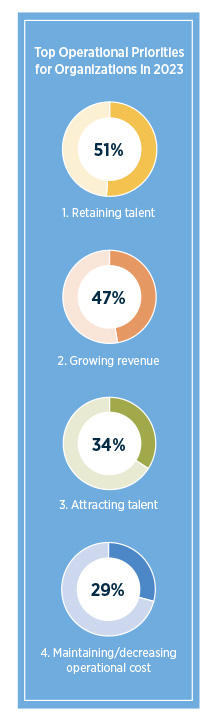

During the pandemic, many employers swiftly implemented new solutions, technologies and programs to safeguard the wellbeing of their people. However, the rapid evolution of benefits has prompted organizations to reevaluate their approach. According to data from Gallagher's 2023 Benefits Strategy & Benchmarking Survey, 2023 — which are analyzed in Gallagher's 2023 Workforce Trends Report — organizations are now focusing on optimizing and streamlining comprehensive benefit packages. Retaining talent remains a top operational priority from 2022 to 2023 (52% and 51% respectively) while attracting talent has decreased in importance, dropping from 40% in 2022 to 34% in 2023. In alignment with these statistics, turnover has increased by 7.7%.

The data reveals that organizations are now focused on maintaining or decreasing operational costs and growing revenue; the importance of growing revenue increased from 43% in 2022 to 47% in 2023. This trend indicates that organizations are focused on doing more with less, by increasing their efficiencies and controlling their costs. It's time to reevaluate the measures implemented during the pandemic to ensure alignment with organizational goals and employee wellbeing.

Organizations that looked to achieve efficiency found that voluntary benefits have become more important. Rather than altering core medical benefit plans, the data suggests companies are shifting toward enhancing employee-paid voluntary benefits, effectively addressing gaps in employer spend. The data for 2023 demonstrates a surge in interest for traditional supplemental health enhancements, with accident witnessing a 41% increase, critical illness experiencing a 36% increase and hospital indemnity recording a 24% increase compared to 2022.

don't offer stand-alone long-term care benefits

To stay competitive amid high turnover rates and staffing challenges, companies are leveraging their new HR technology investments and implementing holistic benefits and educational initiatives. This technology not only alleviated administration burdens, but also changed the enrollment and benefit experience, focusing on awareness and education, and empowering employees to make well-informed decisions.

Education is important not only for employees but also for employers that now recognize a shifting benefit landscape in 2023, particularly the growing importance of long-term care (LTC). However, a majority of employers (77%) don't offer stand-alone LTC coverage, while another 57% of employers don't have permanent life solutions as part of their comprehensive benefit programs. As a result, employers lack the necessary benefit strategies for LTC solutions. Addressing this gap will require careful consideration of ongoing state-specific legislation as changes progress rapidly. Informed organizations are actively preparing by offering voluntary benefit solutions that include simplified administration (i.e., direct billing).

are using voluntary benefits as a way to support employee recruitment and retention in 2023 — are you one of them?

Access to physical and emotional wellbeing benefits and programs is central to the quality of the employee experience, as well as performance outcomes. Adding selective voluntary benefits or increasing subsidies for current options can help attract and retain a competitive workforce. Get insights from over 4,000 employers, and identify opportunities for your organization to better compete for top talent and build success.

VIEW AS PDF