Author: Glenn Drees,CPCU

Historical view of the Food and Ag insurance market

- The overall pace of account rate increases is no longer accelerating.

- Exposures continue to increase. Payrolls are increasing from the wage inflation pressure, sales are increasing due to price increases of commodities and inflation, and construction inflation is pushing property values higher as building materials and labor costs force replacement costs higher.

- Rising insurance costs are not the only costs that are challenging our clients. Higher input costs for growers, higher commodity and ingredient costs for manufacturers, supply chain challenges, the war in Ukraine and a tight labor markets are just a few.

- In the food manufacturing space, there continues to be a contraction of the number of insurers that are willing to provide capacity.

- After several years of rate increases, insurer's profitability has improved. They are proceeding with caution as they carefully watch inflation, recessionary pressure, social inflation and a backlog of lawsuits winding their way through the courts.

- Increased market competition minimized rate increases and led to underwriter declinations due to overwhelming submission loads. They want to know what it will take to win before they even begin the underwriting process.

Current trends in the Food and Ag insurance market

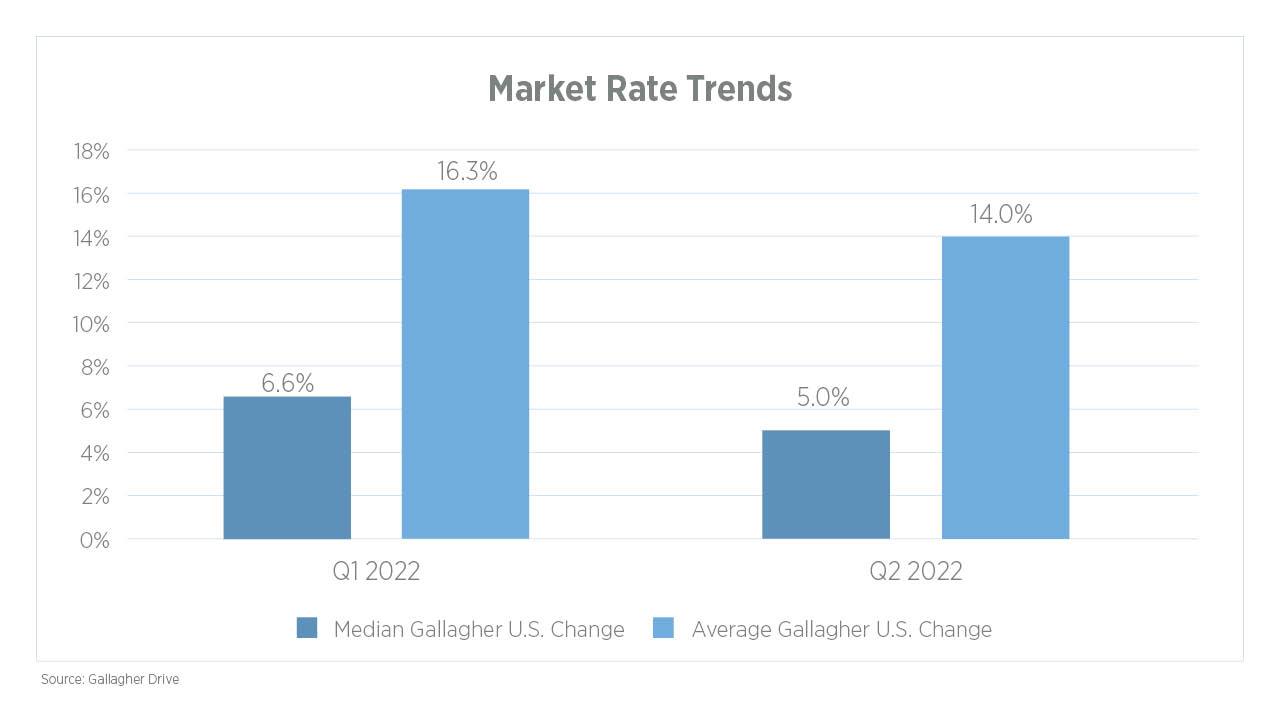

- Rate increases are now averaging 15.2% over the last two quarters, depending on risk profile and line of coverage mix.

- There is competition for accounts that have good loss history, proven management and strong balance sheets.

- In Q1 2022, 24.0% of our clients saw rate decreases on an account basis. This decrease is highly nuanced and is strongly dependent on risk characteristics.

- Product recall/contamination insurance pricing has been stable, and with adequate capacity. There has been one new entrant into the market, and we anticipate one additional carrier this year.

- Property has been and continues to be one of the most challenging lines. There is absolute insistence on accurate statements of value, business income worksheets and responses to risk improvement recommendations. Average rate increases where there is a single property insurer are hovering around 10.0% and for shared property programs the rate increases are 20.0%-25.0%.

- General liability rate increases have been trending down and averaged 5.4% in Q1 2022.

- Workers compensation, the only real coverage with rate decline, has shown low single-digit rate reduction in each of the last four quarters.

- Umbrella continues to show a better trend line, with each of the last few quarters showing a smaller rate of increase. Accounts with large fleets, producers of ingredients and those with risk characteristics that underwriters deem as high hazard will see higher rate increases and shrinking capacity. The pricing for the higher layers appears to be improving more quickly than the first layer. The average rate increase in the most recent quarter was 8.3%.

- Auto rates for food and agriculture accounts are trending similar to other industries. The average rate increase for the past four quarters was 10.5%.

Future considerations for the Food and Ag market

- There are many trends to watch outside of the insurance marketplace that will affect insurance rates, including inflation, supply chain, labor shortage, litigation trends, geopolitical instability and interest rates.

- The effects of COVID-19 will be with us for a while, but our clients are emerging from lockdowns and slowdowns.

- Our clients feed the world. The food they produce is critical for the almost 8 billion people that inhabit the earth. Both food production and food distribution need to continue to improve to meet the growing demand.

- The use of technology continues to grow. From precision agriculture to the use of drones to robots in manufacturing, food and agriculture has become more automated and has resulted in increased cybersecurity risks.

- Climate change is affecting crop yields and changing weather patterns. Floods and severe weather are impacting loss expectancies, and property insurance modeling is changing as a result.

Because of the highly nuanced nature of this market, it is imperative that you are working with an insurance broker who specializes in the food and agriculture industry or the particular line of coverage. Gallagher has a vast network of specialists that understand your industry and business, along with the best solutions in the marketplace for your specific challenges. Visit our food and agriculture page for more information.

About our data

Gallagher Drive® is our premier data and analytics platform that combines market condition, claims history and industry benchmark information to give our clients and carriers the real-time data they need to optimize risk management programs. When used as part of CORE360®, our unique comprehensive approach to evaluating our client's risk management program, Gallagher Drive creates meaningful insights to help them make more informed risk management decisions, find efficient use of capital, and identify the top markets with the best solutions for their risks.

Rate changes in this report were calculated by using the changes in premium and exposure of Gallagher clients renewing in Q1 and Q2 of 2022. Due to the variability that we are seeing in this market and specific account characteristics, individual rates may vary.