Authors: Mary Heymans

The COVID-19 pandemic has increased pressures on healthcare organizations nationally to continue to grow and evolve the role of advanced practice providers (APPs). More than ever, healthcare organizations are working to differentiate base pay to align with market competitive factors and better recognize differences in scope of practice, specialty, practice and setting, while increasing prevalence and payments within performance-based incentive plans.

Those are among the findings of Gallagher's 2020 National Advanced Practice Provider Compensation Survey Report, published in December 2020. The latest survey reports data on nearly 67,000 individual APPs associated with 933 sites of service nationally, making it a premier source of APP compensation data to support overall organizational wellbeing for healthcare organizations.

Coming decade to face a primary care physician shortage

The need for nurse practitioners (NPs) and physician assistants (PAs) continues to grow. Experts predict a shortage of nearly 139,000 primary care physicians by 2033. Compounding the looming shortage are increased pressures due to COVID-19, making the need for qualified healthcare providers absolutely essential.

The use of NPs to close anticipated gaps in primary care access could substantially reduce the primary care shortage, according to the Medical Group Management Association (MGMA). Alan J. Beason, an MGMA consultant, notes, "We need to push as much as we can to the next level of licensure and certification [to] take some of that burden off the doctors," as the healthcare sector continues to push its limits and solicit the next decade's healthcare professionals.1

Overall APP total cash compensation has increased steadily by 2% to 3% from 2014 to 2019, according to Gallagher findings. Consistent with Gallagher team recommendations to clients, the overwhelming majority of organizations (97%) do not differentiate pay between nurse practitioners and physician assistants when the scope of work and practice is the same. However, Gallagher consultants consistently observe that PA pay marginally exceeds NP pay, as shown in Figure 1 which may be more indicative of practice setting or specialty represented within this sample.

In 2020, median pay for physician assistants decreased slightly (-0.1%), while nurse practitioner pay increased by 1% to moderately lessen this pay discrepancy.

More than 75% of organizations compensate their APPs using pay grades, the survey found. Similar to findings of the survey in previous years, organizations establish pay grade tiers based on the following criteria, listed from most to least prevalent:

- Specialty area

- Practice setting

- Operation room/first assist requirement

- Patient acuity/complexity

- Procedural services

- ED/unassigned call requirements

- Independent practice/panel

In 2020, the average number of pay grade tiers was four. While the survey data lags the market in this area, Gallagher consultants are seeing clients implement more pay tiers and positions to recognize differences in practice setting, scope of work and pay components (e.g., productivity eligibility or not), as well as more specialty-specific pay determination for APPs. This alignment of base pay with specialty, scope of services, and setting is similar to that for physicians.

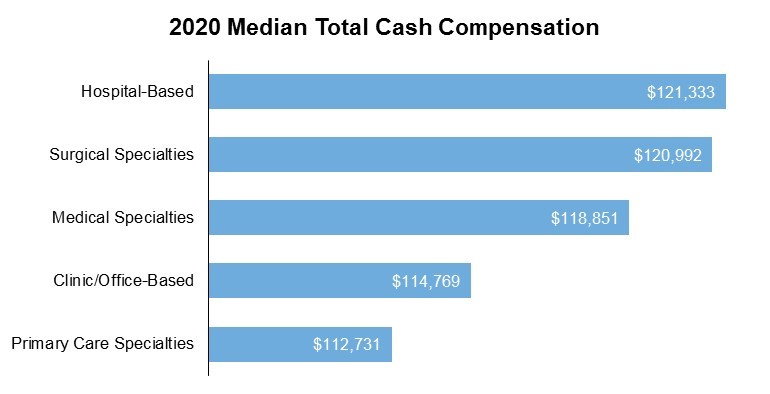

Figure 2 illustrates the variation in median compensation among the various specialty groupings and practice settings. More lucrative specialty areas and/or practice settings may help to predict where the next generation of APPs will be drawn to practice.

Aligning APP pay with physicians' pay

As healthcare organizations look to align APP pay philosophy and structure more closely to that their physician partners, organizations are adjusting their pay and pay structures accordingly. Over the past years, the Gallagher team has seen APPs' base salaries represent less of the total cash compensation at the 75th and 90th percentiles. This is indicative of the shift towards additional pay components for productivity, quality, and call, among other variables.

The majority of survey respondents (68%) report providing some type of on-call pay for their APPs. The survey reports that 65% of participants provide some sort of formal incentive program for their APPs, up from 63% in 2019 and only 22% in 2009.

Of the organizations offering an incentive program, only 20% offer solely a pay-for-performance incentive; 28% offer solely a productivity based incentive (although not typically for all APPs), and slightly more than half (52%) use a combination of both productivity and pay-for-performance incentives. An incentive program that includes both pay for qualitative performance and productivity is the most effective in recognizing differences when APPs are providing billable visits. A straight salary, however, may be more suitable for those APPs who consistently see non-billable visits such as post-op and follow-up appointments.1

Specialties commanding the highest pay

Cardiovascular/cardiothoracic surgery currently is the highest paid APP specialty, at the 90th percentile, nearly 12% higher in compensation than the second-highest paid specialty, OB/GYN: Maternal and fetal medicine. Pediatric cardiology, pediatric critical care, and neonatology also are among the highest paid specialties—see Figure 3. Survey respondents identified many of these specialties also as the most difficult to recruit.

Sixty-nine percent of organizations identified specific specialties they found difficult to recruit in 2020. Those topping the list include critical care, cardiothoracic, neonatology, and psychiatry. However, recruiting APPs is only half the problem. Once a position is filled, organizations must work to retain their talent for the long term. Gallagher clients report that retention typically is hardest in the first five years of employment when APPs situated lower in the pay range are more likely to move to competing organizations to maximize increases in pay more quickly.

Signing bonuses are becoming more common

Healthcare organizations use a variety of pay tactics to recruit and retain their employees. Relocation bonuses, retention bonuses, and student loan forgiveness have increased in prevalence, with the median bonuses/assistance at $5,000 (relocation), $5,000 (retention), and $20,000 (loan forgiveness), respectively.

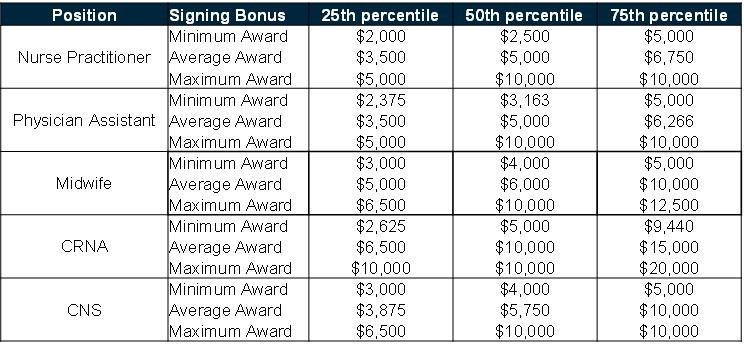

More than 60% of organizations participating report offering signing bonuses to employees. Of those organizations offering signing bonuses, see the prevalence for each of the positions outlined in Figure 4. For the average bonus provided, the lowest bonus provided, and the highest bonus provided, see Figure 5.

Figure 4. Prevalence of Signing Bonuses

Figure 5. Signing Bonus Market Range

To discuss your situation with a Gallagher expert or purchase a copy of Gallagher's 2020 National Advanced Practice Provider Compensation Survey Report, please contact the Gallagher HR & Compensation Consulting team. During uncertain times, Gallagher can help your organization face the future with confidence.