Authors: Eric Elbell Kevin Schmid

Stock market investors in 2021 enjoyed strong returns and a relatively smooth ride, as the S&P 500 Index produced a total return of almost 29% for the calendar year while experiencing an intra-year peak-to-trough decline of only 5%. The early months of 2022, however, have brought a decidedly different market environment, as certain factors — chiefly, rising interest rates, persistently high inflation, and, most recently, geopolitical concerns — have weighed on financial assets, producing a rocky start to the year for both stocks and bonds. Through February 28, a basic portfolio consisting of 60% equities and 40% bonds had generated a return of -5.8%, resulting in a trailing one-year return for such a mix of just 4.0%1. Here's an update on these issues that have unnerved markets in 2022.

Inflation

Inflationary pressures have been a concern for almost a year now, as the reopening of the economy has been accompanied by labor market dislocations, supply chain disruptions, product shortage, and rising energy costs.

Before the COVID-19 pandemic, inflation remained below its long-term trend for quite some time, and the Federal Reserve originally expected that post-pandemic price spikes would be transitory. Those hopes faded during the latter half of 2021, as higher prices lingered and spread to a broader array of products and services. The annual change in the consumer price index (CPI) recently hit a 40-year high.

The near-term outlook for inflation will be highly influenced by the degree to which reopening pressures abate as well as the trend in energy prices. At the end of February, West Texas Intermediate (WTI) crude oil futures traded at almost $92 per barrel2, nearly double their price at the end of 2020 and up more than 20% in 2022 alone.

Of note, financial markets still maintain a relatively subdued long-term inflation outlook, notwithstanding recent inflation readings. The implied inflation rate over 10 years (also called the "breakeven rate") — measured as the difference between the yield on a 10-year U.S. Treasury bond and comparable maturity Treasury Inflation-Protected Securities (TIPS) bonds — currently sits at 2.69%3:

Interest rates

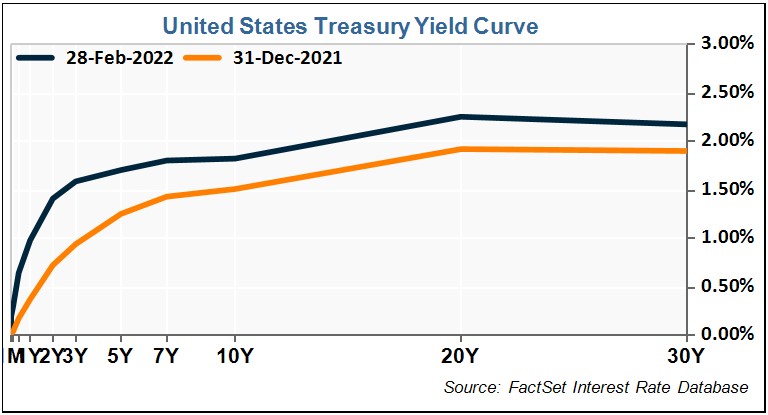

With inflation remaining stubbornly high, U.S. Treasury bond yields have risen in 2022, particularly in the short-to-intermediate range of the yield curve, as investors anticipate the Federal Reserve being forced to act more aggressively to reverse its pandemic-induced zero interest rate policy with regard to the federal-funds rate4. From the start of the year through the end of February, the 2-year Treasury yield jumped from 0.73% to 1.43%, while the 10-year Treasury yield rose from 1.51% to 1.84%.

The Fed has acknowledged it intends to lift its benchmark rate in March, which is widely expected to be followed by multiple additional hikes. The trajectory of rate increases through the year is currently subject to much debate, with estimates changing swiftly as events unfold. For instance, earlier in the month of February, the fed-fund futures market had placed an 80% probability that the Fed would initiate a cycle of interest rate hikes with an aggressive 50 basis point increase in March. By the end of February, however, that implied probability had dropped to approximately 20% as investors estimated the Fed may take a slower approach amid escalating geopolitical developments.

Geopolitics

Russian's late-February invasion of neighboring Ukraine did not cause an immediate adverse stock market reaction, perhaps because the action was telegraphed in advance; in fact, the S&P 500 index actually rose in the first two days after the start of the invasion. Nonetheless, the development may have lingering economic ramifications that could complicate the investment landscape. Foremost among these may be additional inflationary pressures, as WTI futures have surged to well over $100 a barrel following the invasion, the highest level since 2014.

In addition, a land war in Europe coupled with diplomatic isolation of Russia by most Western countries threatens to constrain the supply of various other commodities while exacerbating existing supply chain challenges. On the other hand — as noted above — it is now more likely that the Fed will take a less aggressive approach to raising interest rates, and bond yields have in fact fallen since the start of the invasion.

Perspectives

As we cannot predict with any degree of certainty the outcome of the military conflict in Ukraine or its long-term economic and geopolitical ramifications, it is accordingly difficult to predict refined estimates of its potential impact on financial assets. Suffice it to say that the conflict has introduced a new set of concerns for investors and could create greater market volatility for the foreseeable future.

In the same vein, as we state often, we cannot predict the short-term direction of markets. Further, we remind investors that stock markets have historically weathered ups and downs, including bear markets, and still provided attractive long-term returns. As noted earlier, 2021 was a year with remarkably low volatility, but the norm is for equity markets to experience double-digit intra-year losses5 even in years that finish with very strong returns.

As such, we encourage long-term investors to continue following a disciplined approach that includes maintaining a diversified portfolio with appropriate levels of risk that can withstand short-term declines, considering steps to rebalance portfolios to adhere to long-term policy guidelines (subject to funding and distribution considerations and market conditions), and seeking to capture strategic and tactical asset allocation opportunities as they arise.

Likewise, we discourage speculative attempts to time the market. Your Gallagher consultants are closely monitoring events and circumstances as they relate to individual client portfolios and will provide the necessary guidance to make financial moves when appropriate.