Our collaboration focuses on risk management and incorporates engineering data being fed and reported into RiskWise, S2’s proprietary risk management system. RiskWise is comprised of multiple modules, which can be seamlessly integrated to provide clients with visibility of their health, safety, fire and environmental risks. Using RiskWise assists with legislative compliance and provides full audit trails to demonstrate due diligence. RiskWise enables accessibility from any location and remotely, via the RiskWise App. S2 then collaborates closely with Gallagher, providing ongoing visibility of risks which could impact insurance claims.

For example, RiskWise has been utilised to support one of Gallagher’s largest, pan-European Real Estate clients for a number of years. We were able to use the system to develop a robust process for effectively tracking and updating the outcomes of the client’s risk improvement notices. Before they can be marked as complete on RiskWise, they must first be signed off by the insurer; this provides reassurance to the insurers that notices are being appropriately addressed.

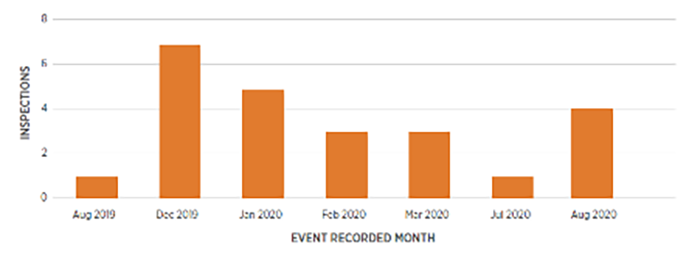

In addition, the client, Gallagher and S2 have the benefit of full visibility of incidents that might affect the client’s risk profile or insurance. Property Managers log and manage incidents that occur (such as accidents) on the system – thereby creating a ‘real time’ view of the client’s risks. The system gives clients peace of mind that compliance issues and risks are being actively managed as well as providing them with full visibility of safety risk on their property portfolios.

The importance of joined-up risk management

Historically, risk management priorities and responsibilities were separated between property investors, owners and landlords, managing agents, insurers, occupiers and insurance brokers. By delivering a joined-up approach to risk management, there are benefits to all parties, whilst also providing a more powerful solution to asset protection and business continuity. In terms of the potential benefits, these vary across different stakeholders, but include:

Property Owners and Investors

- Asset protection against loss, damage and destruction

- Business continuity and continuity of rental income

- Rigorous health & safety management to help protect against accidents, litigation and financial penalties

- Protection and enhanced brand reputation

- Improved desirability of property, improved rental income and tenancy levels

- 24/7 online access to risk management data to help ensure effective risk management and peace of mind

- Funding often provided by the insurer for risk management

- Global consistency of risk management to defined corporate standard

Insurers

- Improved asset protection against loss, damage or destruction

- Enhanced visibility of operational and inherent risk and associated management processes

- Reassurance of risk resolution

- Reduced claims, improved claims defensibility

- Greater visibility of claims data to help identify root cause and more effectively direct risk management efforts

Managing Agents/Property Companies

- More wide-ranging and pragmatic approach

- Independent third-party reassurance for well-performing sites

- Straightforward resolution of outstanding risks due to enhanced communication between all parties

Insurance Auditing and Risk Management

In addition to implementing RiskWise, we have worked alongside S2 to offer clients comprehensive risk and insurance audits. Whilst insurers’ surveys are carried out to provide key property information for their own purposes (for example, estimated maximum loss calculations and reinsurance), they usually only cover the physical aspects of risk.

The S2 Partnership undertakes insurance risk management audits which incorporate additional risks including liability, security, business continuity and environmental pollution, whilst also allowing for seasonal variations in property risk. The results are shared with clients as part of their risk management strategy.

Providing a more holistic approach to risk management and asset protection, an insurance risk management audit:

- Covers a wider brief of risk management, legal compliance and underwriting information

- Provides a critical review of procedures, systems, documentation and training to assess operational risk management

- Reviews legal compliance at property level to confirm risks are identified and managed (risk assessments, statutory inspections and documentation)

- Includes a detailed inspection of all areas of a property (internal and external landlord and tenant areas)

- Examines all threats which could contribute to a loss situation (e.g. fire, flood, security/theft, impact damage, escape of water, environmental pollution, subsidence, neighbours)

- Reviews all accidents and claims including attritional losses which can erode premiums

- Reports on individual properties with specific, practical recommendations and photographic evidence. Importantly, revisits and the use of the RiskWise risk management system ensure report findings and recommendations are tracked through to resolution, helping to reduce risk and ensure asset protection.

As clients become more and more sophisticated in their appetite and approach to risk, such tools and services are proving more and more popular; with the benefits being seen by all parties.

About the S2 Partnership

Established in 1999, S2 Partnership is an independent, privately-owned specialist safety and environmental risk management company. S₂ Partnership fully understands the importance of asset protection and business continuity for clients with property portfolios and works with them to manage and reduce risk and its consequences.

With a consultancy team comprised of specialists in their respective fields, consultants are located strategically around the UK to provide full nationwide coverage.

Widely regarded as one of the top independent specialist providers of consultancy and software, S₂ Partnership works with leading property investors, owners, managers, insurers and occupiers. We take great pride in knowing that our clients are at the core of all that we do: delivering intelligent risk management.

Conditions and Limitations

This note is not intended to give legal or financial advice, and, accordingly, it should not be relied upon for such. It should not be regarded as a comprehensive statement of the law and/ or market practice in this area. In preparing this note we have relied on information sourced from third parties and we make no claims as to the completeness or accuracy of the information contained herein. It reflects our understanding as at 1st September 2020, but you will recognise that matters concerning COVID-19 are fast changing across the world.

You should not act upon information in this bulletin nor determine not to act, without first seeking specific legal and/or specialist advice. Our advice to our clients is as an insurance broker and is provided subject to specific terms and conditions, the terms of which take precedence over any representations in this document. No third party to whom this is passed can rely on it. We and our officers, employees or agents shall not be responsible for any loss whatsoever arising from the recipient’s reliance upon any information we provide herein and exclude liability for the content to fullest extent permitted by law. Should you require advice about your specific insurance arrangements or specific claim circumstances, please get in touch with your usual contact at Gallagher Construction.