Authors: Laura Ford Matthew Whitson

The media started to pay a great deal of attention to technology and real estate industry layoffs this summer. Arising from that flurry of interest was speculation that slower hiring and limited projections for new growth may be bellwether indicators for the market.

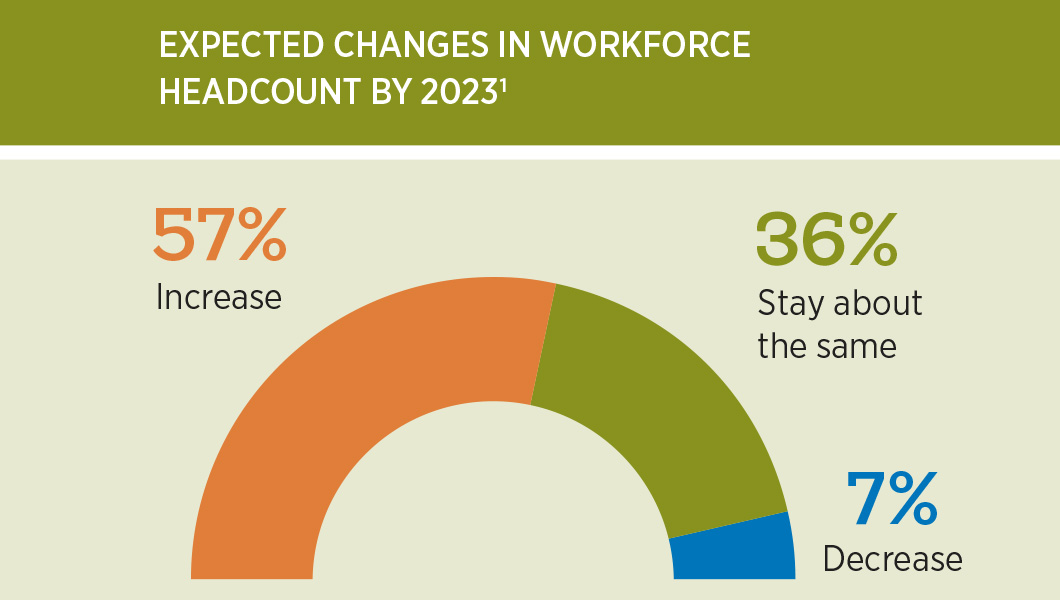

Despite the layoff buzz, a widespread whiplash effect on hiring remains uncertain. Up until recently, there's been little evidence that other industries will take the same turn, and any staff reductions seem to be isolated to those that experienced a boom period during the pandemic. However, new earnings expectations have shifted dramatically, which will likely have an impact on both hiring and wage levels. It's also worth noting that some may be entering a period of right-sizing. Overall, predictions from earlier in the year show that nearly 3 in 5 (57%) anticipate headcount growth through 2023, while less than 1 in 10 (7%) anticipate a decline.1

There could be a slowdown in worker reshuffling and turnover if employers eliminate job openings or temper their staffing expectations and accept a smaller workforce footprint. Currently, taking a closer look at alternative populations, like recent retirees and candidates with unusual resume gaps or a criminal record, can expand opportunities to stabilize hiring needs.

As employers rethink how to acquire the employee skills and competencies they need, the idea of cultivating homegrown talent is capturing attention. Some are reevaluating hiring criteria, including degrees and certifications, to determine if designated qualifications are consistently linked to successful outcomes. Others are adjusting expectations and using coaching to rapidly develop and fast-track individuals when it's not possible to hire talent with the necessary experience. However, slowing wage compression, rectifying wage inversion and increasing pay transparency currently present the most promising opportunities to stabilize and optimize the workforce.

The impact of a dynamic labor market and compensation pressures

Upward pressure on wages has generally continued as competition for talent compels employers to pay more. Adjusting base salary is the most common approach to addressing attraction and retention concerns, but for many, rising demands for higher compensation risk exceeding the supply.

Base salary enhancements were offered by 78% of employers to attract and retain talent in 2022, up 6 points from the year before.1 Many of these efforts appear to be succeeding, at least for attraction. A survey conducted during the first quarter of the year found that low pay was one of the topmost reasons why employees quit their jobs (59%), second only to a toxic company culture (62%).2

When the focus on new talent acquisition becomes all consuming, the need to address the salaries of current employees may be neglected. This imbalance needs to be rectified because wage compression occurs if the market rate for new hires exceeds the pace of salary increases. Similarities between the salaries of new employees and those who are long tenured or have more responsibilities often introduce organizational issues and legal complications.

Ripple effects from talent acquisition practices can affect everything from morale to productivity and turnover. Ninety-six percent of employers express concern about wage compression, yet only 36% have a counter-strategy for retention.3 Established members of the workforce are also vulnerable to wage inversion, which happens when less experienced team members out-earn their peers or managers. Like wage compression, there can be legal risks. If the employee earning less than the new hire belongs to a protected worker class — gender, race, sexual orientation, age or other underrepresented groups — the organization could face a discrimination claim.

Susceptibility to wage inversion is higher in the absence of a consistent compensation strategy or an established chain of approval for decisions. Outside of hiring, common compression risks occur when advancement opportunities are limited, during mergers and acquisitions, and when the minimum wage or hiring floor increases.

The growing demand for pay transparency

Establishing pay transparency practices can provide an antidote to turnover caused by wage compression. While fewer than 1 in 5 employees (19%) say their employers internally disclose salary ranges to the entire workforce, cultural shifts are underway. Several states have either passed a law or have legislation pending that would require pay ranges in job postings.4

Changing generational attitudes about sharing salary specifics with others are lifting the taboo. More than 2 in 5 Gen Z workers (42%) and millennial employees (40%) have shared their pay information with a coworker or other professional contact.4 Pay transparency also correlates with diversity, equity and inclusion (DEI) objectives. However, secrecy may skew success with salary negotiations in favor of men over women, and white men over men and women of color.5

Solutions for avoiding blind spots and unintended consequences

Hiring guidelines that use existing employee data, coded by job, help flag new employment offers which fall outside of the appropriate range. Also, salary bands and tenure-based evaluations support efforts to help ensure that salary adjustments apply to long-tenured employees. Determining pay grades and salary ranges — aligned with the organization's compensation philosophy and based on its unique needs and goals — creates a foundation for managing pay effectively.

Annual compensation reviews may not be sufficient to keep pace with the current market. More frequent cycles for tracking and evaluating metrics like company ratio and salary distribution allow for timely adjustments. Employers can identify employees who fall outside of salary bands on a regular basis and meet their targets. If compression is found, the organization also has an earlier opportunity to acknowledge this issue and detail their plan to address it. Importantly, the rationale for reducing or ceasing pay increases for employees who are out of range, until their colleagues can catch up, should be communicated to the workforce.

Non-financial compensation presents an alternative when differentials exist that the budget can't cover, such as four-day work weeks, extra paid time off or even student loan benefits. And improved advancement opportunities are cited by 37% of employees as a reason for moving to new company.2 Establishing career ladders can create an inviting and rewarding path to contribute at higher levels.