Authors: Peter Dunn Alex Kreibich Alex Rule

The abundance of variables that keep healthcare costs unpredictable make a relentless task of finding ways to budget effectively. However, well-directed efforts minimize surprises and avoid over-allocating dollars that can be put to better use for top priorities, such as the employee experience or business growth.

Optimizing benefit costs begins by exploring the current forces that drive them. A basic understanding of how they interrelate prepares employers to think more critically about spend allocations for benefits overall, particularly healthcare, as well as employee communication. The end goal is to gain the best return on investment (ROI) in organizational wellbeing, which always factors in workforce wellbeing.

Forces driving healthcare trends

Both employers and employees are bracing themselves again to endure additional financial pressures from healthcare cost increases. Employer contributions to private health insurance premiums are projected to grow by 5.1% in 2022 for private businesses, and 5% for household premiums.1 Meanwhile, COVID's toll on claim costs has not yet been fully tallied due to unknown costs of delayed and deferred care. Missed opportunities for preventive care in the past two years create the potential for a downstream impact lasting three to five years. It is the risky price of diagnosing healthcare-intensive conditions, such as cancer, later rather than earlier.

Existing reimbursement models pose another challenge for employers because the interests of two major players — healthcare payers and healthcare providers — do not align with their own. Although greater consolidation is increasing providers' leverage with payers, medical loss ratios and enhanced gross margins resulting from higher premiums are lowering payers' motivation to mitigate costs.

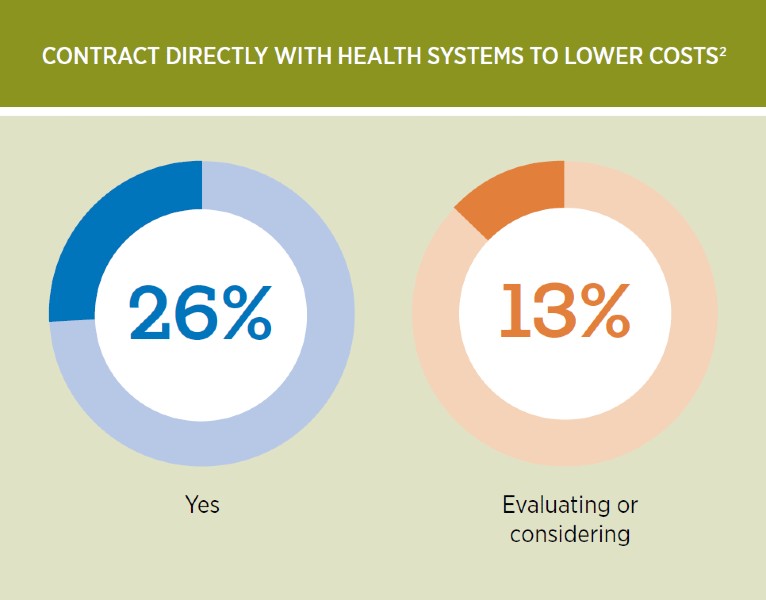

Proven time and again, just thinking differently about complicated or stubborn issues often breaks a seemingly immovable impasse. In this case, direct contracting with health systems offers one cost solution. Yet so far just 26% of employers apply it, and 13% are evaluating or considering this type of arrangement.

Employers must also contend with the pandemic's economic effects. As hospital systems try to overcome labor shortages with increased pay, they need to make up for those accumulating costs, and the tab is running high.

Extreme competition for talent has led the state of Montana to cover eligible healthcare providers' relocation costs. They receive up to $12,500 for moving expenses, plus 35% of the total reimbursement amount to offset expected payroll tax deductions for the employee's actual qualifying expenses for moving and relocation.3 Desperate measures like these raise the level of compensation competition across the country. And for medical services, there is generally a lag between the initial appearance of labor shortages and the experience of higher healthcare prices.4

While it is fairly safe to assume that virtual care is here to stay, fragmentation and spotty utilization make the impact of this model difficult to predict. An increased availability of point solutions more widely supports employees. However, underexposure caused by too little communication often undermines awareness, understanding and perceived value. Daily demands placed on HR leaders and resource limitations can make strategic planning difficult. Yet, for ROI management purposes, it is essential to consider how employees access care and to evaluate their experience.

The link between healthcare benefits, financial wellbeing and organizational outcomes

If leadership teams and managers expect to lower the expense of healthcare and other benefits as they increase revenue, certain actions are critical. They need to measure and understand the potential for physical health, mental health and financial wellbeing to affect organizational health — and invest in strategic opportunities as an avenue for adding margin to the business. However, to make this commitment, leaders may need to see a clearer connection between employee wellbeing and operational outcomes.

Providing better insight into what is measured, and why, is the first step toward making a solid case, followed by monitoring key predictors of success. The ability to establish a strong link between benefit outcomes and business metrics validates the importance of this interrelationship. But an overwhelming 91% of HR leaders need more support to achieve this goal and earn leadership's interest and investment.2

Moving data from silos into a more integrated platform can also clarify the wellbeing connection. Predictive technology will increasingly be able to identify red flags for turnover rates or preventive care spend, allowing employers to address these risks closer to real time.

Metrics on active participation in retirement programs and engagement with financial wellbeing tools provide insight into employee financial stability, which is linked to organizational sustainability. Optimal financial wellbeing outcomes, which support better physical and emotional health, become likelier when employers actively help employees engage in benefits. When people do not retire because they cannot, this predicament often increases costs for organizations.

Sharing hard evidence of the effects of compromised health on employee and business outcomes, spotlighting higher healthcare costs, elevates the discussion to the level of C-suite interest. Illustrative metrics are abundant. For instance, research shows that 40% of employees report very high levels of stress and 25% cite work as the top stressor in their lives. Those experiencing higher levels spend 50% more on healthcare than their less stressed peers.5

Left unaddressed, mental and emotional strain can also lead to risky behaviors that may affect work performance. Alcohol abuse rose considerably during the pandemic. Employees who abuse alcohol are three and a half times more likely to be involved in a workplace accident than coworkers. And about 40% of industrial fatalities and injuries can be linked to alcohol misuse.5

The indispensability of enhanced employee communication

Spending on communication about benefits and employee wellbeing amounts to a fraction of a percentage compared with most organizations' annual investment in healthcare benefits. And beyond enrollment, many benefit platforms do little if anything to improve employees' understanding of available health and wellbeing resources — or how to optimize their value. This lack of communication is a lost opportunity for building and competing on a better employee experience.

Even with a clear business case for improving the strategic use of employee health and wellbeing communications, only 27% of employers have secured additional investments for this purpose in 2021. Requests made by another 6% were unsuccessful while 67% made no attempt.2

The most successful communication programs are frequent, varied in content, multi-channel and tailored to the target audience. When campaigns occur often and are well-articulated, organizations have managed to spend significantly less on financial incentives and still achieve high participation rates.5 In fact, strategically planned and executed communication campaigns may prove better than adding tools and point solutions

When planning to optimize cost-effectiveness, it is important to evaluate currently available benefits with a focus on healthcare. New options sometimes fill gaps that others cannot. But it is also true that redesigning and realigning existing offerings with organizational needs, and maximizing ROI through communication, may achieve equal or better results.

Many organizations now accumulate priorities where they recently invested financial resources. Yet left idle for too long, these intentions may hold back progress. Reviewing significant expenses as the business climate changes can identify opportunities to lower healthcare and other costs, allowing more constructive budget allocations. And wherever applied, strategically enhanced communication, integrated platforms and effective measurement help improve benefits use by enabling employees to better understand the value of these offerings and employers to realize a better ROI.

ACCESS THE REPORT