With UK redundancies raising to the highest level since 2009 and the job retention scheme (furlough) extended until the end of September 2021, more and more households are having to cope on lower incomes.

Even if an individual has not themselves been impacted, their partner may have lost their job, leading to a reduction in household income.

Employees with low levels of financial wellbeing are prone to higher levels of mental stress, absenteeism and more likely to struggle to thrive at work.

During the latest poll we took in February 2021, 67% of HR leaders agreed that employers have a responsibility to support employees' financial wellbeing, while an additional 33% strongly agreed that employers should do all they can to support the financial wellbeing of their people.

In our recent Financial Wellbeing webinar, we explored how organisations can boost their employee financial wellbeing, with input from Yorkshire Building Society, Biffa and a research associate from Oxford University. Feel free to watch the on-demand webinar now.

How do employers benefit?

Organisations that offer employees financial wellbeing solutions are providing a valuable benefit that goes beyond money management.

Including employee financial wellbeing as part of a company’s benefit strategy can also lead to a number of tangible benefits for the employer, such as:

- Reduced employee stress and anxiety

- Reduced absenteeism in the workforce

- Increased productivity and performance

- Increased talent retention

- Greater appreciation of employee benefits which can lead to increased employee engagement and employer advocacy

How can Gallagher help?

In addition to our range of live financial education webinars, we’ve created MoneyFit, a fast, effective tool for supporting employee financial wellbeing.

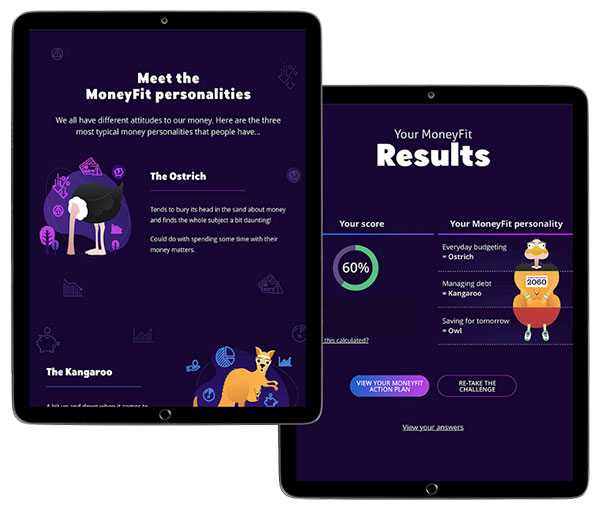

MoneyFit is designed to get your people thinking differently about their personal finances and helps inform areas of money management that need more focus. Employees take a 15 minute 100% anonymous healthcheck which delivers a financial wellbeing score, unique money personality and an Action Plan linking to useful free resources.

Employers can use MoneyFit to measure employee financial wellbeing by age and gender, informing their financial wellbeing strategy. They can also discover people’s engagement levels with employee benefits as well as receive recommended employer actions to improve overall employee Financial Wellbeing. Interested in learning more?