Author: Phil Bushnell

Data often drives decisions and throughout the COVID-19 pandemic. Gallagher has been engaging in Pulse Surveys to help identify some of the trends and activities surrounding organizations’ responses to the pandemic and its effect on the workforce. Nonprofit organizations are often on the front lines of crisis and have an even greater need to maintain its organizational wellbeing. The following summarizes the results of some of the pulse surveys Gallagher has initiated since we confronted this crisis. These survey results are those of all organizations but where nonprofit & social service organizations stand out, we have so indicated.

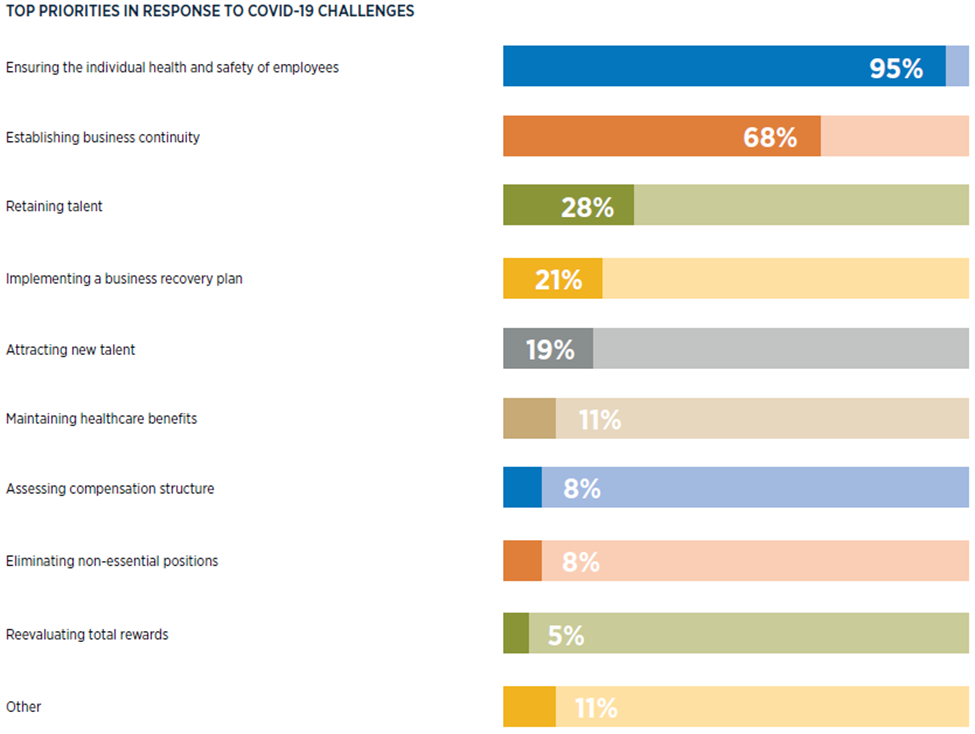

The disruption surrounding the COVID-19 pandemic has resulted in a shifting of organizational priorities. Pre-COVID human resource priorities centered on talent, growth, and cost control. In April, we identified that the health and safety of employees, business continuity, and a recovery plan had replaced those pre-COVID priorities.

However, between April and August, we saw that one of the key priorities for employers, recovery planning dropped by over half from 44% in April to 21% in August. And signaling some optimism for rebuilding and future growth, the focus on talent attraction rose from 6% to 19% over that four-month period.

Employer outlook for 2022 revenue has shifted considerably as a result of COVID-19. Prior to the pandemic, revenue changes employers projected would occur by 2022 were split — between a decrease for just 6%, little to no change for 24% and an increase for 70%. But in August, 36% expected a decrease, which is a jump of 30 points. Comparatively, just 34% expected revenue increases, which is a 36-point decline. The remaining 30% either believed results would be similar or didn’t yet know. The pandemic’s immediate effect on revenues will become clearer as FY 2021 draws nearer, but industries that provide consumer tax sources such as restaurants, entertainment and community services are among the hardest hit. Data shows that roughly half of social services (52%) and public entity (50%) employers anticipated revenue decreases.

So what does that mean for us as employees? Well, continuing economic pressures have led nearly half (48%) of employers to either implement (36%) or plan (12%) furloughs or layoffs. Industries that experienced the greatest percentages included manufacturing (61%), business services (57%), social services (51%) and healthcare (48%). Within technology (36%), public entity (33%) and financial services (25%) organizations, the impact has been milder. In an effort to curtail the financial effects of furloughs, layoffs and leaves, 21% of employers addressed health benefits eligibility and continuation for affected employees by amending the plan terms. This practice is more common within the healthcare (43%), social services (33%) and business services (31%) industries. And rates are much lower among public entities (9%) and financial services organizations (0%).

Despite reduced revenue expectations through 2022, most employers aren’t reducing healthcare or other benefits. Overall health plan design strategies were strikingly consistent when comparing May and August survey results, which reveals that COVID-19 cost pressures have not driven large-scale changes. There’s been a slight uptick of 2 points in employers that haven’t reduced these benefits over this three-month period or don’t intend to, from 86% to 88%. The findings were consistent across all industries including social service organizations. Anticipated additions or expansions to total rewards in 2021 far surpassed reductions. As of August 2020, just 14% of employers anticipated reductions in total rewards for 2021. Comparatively, far more employers were planning to offer new total rewards or expand what they currently had (55%). The top areas of focus included emotional wellbeing (30%), employee communication programs (21%), physical wellbeing (20%) and financial wellbeing (19%). These benefits align with workforce needs amplified by the pandemic.

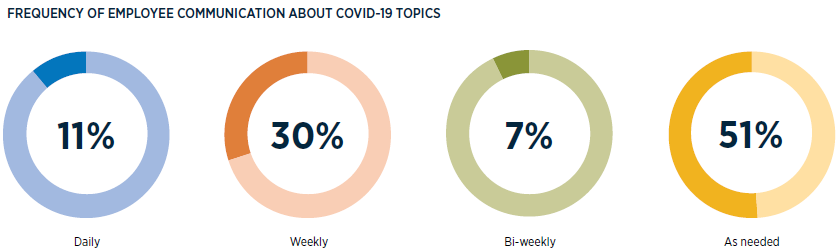

The cadence of communication has changed as employers and employees have adjusted to a pandemic-altered work environment. Daily or weekly communication fell 24 points since April, when organizations and individuals were in the throes of adapting to changes in infrastructure and work routines. But in August, messages about COVID-19 were sent only as needed by 51% of employers (vs. 32% in April). A brisker pace was maintained either daily by 11% or weekly by 30%, while the other 7% settled on a bi-weekly frequency. Four months earlier, the comparative rates were 31%, 34% and 3%, respectively. At its root, a pandemic is a health issue, which is why it’s not surprising that 67% of healthcare organizations were communicating daily or weekly.

COVID-19 continues to accelerate telehealth adoption. Digitally delivered health services provided a much-needed solution for the many employers that adopted them in 2020. They’re helping protect employees from exposure to COVID-19, flu and other viruses while shifting patients to a lower-cost setting in a challenging financial environment. Another patient advantage is having a comfortable and convenient outlet for getting some of the medical services they put off. This care delivery model supports both physical and emotional wellbeing, including the possibility of earlier detection of unknown issues.

An increase in employees working at home has shown little effect on direct changes to compensation. Permanent changes to the number of employees working at home were expected by 61% of employers — yet only 6% were thinking about adjusting compensation as a result. Just 2% identified the potential for eliminating or reducing geographic differentials, and 1% each were considering pay increases, pay decreases, variable pay increases or variable pay decreases. Interest among industries was consistently below 5% for each method, except 12% of technology employers were looking at eliminating or reducing geographic differentials.

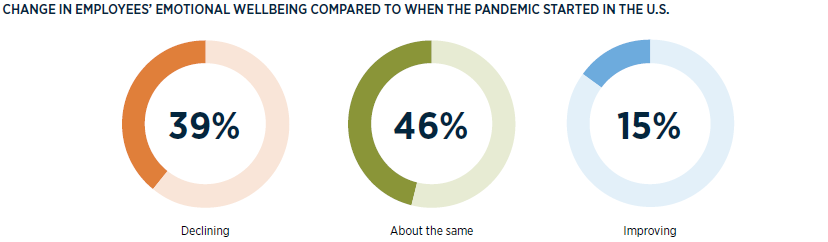

A decline in employee emotional wellbeing is more than twice as likely as an improvement. While the threat of COVID-19 to physical health is serious, the strain of coping with lifestyle changes, financial worries and other pandemic-linked anxieties affects far more employees. Ensuring workplace safety helps reduce stress and provides an opportunity to advance the conversation about mental and emotional health. Compared to when the pandemic started, 39% of employers have indicated a decline in employee emotional wellbeing. Lower levels were most common among public entities (52%) and the healthcare (46%) and business services (45%) industries. For another 46%, the emotional wellbeing of their workforce was about the same. However, 15% reported an improvement in the level of emotional wellbeing. Work-at-home or flex scheduling policies and an increase in workforce civility and kindness noted by about half of employers could be reasons for this positive trend. This finding also correlates with the results of a July survey that found two-thirds (65%) of employers ranked emotional wellbeing as a much higher priority.

The cumulative effects on employees of coping with lifestyle changes, financial worries and other anxieties has continued to capture the attention of their organization’s leaders. And these employers are still rising to meet the challenges of the pandemic with a steady focus on employee health and safety — and a commitment to total rewards. As the state of overall employee wellbeing goes, so goes the state of the organization’s wellbeing. Making headway hinges on building employee resiliency against burnout, which takes planning and implementing an effective strategy backed by leadership. When employees can tap into a reservoir of wellbeing, they’re able to bring their best selves to work each day.

Data contained in this article has been taken from Gallagher’s 2020 COVID-19 Pulse Survey titled Sustaining Organizational Wellbeing and Resiliency Through a Crisis.