Authors: Kevin Talbot Gillian Scott

Employers are used to riding out difficult periods when demand for talent exceeds supply — they have strategies for that. But the factors that are important to consider have increased, while the depth of demand for hiring employees remains at odds with a shallow pool of availability.

Margins for error when determining the best approach to recruiting, rewarding and retaining talent may never have been so small. From January through June of 2022, 72% of organizations experienced an increase in open positions.1 Workforce shortages and the scramble for limited talent are now driving compensation and benefit reforms, aided by technological advances aimed at easing widespread staffing issues.

As long as inflation pushes up the cost of groceries, gas and other essential and non-essential goods while the job market remains strong, employee demands for higher wages will continue. Organizations are acutely aware that competition for talent in this economic environment is eroding compensation structures, adding costs and reducing profit margins. Tension between colliding wage and market inflation needs an outlet — and a reconfigured approach to compensation, and more broadly total rewards, can provide one.

Competitive compensation is a starting point for attracting and keeping top talent, but an updated approach to holistic total rewards design helps carry employers across the finish line. In 2022, 4% added childcare assistance to help with inflationary pressure, 11% are reimbursing for transportation costs, and 29% are extending timelines for remote work.1

The competitive necessity of putting a premium on flexibility

Returning to reopened workplaces as the pandemic moves into a milder phase, some employees may be greeted with an updated environment. But a more important focus on renewal applies to their experience beyond their surroundings. Wherever they work, employees expect more flexibility and choice in policies and benefits — and more employers are supporting different needs within the realm of affordability and effectiveness.

Large-scale remote work, initially regarded by many organizations as a temporary solution in 2020, proved its merits quickly. Extending this option to qualified employees is becoming a must-have policy in many industries, often as part of a hybrid model that requires or allows employees to work onsite for a set number of days each week.

In the last quarter of 2021, 36% of middle-market companies reported having remote employees who weren't remote before the pandemic. Research also indicates a growing preference for location flexibility among workers, showing that 1 in 3 would leave their jobs if remote work were eliminated. And 4 in 5 would recommend working remotely to a friend. 2

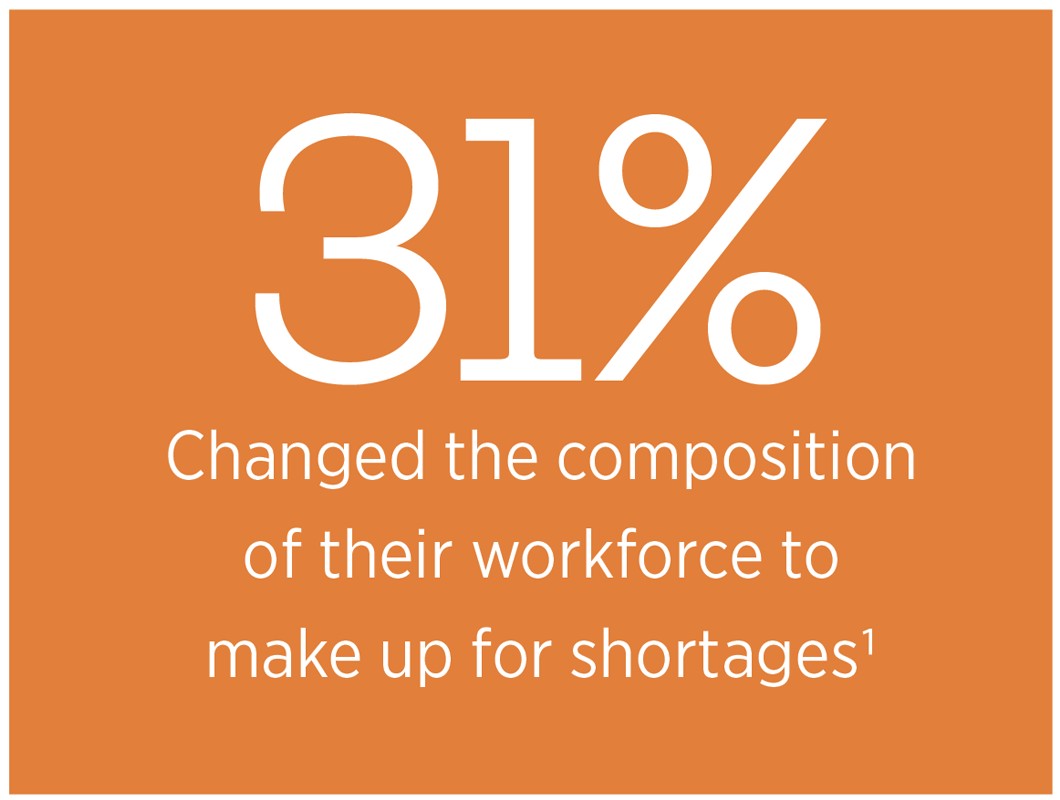

Short staffed in the face of increasing wage demands that can't be met, some employers (61%) have implemented flexible schedules to avoid overwhelming their workforce. And almost a third (31%) changed the composition of their workforce by hiring more part-time than full-time employees. 1

Efforts to enhance flexibility also extend to career development and performance management. For instance, managers may set aside time to talk about career goals and pay with employees more than once a year to stay current on ways to make their individual experience more rewarding. Programs that provide guidance on pursuing advancement, and support for emotional wellbeing, also increase satisfaction and contribute to a culture that promotes attachment to the organization.

Employers can optimize total rewards by evaluating everything employees gain from working for their organization, and making changes or additions that will continue to provide what's important. In 2022, this includes carefully considering options that are likely to slow attrition, attract new talent, and minimize hiring and rehiring costs.

The non-negotiability of adequate support for work-life balance

Older employees departed the workforce at a higher rate during the pandemic.3 Mid-career caregivers, whose average demographic is a 49-year-old working woman, are more prone to stress as members of the sandwich generation.4, 5 And younger generations have a tougher time getting ahead in the work world, which takes a toll on their mental health.6

Work-life balance is no longer just a general framework for benefits and work culture overall. In the interest of individual and organizational performance — and employee retention — the ability to achieve this outcome should be a criterion for every related decision and action.

Offering benefits that promote a better quality of life, 24/7, demonstrates an understanding that an organization's people determine their bottom line. Besides work-life balance staples such as parental leave that proved so essential during the pandemic, interest in forward-thinking policies like a four-day work week may soon be top of mind for employers. Already, select U.S. organizations are participating in a program that tests the realities of this concept.

When policies and total rewards are proven to actually enable work life balance, the achievement of higher engagement levels, increased productivity and reduced absenteeism will make saving costs much easier.

Attracting and retaining employees through a commitment to social responsibility

Realignment of talent management strategies increasingly emphasizes the need to set environmental, social and governance (ESG) criteria for the organization's operations. A growing number of investors consider these standards important when evaluating investments, including 82% from 24 countries around the world who say that companies have a responsibility to address social issues.7

Unfolding global events may lend a sense of urgency for many. While there's new confidence about a true end in sight for the pandemic, the current effects of geopolitical turmoil can be extreme, such as the widespread inhumanity of war in Ukraine. Many employees want to be associated with an organization that demonstrates a commitment to protecting the planet, advancing social good and supporting diversity, equity and inclusion (DEI) practices.

Understanding the critical relationship that often exists between adherence to ESG principles and how employees perceive their organization can boost success when competing for talent. That's likely to be the case in any labor market, especially among younger generations. By clearly communicating and consistently upholding their mission, vision and values, employers can authenticate their belief in these tenets.

Creating a total rewards feedback loop for employers and employees through periodic evaluation

Uncertainty about workforce opinions on the value of their total rewards serves as an important maintenance-required alert. A key step in assessing the effectiveness of compensation and benefits is measuring outcomes against program goals, but some employers overlook this investment checkup.

A variety of total rewards evaluation tools are available, and many address goals for specific programs. But essential takeaways and actions should include a clear understanding of employee experiences and preferences to guide the development of a plan that prioritizes improvements to be made over time.

If the goal is to increase employee satisfaction and reduce attrition rates, conducting baseline surveys on total rewards before implementing a new program allows comparative insights. Focus groups add dimension to these findings by gathering data on the pros and cons of the current benefits package and generating new ideas for enhancement. Firsthand feedback from employees at all levels of the organization is essential to overall relevance.

Artificial-intelligence-enabled and virtual focus groups can deliver efficiencies. When employers are considering specific changes to total rewards, these groups help speed the process of identifying, segmenting and documenting concerns for predictive analysis of possible outcomes.

Surveys can be useful for measuring the opinions and attitudes of employees across a broad spectrum of indicators. Besides reactions to total rewards design and policies, data on their levels of satisfaction, engagement, commitment, motivation and sense of purpose can be very informative.