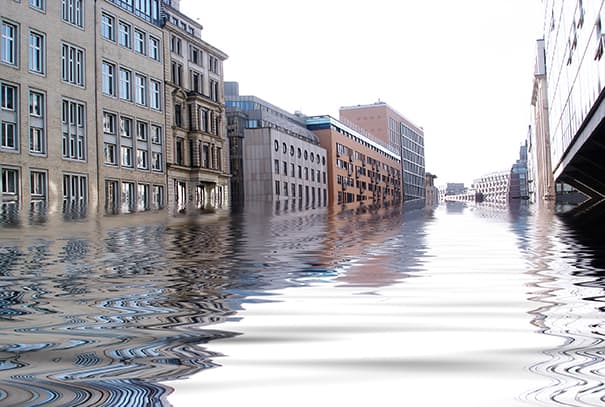

FloodFlash is a new type of flood insurance, with capacity provided by Lloyds and the potential to offer multimillion pound limits for large organisations.

Many major businesses with flood exposures have experienced challenging insurance renewals, where property and business interruption insurers have:

- Refused to offer flood insurance

- Imposed high deductibles and/or restrictive limits

- Demanded significant premium increases

Faced with the very real risk of flooding and limited viable alternatives many businesses have had to accept the situation.

Gallagher has worked with FloodFlash to provide an innovative, technology led solution for businesses struggling to insure flood risk. The FloodFlash concept is illustrated in the video below.

Businesses are using FloodFlash as a cost effective way of protecting assets and revenue from the risk of flooding. It can be used to:

- fill high flood risk deductibles required by property insurers

- ‘boost’ the limits offered by property insurers

- isolate flood risk from the property programme

- receive rapid payouts to initiate recovery quicker and protect cash-flow

If these issues and challenges are familiar to you please contact Laura Self on the details below to arrange a discussion with one of our specialists.