- Protecting the Balance Sheet in Today's Environment

- Attracting and Retaining a Highly-Skilled and Diverse Workforce

- Facilitation Better Employee Financial Wellbeing

- Looking Ahead

All levels of the energy industry are experiencing extreme financial pressure. Producers, gatherers, and midstream companies, as well as refiners, all need to adjust to doing business in a post-COVID-19 environment. This will most likely include changing regulations implemented under the Biden administration, with the federal government likely shifting support toward clean energy, seeking to rejoin the Paris Agreement, and revisiting the rollbacks of environmental regulations put in place by the Trump administration.

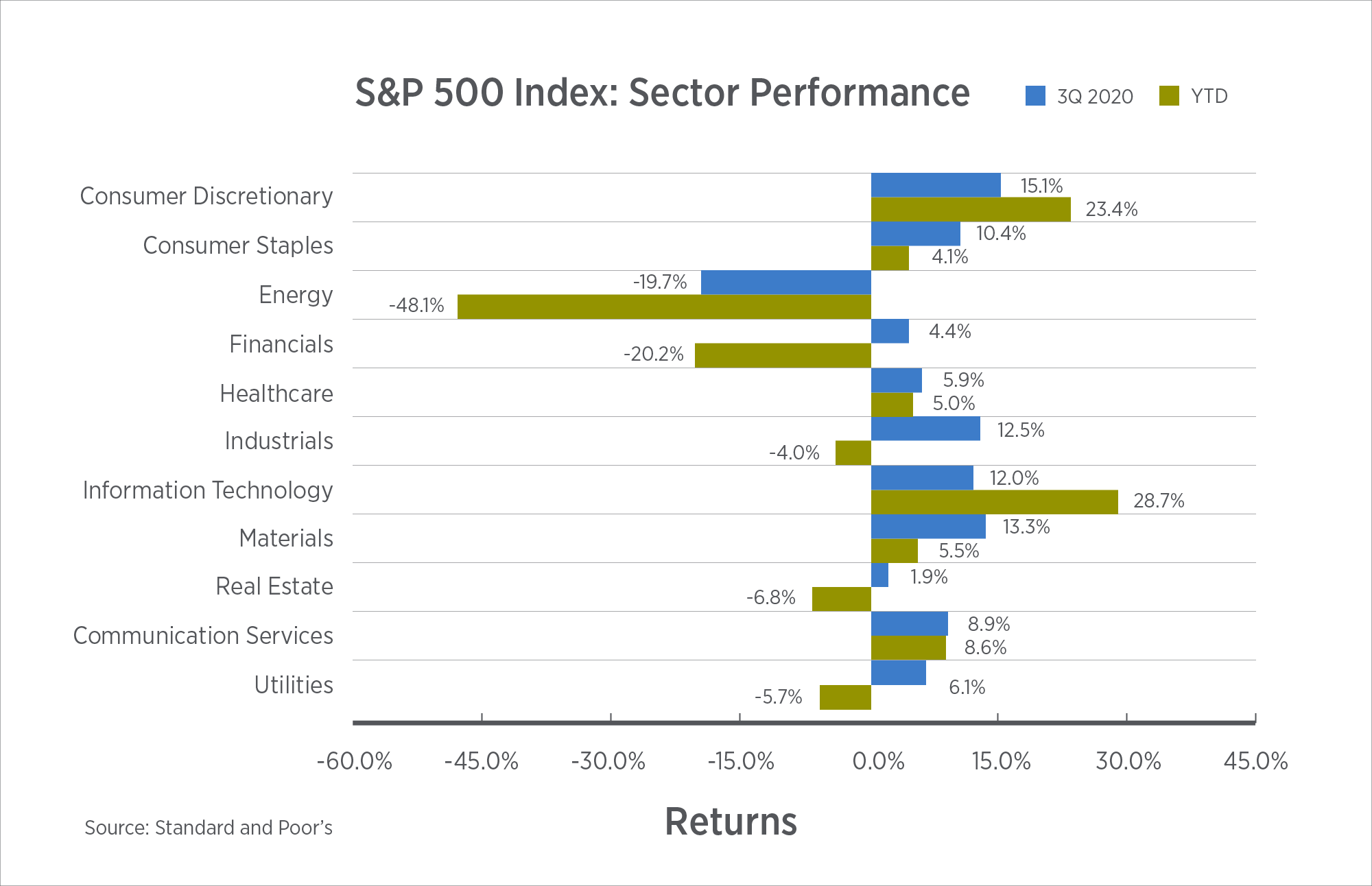

Although the energy sector was largely deemed essential and did not experience widespread mandated shutdowns due to the COVID-19 pandemic, an oil industry stimulus package would help to keep some companies afloat until oil prices rebound to sustainable levels. As the possibility of a stimulus package designed specifically for the energy sector lingers, energy companies continue to lose value. The S&P 500's energy sector lost more than 40% of its value in 2020 — despite the dramatic rebound in the overall stock market over the past months.1

Protecting the balance sheet in today's environment

As leaders in the energy sector navigate the short term, they must strive to manage plan-related fees, match calculations to achieve maximum benefit for dollars spent, and explore alternative plan design options.

Evaluate retirement plan fees

Plan sponsors are trying to arrive at the right strategy for reducing plan fees without sacrificing service. A documented evaluation process helps clarify the current fee structure and strategy for participant engagement — and whether a provider's solution is in the best of interest of their workforce.

Benchmarking of retirement plan fees occurs at different intervals for employers, from annually (53%), to every other year (4%), or every three to five years (17%). 26% don't follow a set schedule. These practices merit close scrutiny, especially for DC plans where litigation has largely focused on fees. Although the DOL recommends benchmarking every three to five years, there's a trend toward checking retirement plan fees more frequently.2

The manner in which retirement plan fees are allocated is also becoming a major focus in the retirement industry. As fiduciaries, employers need to know not only how much the plan pays in total fees, but also how their fees are paid. There's a specific interest in understanding whether payments for recordkeeping and administrative fees are made from plan assets, charged directly or added to the expense ratios of the investments offered in the plan.

Increasingly, many employers are establishing a formal Investment Committee that conducts periodic reviews of their retirement plan, and its investment options, to ensure investment performance and total fees are reasonable (78%). Nearly all upper midsize (97%) and every large employer (100%) have such a committee. Two reasons all large market employers adopt a committee are: their larger plan sizes that make them a more visible target for litigation, and the structured oversight they gain helps them limit their potential liability.3

Only provide matching contributions to non-highly compensated employees

A plan sponsor may elect to provide matching contributions only to employees who are not defined as a highly compensated employee. Generally, a highly compensated employee is an employee that earns at least $130,000 in 2020 or is a 5% owner. This measure would reduce employer spend, would not adversely impact compliance testing, and still support much of the employee population.

Revise the definition of compensation

By potentially excluding certain types of pay such as bonuses and commission, a plan sponsor may be able to reduce their cost on matching and other employer contributions.

Add a dollar cap to the match

Adding a dollar cap likely reduces employer matching contribution to the highly compensated employees, but may preserve it for the majority of lower paid employees. For example, if a plan sponsor matches 50% on the first 6%, and caps their match at $5,000 annually, only employees deferring greater than $10,000 annually would receive a reduced matching contribution.

Delay employer contributions

In order to deduct the company contribution for the year, you must deposit company contributions by the due date (with extensions) of the company tax return for the year. That could be as late as September or October of the following year for calendar year end Plans. In addition to the deductibility deadline, there are also rules that specify when various contributions must be deposited to maintain plan compliance (examples include, but are not limited to, safe harbor contributions, top-heavy minimum contributions, and discretionary contributions). Finally, be sure to review your plan document to ensure that it allows for making an annual contribution as opposed to a per pay contribution. If your document indicates per pay, an amendment will be needed.

Evaluate plan design and long-term goals

Proper retirement plan design includes the following:

- Contribution and Match

- Longevity of Savings

- Asset Allocation

Attracting and retaining a highly-skilled and diverse workforce

In 2020, plan sponsors split focus between health care and retirement has come into balance, especially for larger plans. Most plan sponsors report that health and retirement benefits compete for funding.4

For 3 in 10 employers (31%), financial wellbeing benefits have become a more important part of total rewards during the COVID-19 pandemic.5

Issues in energy:

- Fragmented workforce

- Communicating and engaging employees according to their demographic needs

- Staff nearing retirement age

- Lack of financial wellbeing translates into financial stress and engagement challenges

- Retirement plan strategy for highly skilled (compensated) employees

- Workforce generational retirement readiness impacts financial performance

- Succession planning strategies that address key stages from the beginning of a career to retirement

- Culture of resiliency and financial wellbeing

Plan design in the energy industry

95% have a 401(k) retirement program6 and match employee contributions with 62% of oil and gas companies7 granting full-time employees' eligibility to participate immediately upon hire. 34% use auto-escalation and, in recent years, the use of auto-enrollment (59%) has increased long-term participation, significantly improving employees' retirement savings. Most oil and gas companies (88%) use target date funds as their QDIA — which can be used as a default investment strategy or self-elected option. Target date funds offer the ability to align investment portfolios with the employee's intended retirement date, making them the unanimous choice among large employers (100%).8 Of those who offer a non-qualified deferred compensation plan, 86% offer a 409A plan type and 21% offer a 457(b).9

Energy Consulting

From strengthening employee wellbeing to managing an aging workforce, our team is here to help.

Facilitating better employee financial wellbeing

2020 revealed financial fragility and concerns about ongoing market volatility. From an employee perspective, a shortage of retirement income is caused by a variety of factors. Insufficient savings ranked first (35%), followed by medical (30%) and long-term care expenses (19%).10

Retirement plans are the cornerstone of most individual's financial safety net and an employers' financial wellbeing program. Participants need more education on financial planning overall, including budgeting, saving, social security, investing, financial risks and income replacement needed for retirement.

A bright spot is energy is one of the top industries with a high (86.4%) participation rate in the retirement plan and an average participant account balance of $111,623.1111

Looking ahead for energy employees

Third-party advisors can look objectively at the organization's health and sustainability as well as the financial wellbeing of the workforce. It's a holistic approach to organizational wellbeing that is focused on attracting, engaging and retaining skilled workers and specific to the needs of the energy industry.

At Gallagher, we run to problems, not away from them. Our team of advisors and consultants consists of accredited Investment Fiduciaries, Certified Employee Benefit Specialists, Certified Financial Planners, Chartered Retirement Plan Specialists, Financial Wellbeing Consultants, and ERISA attorneys uniquely positions us to support the needs of Oil and Gas companies today—and as they innovate for the future.

Sources

1 Epiq. "The Pandemic Strikes Again. Energy Sector Bankruptcies Rise." JD Supra. September 16, 2020.

2,3 Gallagher. 2020 US Retirement Pulse Survey.

4 Fidelity. "2020 Plan Sponsor Attitudes Survey." 2021

5 Gllagher. "COVID-19 Pulse Results Survey: Work in a New Normal." August 2020.

6 Gallagher. "2020 Benefits Strategy and Benchmarking Survey.”

7, 8 PLANSPONORS. "2020 Defined Contribution Plan Industry Report. – Oil & Gas/Energy."

9 Gallagher. "2020 Benefits Strategy and Benchmarking Survey."

10 Christ, Aubrey. "Financial Fear Factors Webinar, Part 1." Gallagher. August 2020.

11 PLANSPONORS. "2020 Defined Contribution Plan Industry Report. – Oil & Gas/Energy."