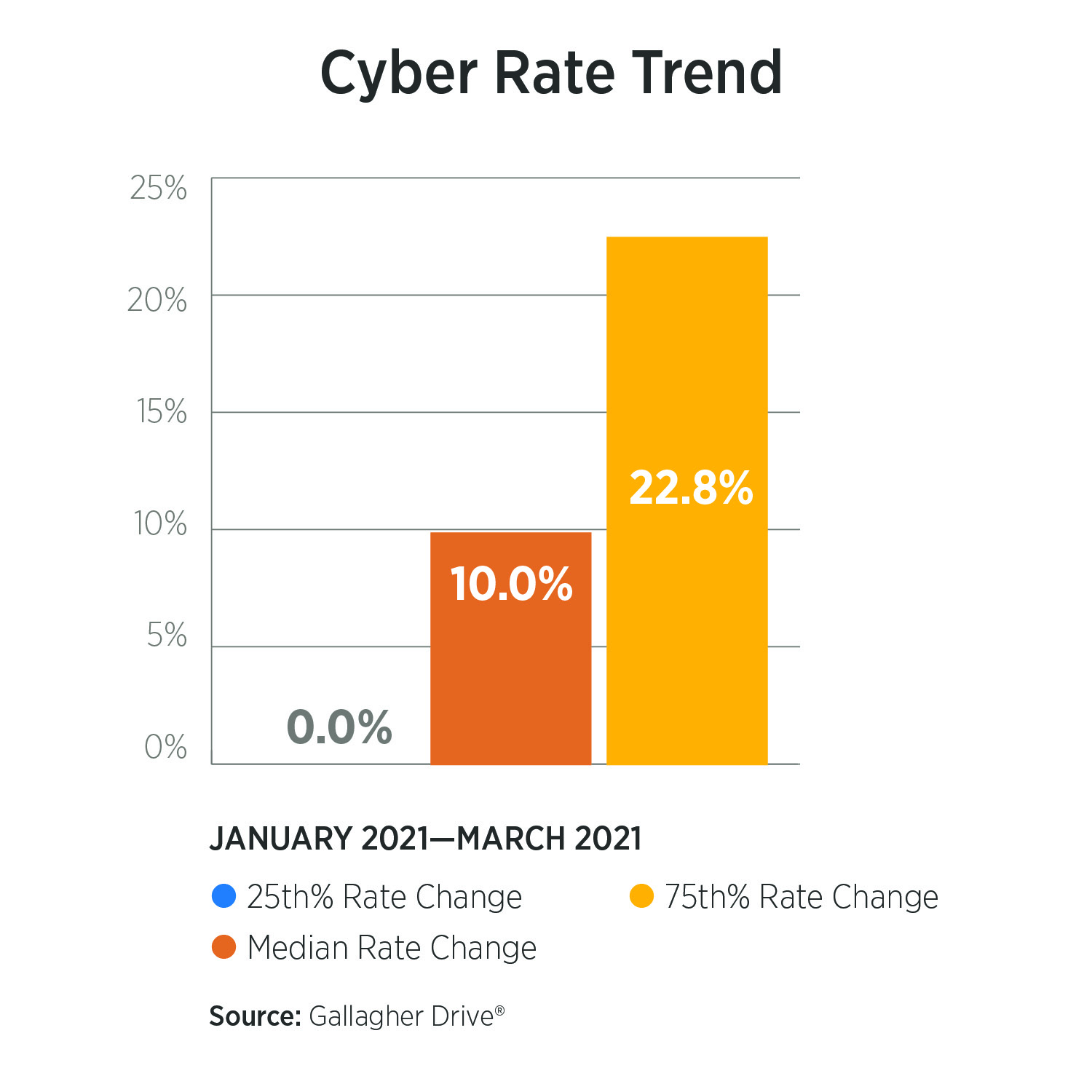

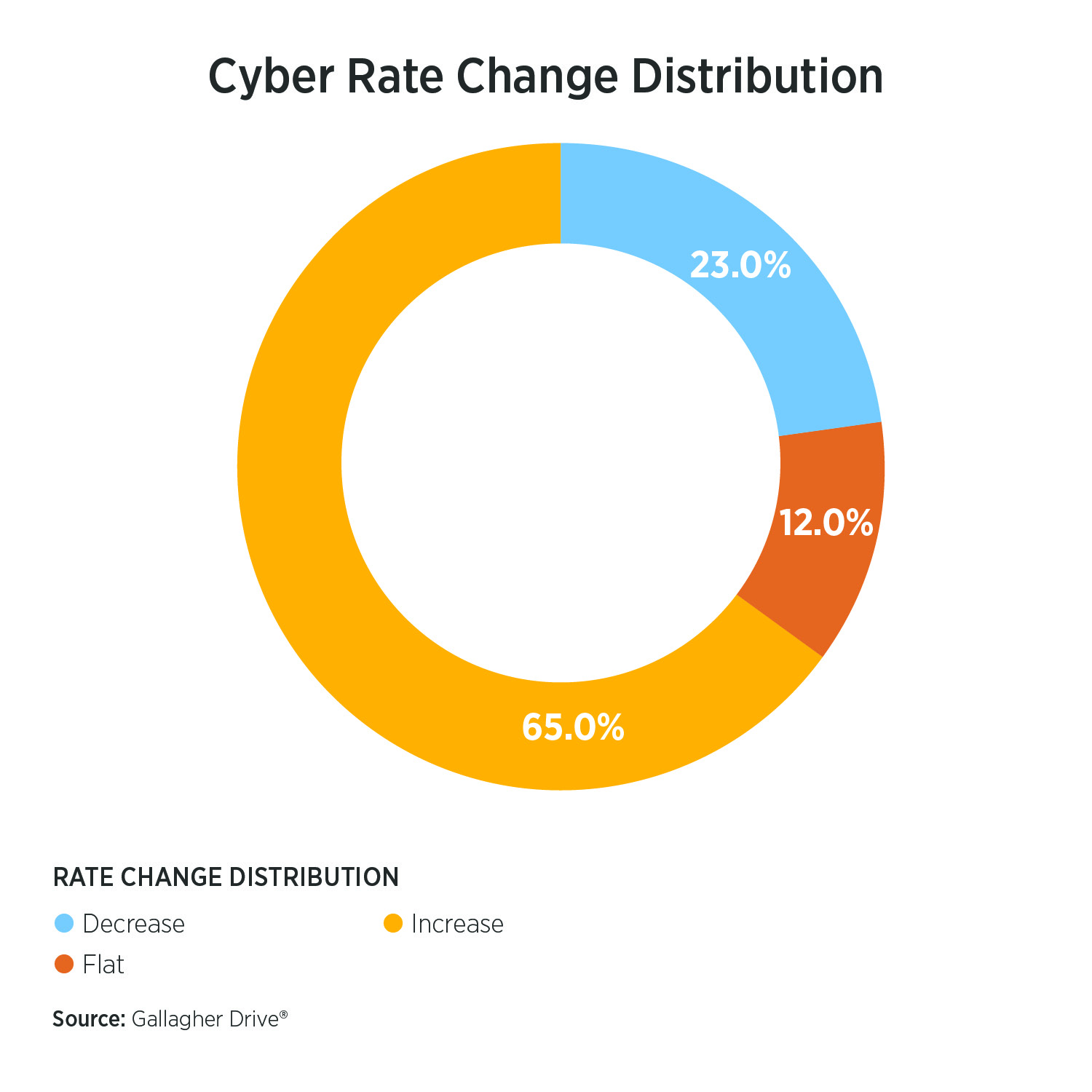

Cyber Liability Insurance within Food and Agriculture

Our food and agriculture practice vertical has not escaped the avalanche of claim activity from ransomware, phishing, and other cyber attacks. The theme is the same as other industries; rate increases, higher retentions, reduced capacity and more underwriting scrutiny. The increased frequency and severity of claims has caused Gallagher clients to become more focused on benchmarking adequate cyber limits, improving data security controls, and understanding the business interruption potential if the network does go down.

Product Recall Insurance

This has been a coverage line that has been stable from both a pricing and coverage standpoint.

- Renewal rate trends are varying from -1% to +4% in the most recent quarter.

- $25M limits are easily attainable for most food and ingredient companies.

- Our recall team has the ability to obtain limits up to and exceeding $100M if needed.

Designing product recall coverage for the unique needs of each client, working directly with insurance company underwriters and not through wholesalers, and maximizing claims recovery when an event does occur are all reasons that food and agriculture companies select Gallagher.

Conclusion

Given the highly nuanced nature of the current market, it is imperative that you are working with an insurance broker who specializes in Food & Agriculture. Gallagher's dedicated Food & Agriculture Practice has a vast network of specialists who understand your business, creating the best solutions in the marketplace for your specific challenges.

Sources

*The data for all charts within this document were pulled utilizing Gallagher Drive®, our proprietary data and analytics platform. US Client Data, Jan 2021— March 2021. The median is the value separating the higher half from the lower half data sample (or the middle value). Due to the variability that we're seeing in this market and specific account characteristics, individual rates may vary.