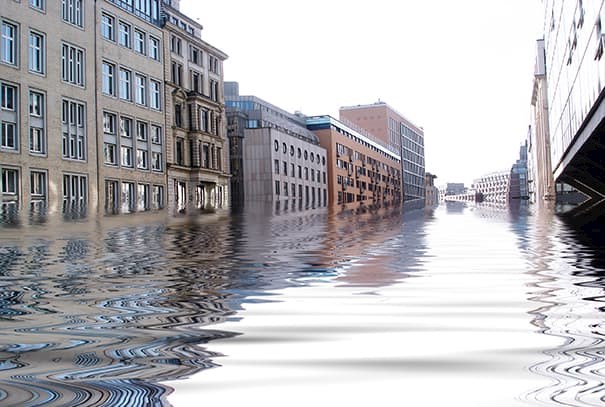

With the increasingly unpredictable weather brought about by climate change, it’s no wonder that flooding is hitting the headlines more and more. Flash flooding, intense storms and extreme weather patterns are all on the rise – for example the sudden storms which took place after the summer heatwave this year.

More than ever businesses could be affected by surface flooding, as they may have inadequate business interruption and insurance covers in place.

Simple steps, such as ensuring stock is off the ground and that all equipment is moveable, can help to prepare for flooding and reduce the risk of total loss. Gallagher specialists are able to support businesses around the UK by arranging flood cover even for difficult cases.

The scale of the problem

Between 2011 and 2017 we saw record breaking weather,1 this problem isn’t likely to change either, with extreme weather likely to cost the UK billions.2 This will especially affect homes and businesses on the coastal line, with 20% of their defences likely to fail if the sea level rises by just 0.5-1m. In fact, 2000km2 of land and 400,000 properties would be at risk if these defences failed during a tidal surge.3 You can check your risk level using the Gov.UK Flood Risk map.

The challenges to UK businesses

There are a wide range of challenges:

- The different types of flooding, ranging from surface and ground water through to coastal and river and sewage floods.

- Due to increased flood risk and an increasingly competitive household insurance market, insurers are no longer able to absorb the costs of high flood risk properties by using profits from low risk ones. This means that businesses impacted by flooding before may be labelled as high-risk for future floods and could be saddled with higher premiums and excesses.

- Although the Government have put Flood Re in place for domestic properties to help tackle the expensive insurance caused by flood risk, an affordable market based solution which correctly reflects risk is required.

- Improved flood defence is only one part of the solution, UK businesses also need to ensure that they are equipped to deal with extreme weather events. This involves where possible dealing with the root causes of the flooding and taking steps to implement a strategy that takes into account the changing nature of flood events and the likely increase in extreme weather events.

These arrangements vary, but property insurance usually includes flooding, plus business interruption can be added to cover the costs if your business is unable to operate.

It isn’t just the Government and businesses that need to overhaul their approach to flood risk. Insurers are also currently plagued by a lack of knowledgeable experts, communication issues with building professionals and a reduced interest in mitigation. Improved access to flood risk information, teamed with better training could improve overall expertise levels and help to improve how insurers provide risk mitigation and insurance advice.

The consequences of a flood

Even if a business has the correct insurance in place, a flood event can have catastrophic effects on their ability to trade:

- Disruption can include business interruption, reduced access or no access to your premises, restricted turnover, stock damage and loss, extensive repairs to the building or damage to your equipment or premises.

- Due to the reduced risk appetite for flood insurance, insurances may opt to exclude high-risk businesses and those who do offer protection often do so at a high cost.

Insurers are not keen to write standalone flood business as they are likely to experience major losses. They will often impose a large burden of proof in order to get cover or request large requirements such as flood risk reports before placing cover.

“Without adequate risk management to prepare for a flooding event, many UK businesses risk financial exposure. This, teamed with a reduced appetite from insurers, has led to flood becoming a serious risk which many businesses are unsure how to respond to.”

– Nick Muir, Head of Property, London Market at Gallagher

How Gallagher can help businesses exposed to flood

This is why Gallagher offers a multi flood solution, which assesses their actual exposure to flood and calculates an accurate EML (estimated maximum loss). The client can then present this (hopefully more manageable) risk to their insurer. If the risk is still too great for an insurer to place business, then the Gallagher Flood Solutions team can be utilised to place cover for large and complex risks.

Weather modelling and its benefit for businesses

During 2015/16, severe flooding led to over 300,000 commercial properties being put at risk. These businesses could have better protected their infrastructure with advance planning. Gallagher specialists can assist with your flood exposures; our aim is to provide accurate and timely analyses using a broad range of analytical disciplines with intelligence and innovation. This helps to challenge harsh insurance terms through an intelligent approach to risk assessment and mitigation. We offer a full risk management service which includes flood inspection, reporting and surveys.

While you can never truly know the weather, we have access to leading mapping technologies which can assess the flood risk for your business and help you to avoid a potential flood crisis. This is the first step in assessing your flood risk. These tools include geocoding, national catastrophe analysis, Gallagher flood modelling capability, flood analysis, subsidence hazards, and storm surge recognition. We can perform an in-depth analysis on your postcode to highlight your proximity to flood zones, river banks or storm surge points.

Gallagher can use this information not only to offer practical tips to reduce flood risk but also to put you and your business in a better position with a potential insurer. Our risk survey team identify and quantify your exposure to flood and help them increase their flood resistance and exposures. This helps you negotiate the best terms from the insurance market. This is not passive; we help you build a flood contingency plan to reduce your exposure to flood and speed up your recovery. Not only do these measures reduce risk, they can help you cut your premium or excess.

Our team can include advice on how to:

- significantly reduce financial loss

- limit damage to property, stock and equipment

- minimise business disruption and enhance continuity, helping retain clients and contracts

- create a flood contingency plan

- maintain customer, supplier and business records

- re-present your business to the insurance market as a more attractive risk

For example, we can advise you where to place critical machinery to keep the production line moving, or how to agree a back-up plan with key suppliers.

Gallagher wants your policy to respond so that you also get your business back up and running again as soon as possible.

We offer bespoke solutions to help your business continuity planning against these effects and bolster your ability to recover.

What if the insurer still doesn’t want to accept the risk?

If the risk is still too great for a standard insurer to place cover, then Gallagher has specialist flood solutions for high risk or exposure businesses. Our specialist London-based team can use their connections, including Capsicum RE, our reinsurance and risk transfer company, to help secure the correct level of cover for your business even if this means a higher excess and other conditions put in place.

Case study

The problem:

A global retailer involved in the design, marketing, manufacture, import, export, retail and wholesale of clothing and footwear including fashion accessories. They needed a property solution from an insurer who could also place property risk with full flood protection. This was priced at £50,000 only for flood cover when the client required more comprehensive cover.

Our approach:

In this instance the Gallagher team had a different scope on the flood risk due to the collaborative work with the Analytics team. Due to the information provided the insurer lifted the restrictions on the flood cover and offered a full mini-global offering at a competitive price and bettered anything other brokers offered at that tender exercise.

Our solution:

We placed a full mini-global client with full flood cover, and the client was impressed with their more comprehensive cover.

Our conclusions

Climate change is irrevocably transforming weather risk and bringing with it increased sea levels and heavier rain than ever before. While the Government are working to improve flood resistance and have put Flood Re in place for disasters for domestic properties, neither of these are an immediate solution. Appetite for insuring flood risk may be low, but businesses still need to take the time to assess their risks and secure insurance where necessary.

Gallagher can help not only with risk management and reduction, but also with placing insurance – even if you are a high-flood risk or feel you may be uninsurable. The future holds more frequent and higher losses due to flooding but there are solutions to help you anticipate and respond to flood peril.

Sources:

- https://environmentagency.blog.gov.uk/2018/03/28/managing-flood-risk-now-and-into-the-future/

- https://www.independent.co.uk/environment/climate-change-global-warming-extreme-weather-floodinghomes- drought-uk-economy-a7964851.html

- https://www.theccc.org.uk/wp-content/uploads/2016/01/ccc_infographic_floodrisk_final_hi-res.png