Author: Jay Pepper

As Robert Plant sang, "If it keeps on rainin', levee's going to break." Well, here we are in 2023, and the forecast calls for rain, and then more rain.

Long-term care — the here and now

Anyone paying attention to the long-term care (LTC) market is well aware of the burgeoning financial challenge we face as a nation to service a growing population of people who need help when they can't help themselves. LTC is complex and requires multi-faceted solutions pertaining to the quality of care, growing demand for home and community-based services (HCBS), improving support for professional and personal caregivers, the sheer growth of the industry, and of course, how to pay for it all. LTC is an issue that's been building since the Baby Boomers started to hit their retirement age in the 1990s and is exacerbated by an increase in average life expectancy.

The US has reached the point where public and private leadership must drive substantive change if we are to effectively cater to our aging population — physically, emotionally and financially. Given that about 21% of households1 in the US are affected by the need for — or the need to provide for — LTC assistance, it's something many Americans are dealing with firsthand as many more enter the market each day.

The 20+ year long-term care forecast

Some states are looking at potentially instituting new taxes that pay for LTC services. To date, the primary solution has been to finance LTC needs through Medicaid, which is the levee that simply cannot meet the growing needs of the LTC community without finding new sources for income (i.e., taxes).

A major driver of the LTC crisis is the simple fact that we are getting older as a nation:

- Over 56 million people in the US are age 65 or older.2

- That number grows by about 10,000 every day.3

- About 70% of people will need LTC at some point in their lifetime.4

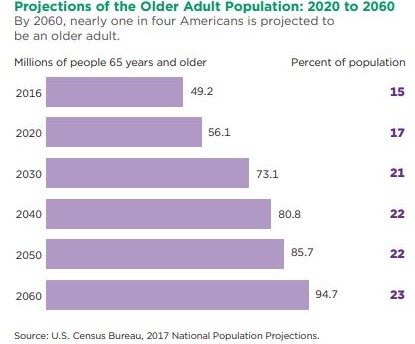

If these numbers look a little daunting, consider that according to the 2020 US Census Bureau data, the projections for the size of the 65+ community are nearly 81 million in 2040 and nearly 95 million in 2060.5

The cost of long-term care

With a growth rate of nearly 80% in the next 40 years, people age 65 and older are the fastest-growing age segment in the US. The question then becomes: who will pay for the increase in demand of LTC services and how much will it costs to grow old?

According to the Kaiser Family Foundation (KFF), US spending on LTC was $402 billion in 2020 — almost 10% of total healthcare spending. Medicaid and Medicare covered more than 70% of that total, with Medicaid being the dominant payer at $215 billion — just over 53% of the total.6

The Patient Protection and Affordable Care Act (PPACA) uses the term "long-term services and supports" (LTSS), which is synonymous with LTC.

When adjusted for inflation, Medicaid's LTC spending grew from $15 billion in 1990 to $130 billion in 2020, according to a 2022 Penn Wharton Study.7

The average tenure of LTC care is 2.2 years for males and 3.7 years for females.8 The average annual costs of third-party life services and support include (costs vary by market, state and service providers):9

- $82,100 to $92,400 for nursing homes

- $43,500 for assisted living

- $31,000 for in-home care

The average savings account for Medicare beneficiaries was $73,800,6 which doesn't cover even one full year in a nursing home. Medicaid doesn't pay full price on these services, and almost all LTC costs exceeded the median income for the 65+ demographic.

Long-term care legislative updates

Washington state took the lead in this approach by enacting the Washington Cares Act in 2019 (initially the LTC Trust Act). After further analysis and iteration, WA Cares is ready to launch in 2023 with a payroll tax of $0.58 per $100 in earnings that begins on July 1 and a benefit plan that begins in 2026.10

Other states are looking closely at this model and have either pursued steps or are reported to be considering similar legislation. California just completed a two-year task force initiative that proposes an actuarial review of five strawman options that provide varying levels of coverage, features and tax structure.11 The next step is to conduct a complete analysis of these options under a quarterly update-and-review process and present the final assessment to the governor by January 1, 2024.

New York and Pennsylvania introduced legislation in 2022 that in many ways mirrored the Washington plan, but those bills will need to be redrafted and/or reintroduced to move a new program into action. Minnesota has sought third-party input on its own actuarial study to assess revenue options for LTC services. Industry insiders suggest as many as 10 other states are giving a new tax-based program serious consideration.

It's not possible to predict where these efforts are all going to end up legislatively, but it's clear from the data that something must be done. What's also clear is that programs like WA Cares may fall short in providing complete LTC coverage if someone requires these services. Given the current and projected cost of care, there will likely be a need for other funding (either private or public) to provide people with the necessary level of care.

Public funding for long-term care

According to Steve Moses, president of the Center for Long-Term Care Reform, public funding in this arena is a concern. In a paper published in October 2022, he addresses public funding as a problem as much as a solution. He says "Central planning, public funding, heavy regulation, and easy access to welfare benefits have caused most of LTC's problems, such as nursing home bias, poor access and quality, inadequate revenue for care providers, caregiver shortages, and the terrible emotional and financial distress for caregiving families. Medicaid especially is responsible because... the program's LTC benefits are routinely available not only to the poor but to the middle class and affluent as well."

He continues, "America's LTC system is broken. It poorly serves, both financially and emotionally, the people who receive the care as well as the workers and companies who provide (it)."12

Private long-term care insurance

Private group LTC insurance has had its own challenges as a viable solution going back to the late 1980s. The cost of coverage projections didn't support the market properly and didn't prove to be the ultimate solution.

In today's marketplace, however, various hybrid plans combine permanent life options with an LTC rider that give policyholders the ability to access accelerated benefits, along with better risk assessment for the market.

How employers can take action

Convincing data presents an ominous outlook for our growing senior population. There isn't a one-size-fits-all solution in this demanding market, and there are many stakeholders to support. Will tax-based social insurance programs become the wave of the future? What role will the private market play in smoothing out this steep climb up a financial mountain?

Given this, companies and organizations should take a proactive role in the here-and-now toward educating their employees and stakeholders about the need to properly plan for their future. Otherwise, as the song goes, "when the levee breaks, I'll have no place to stay."

Download the Considerations Guide: The Long-Term Care Market to explore what your organization can do to protect your employees' wellbeing.