Author: Eileen Yuen

This Market Conditions report reviews the current state of the U.S. Management Liability market as well as current trends in pricing, terms and market capacity, claims activity and other pertinent factors specific to the banking industry. We'll also take a look at some key factors likely to influence market conditions for banks in 2021.

2020 State of the market overview

Now fully a decade after the financial crisis, the banking industry found itself on more stable ground — or so we thought — as we ushered in 2020. The favorable regulatory environment and economic progress had been contributing to bank growth, and 2020 was forecast to see more of the same.

But early on, the news of a mysterious illness sweeping through China gave financial markets pause, and we quickly saw COVID-19 hit our shores, bringing with it an abundance of uncertainty, creating a roller coaster effect in the market.

An already firm Management Liability insurance marketplace seemed to stop in its tracks, with companies pausing to consider how to approach this unknown potential liability exposure. As the virus became a global pandemic, it exacerbated the insurance markets across all industries, with some industries obviously hit harder than others given lockdowns, shuttered businesses and halted travel.

The banking industry, like many, was confronted with a never-before-seen challenge of going virtual, adopting new operating models, finding ways to continue to serve customers, meeting regulatory requirements and more. The challenges of navigating COVID-19 weighed heavily on banks, and we'll look at some of the repercussions in this report.

The firm market experienced added pressure, and renewal premiums for banks saw an upward trend. There was some variance among asset classes, and between privately held and publicly traded institutions, as follows:1

- Directors & Officers Liability (D&O): Primary D&O rates for publicly traded institutions saw increases among institutions of all sizes, with the magnitude of increase dependent upon claims history, financial performance and responses to the now-ubiquitous COVID-19 questionnaire. Rate increases averaged between +15% and +40%, with community and regional banks generally on the lower end of this scale. Those institutions with claims, strained financials, less than average stock performance or a combination of these saw increases up to and including +100%.

Privately held banks saw renewal rates generally between +10% and +25%, higher for those with underwriting challenges.

For excess D&O layers, there was significant pressure on rates, especially for the lower attachment points, with many markets looking to move up the tower instead of maintaining positions closer to the primary layer. In some cases, premium increases for Excess D&O layers exceeded the primary layer rate change. Side A rates remained somewhat insulated, with rates in the +10% to +20% range.

In addition to the pressure on premiums, retentions increased, capacity shrank and some terms were restricted. Notably, we saw a decline in capacity for shareholder derivative demand investigative costs and a reduction of limit reinstatement provisions on Side A DIC policies.

- Bankers Professional Liability/E&O (BPL/LL): Another area of constriction in the markets was the asset size of the institution that played a role in BPL rates; community and regional banks written on combined package programs between +10% to +30% and larger banks written on stand-alone BPL programs were +%20 to +40%. Insurers increased pressure on retentions, seeking higher levels to force banks to assume more risk themselves. We saw many instances of double or triple retentions offered by an incumbent for renewal. A bank's claim activity, as well as services offered and loan portfolio composition/performance, continued to be key underwriting considerations. Underwriters were also interested in understanding how each bank was responding to and participating in the SBA's Paycheck Protection Program (PPP). Capacity for BPL, especially primary, was limited, and we saw some additional constriction here with the development of litigation relative to the PPP.

- Employment Practices Liability (EPL): The EPL market for banks generally followed the types of change seen in the general marketplace, with rates increasing +5% to +20% and putting upward pressure on retention. Rates continued to be directly impacted by geography, employee count, growth and claim history for the individual institution, with significantly larger increases experienced by those with California exposures or adverse COVID-19 issues. Wage and hour defense coverage remains available, usually sublimited, and should be sought in the renewal process; both defense and indemnity coverage is available from Bermuda, London and very limited U.S. markets.

- Fiduciary Liability: Modest increases were noted, generally flat to +10% for those with little or no change in exposures. Exceptions remained, particularly for institutions with ESOPs or proprietary funds and, in these cases, premium increases were greater than +10% with pressure on retentions as well. Enhancements like settlor coverage and increased sublimits for various penalties remained available from some insurers.

- Financial institution bond: This is an area in the market where claims in a broad sense affected renewal terms. Social engineering, employee dishonesty and fraud remained leading causes of loss, and have widely impacted the underwriting community. This translated into some moderate pressure on rates for most institutions, in the +10% to +20% range. For those with claims themselves, these rate increases were greater. Key considerations from an underwriting perspective remained taking a look at controls in place within the institution, mitigation efforts and now COVID-19, especially remote working procedures.

Some insurers did look to cut back on capacity in lead positions, and many did seek higher deductibles as well. Cyber-related exclusions were more pronounced, and the crossover between this coverage and Cyber continues to demand careful attention to manage potential gaps and/or duplication of coverage.

- Cyber Liability: 2020 saw a shift in the market for Cyber insurance coverage. Having enjoyed soft market conditions for many years, most banks began to see rates tick upward when renewing their cyber programs. Those banks that renewed later in the year saw steeper increases than earlier in 2020, as the market constricted fairly quickly in this space.

The widespread losses affecting the cyber marketplace, particularly relative to ransomware, directly impacted the pricing, retention and capacity available for coverage. By the end of 2020, well-performing banks without claims activity were seeing renewal pricing increasing +20% to +40%, and we expect that to continue. Excess layers saw even greater change due to the fact that they had been so underpriced in prior years, so increases here often exceeded the primary layer rate changes.

Insurance claim activity update

Insurance claim activity for banks has been and continues to be varied. Notable areas with heightened activity included claims related to Cyber, BPL and Trust E&O claims, and a variety of Fidelity claims. While M&A activity declined in the banking sector due to the pandemic, so too did the frequency and severity of what had become the nearly ubiquitous resultant shareholder claims.

We have seen an uptick in event-related D&O claims, particularly related to Cyber events. In such a case, an adverse cyber event has often led to a claim against the bank and/or its board alleging issues like mismanagement of the event or failure to protect from the event. Other challenges for banks continue to be related to fraud, such as fraudulent transfer instructions and related social engineering claims. These matters often cross policies, affecting both the FI Bond and the Cyber coverage, depending on the nature of the circumstances. A careful look at both of these policies is required to avoid both coverage gaps and duplication.

Looking ahead: What to watch in 2021

In the year ahead, we expect to see a continued firm market environment for banks, with average overall rates varying between +15% to +40% across most Management Liability lines.

2021 brings with it a number of factors that will have significant bearing on the banking sector. Those we are closely watching include the following.

M&A

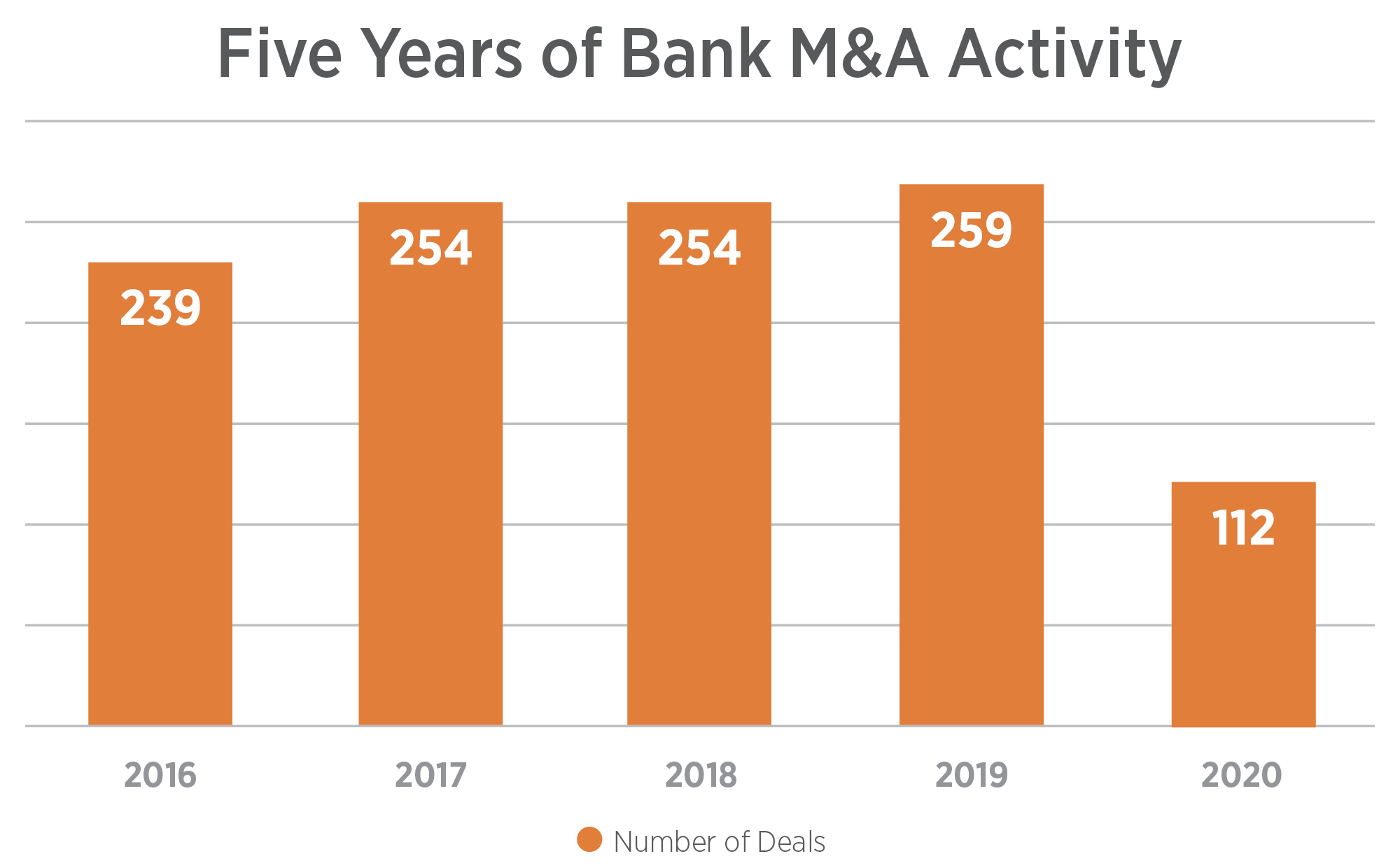

2020 matched 2009 as the slowest year for bank M&A in the last 30 years. With an average of 250 transactions per year over the last five years, this represents a decrease of about 45%.2 Several announced deals were called off in 2020, largely due to economic uncertainty resulting from COVID-19. Comparing 2020 to 2019, it is nearly a 60% decrease.

In 2021, while we expect to see the pace of bank M&A increase, it is unlikely it will match pre-COVID levels. Some catalysts that may spark merger discussions are an aim for cost savings or creating efficiencies in the quest for technology growth/digital expansion by combining with another institution. However, there are reservations among bankers as well; for example, 63% of respondents to Bank Director's 2021 Bank M&A Survey indicated concerns about the quality of a potential target's loan book as a barrier to making an acquisition, which is a sharp rise from the prior year's data (36%).3

For deals that are announced in 2021, we can expect stringent underwriting scrutiny coupled with a cautious approach to terms, meaning a potential for higher M&A retentions. Banks that have recently been active in M&A or plan to announce deals this year should be prepared for pricing adjustments as well, as underwriters seek to offset the higher risk they perceive in this activity with increases in premium.

COVID-19

The onset of the COVID-19 pandemic in 2020 caused tremendous upheaval across the globe. As discussed earlier in this document, banks were affected in a number of ways, forced to rethink their business models in light of shutdowns and social distancing measures. Most notably, with the Fed having cut rates twice, banks' net interest margins were reduced to record lows. Perhaps best summed up using the term "uncertainty," this continues into 2021, but with a glimmer of optimism due to the start of vaccinations, a recently signed $900 billion fiscal aid package and the expectation of further stimulus aid from our new administration.

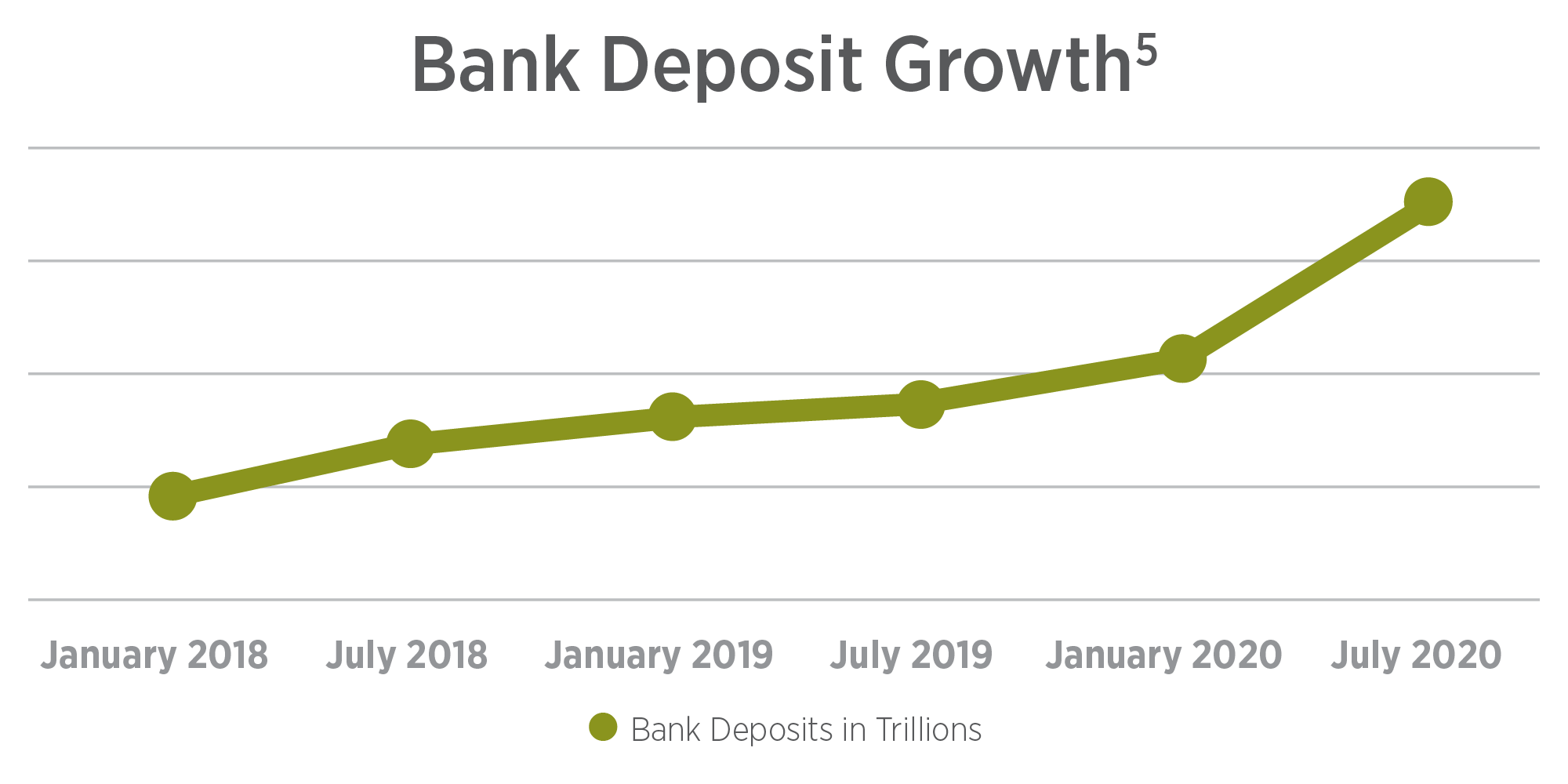

Not to be overlooked, banks came into 2021 with the highest deposit growth seen in years, with a record $2 trillion surge in cash flowing into accounts at U.S. banks between January and July 2020. In April 2020 alone, deposits grew by $865 billion, more than the previous record for an entire year.4

Underwriters have responded to COVID-19 by requiring banks to complete a variety of COVID-19 questionnaires, probing to examine both the human and financial response these institutions have had to the pandemic. We expect to continue to see these more concentrated approaches from the market as underwriters examine each bank's performance — loans, deposits and more.

Lending and the PPP

Banks of all sizes experienced tremendous change in their loan portfolios in 2020 directly resulting from the pandemic. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), signed into law in late March 2020, introduced the PPP with an initial $349 billion in funding and the goal of preventing job loss and small businesses failure due to losses caused by COVID-19. After funding was depleted within two weeks, an additional $310 billion of funding for loans was released, $60 billion of which was set aside for PPP loans from small banks and credit unions.

PPP loans are 100% federally guaranteed loans for small businesses intended for companies to maintain their payroll levels. Unlike most typical SBA loans, the PPP loans are unsecured loans requiring no collateral, no personal guarantee and no showing that credit is unavailable elsewhere.

The PPP caused a sharp increase in the number of loans written by many banks, accompanied by billions in fees collected by these institutions. As of July 2020, it was thought that banks saw some $13 billion in fees, though actual profits won't be known until the loans are paid off or resolved/forgiven.6 Some banks have indicated that the cost to participate in the SBA PPP program has eaten up the bulk of profits, while others have advised that revenue from the program will help boost profits.

Underwriters will continue to closely examine the loan portfolio performance of banks as they enter their renewal negotiations, asking questions about PPP participation in 2020 and in the new round available in 2021.

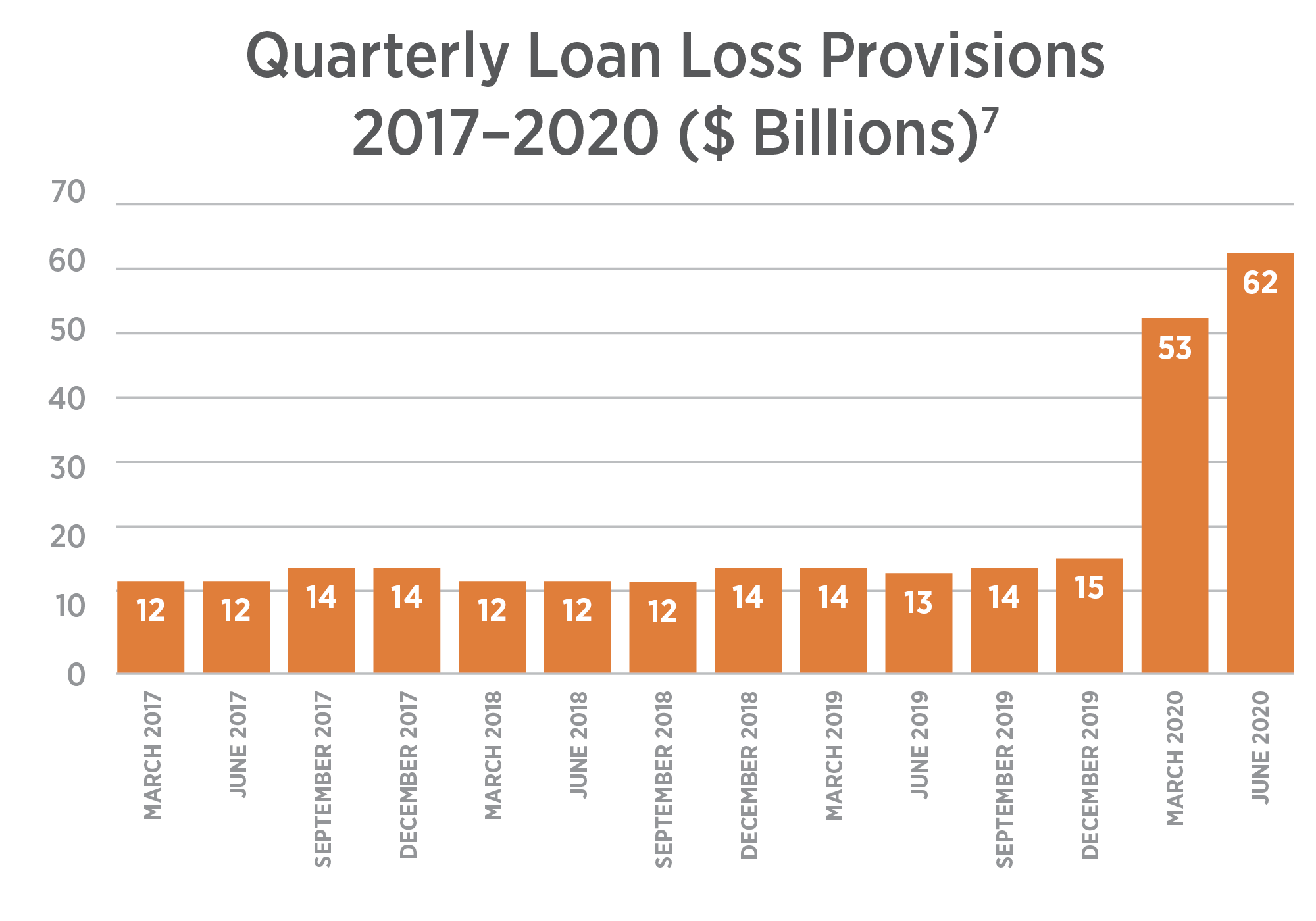

In addition to the PPP, loan loss provisions have soared due to the pandemic (see Quarterly Loan Loss Provision chart), driving underwriting concerns in the BPL and Lender Liability lines of coverage, with higher premiums and retentions on the horizon.

Digitization/Technology

As 2020 began, there was already a pronounced emphasis on technology growth in the banking sector underway, but COVID-19 expedited this focus in ways never imagined. From closed branches and limited hours to moving employees to remote work environments, the pandemic has accelerated the changing relationship between banks and their customers.

Already a trend for younger customers, the pandemic led customers of all ages to embrace more mobile banking options and created the challenge of keeping consumers engaged in an age of digital banking and social distancing. Real-time payments and automated savings tools are likely to continue to gain traction in 2021, as a recent survey indicated that 54% of consumers agreed that they use digital banking tools more due to the pandemic today than they did last year.8

The pandemic not only accelerated digital adoption, it has also been a litmus test for banks' digital infrastructures. Universally, digital inertia has faded, with more banks pursuing technology-driven transformation.9

We have also seen tremendous growth in the Fintech sector due to the pandemic, where consumers adopted these nontraditional platforms for financial services like payment and money transfer activities. We expect to see this trend continue through 2021.

Cybersecurity and third-party risk

With the aforementioned acceleration in digitization and investment in technology comes the potential for increased cyber risk. Already a top boardroom concern for banks, cybersecurity remains a persistent challenge from a risk management perspective. This holds true for the bank itself and very much so for a bank's chosen vendors.

Third-party risk, or vendor risk, has long been a key focus of regulators. Today's cyberthreats have become more frequent and more robust, forcing banks to consider vendor choices more carefully. While not just confined to cyber evaluation, vetting vendors on a broad scale will be a continuous and concerted effort for banks of all sizes.

Customer concerns for the security of their information also loom large. Directed efforts like identity verification and encryption will increase, to continue to provide assurance to customers that their bank is providing a secure platform for their business. Insider/ employee risk is also a key concern due to the psychological stress employees are facing as the pandemic continues.10

From an insurance standpoint, we expect to see more stringent underwriting, as evidenced by the multiple supplemental applications being requested at renewals. New exclusions for the likes of Solar Winds have arisen, and some limits are being reduced, such as those available for ransomware coverage. Carrying over from 2020 are premium increases and retention changes as well.

Regulatory change

The past four years have been characterized by deregulation during Trump's presidency, and it is widely thought that Biden's win could reverse much of that. Following an unprecedented election where many voted remotely, including two runoff Senate races in Georgia, Biden came into office with Democrats holding a Senate majority. Wins for the Democrats in both Georgia races mean a 50-50 tie in the Senate with Vice President Harris serving as a tie-breaker, then yielding a 51–50 Senate majority.

While Biden won't be able to put his mark on some financial regulations for some period of time due to ongoing terms of office for the likes of Federal Reserve Chairman Powell (term expires in February 2022) and FDIC Chairman McWilliams (term expires June 2023), his selection of other officials demonstrates an immediate move toward regulatory change: Treasury Secretary Janet Yellen, CFPB Director Rohit Chopra, SEC Chairman Gary Gensler and others are expected to push for tougher regulation, stress tests, higher fines, broader disclosure rules, greater workforce diversity and more.

With the potential for greater regulatory oversight and enforcement on the horizon for banks, a review of how their insurance programs respond to regulatory action and/or fines/penalties would be a prudent undertaking.

Please note: Adverse loss history, stressed balance sheets, high Texas ratios, regulatory activity or some combination of these factors may result in underwriter responses disparate from those discussed in this report. Banks experiencing these deficiencies should be prepared for more challenging conditions than outlined herein. Now more than ever, it's important to start renewals as soon as possible, and work with your Gallagher team to deliver a comprehensive and professional submission to underwriters.