From investors to central banks, employees and customers, expectations have changed. With calls for a green recovery after COVID-19, focus on ESG factors is only going to intensify. After years as a nice-to-have bolt-on to corporate strategies, ESG has gone mainstream.

ESG now part of investment decisions

According to the Principles for Responsible Investment, the integration of ESG issues into investment practice and decision making is “an increasingly standard part of regulatory and legal requirements for institutional investors”, while investors that do not incorporate ESG issues “are failing their fiduciary duties and are increasingly likely to be subject to legal challenge”.

The practical implications for company management are also starting to bite. In 2020, BlackRock took voting action against the management of 53 companies it identified as making insufficient progress integrating climate risk into their business models or disclosures, and warned another 191 that they were at risk of action unless they improved.

On the regulatory side, the European Taxonomy for Sustainable Activities entered into force in July 2020. The taxonomy establishes six environmental objectives against which economic activities can be measured and represents a “serious effort by financial regulators to mandate disclosure against a sustainability target, rather than a financial one”. Taxonomy disclosures will be critical for companies accessing green financing and support the EU’s transition to net-zero carbon emissions by 2050.

ESG risk in the renewable energy sector

Through the provision of clean electricity, the renewable energy sector has a clear role to play in the transition to net zero – but that is not to say it is without its ESG risks. Only two of the European taxonomy’s environmental objectives relate specifically to climate change: the other four cover the sustainable use of resources, the prevention and control of pollution and the protection and restoration of biodiversity.

The EU Environmental Liability Directive and UK Environmental Damage Regulations meanwhile include a broad range of environment exposures that can impact projects and cause significant business damage in the event of environmental contamination. The financial costs for clean-up and making good can be significant – and that is before reputation damage is considered.

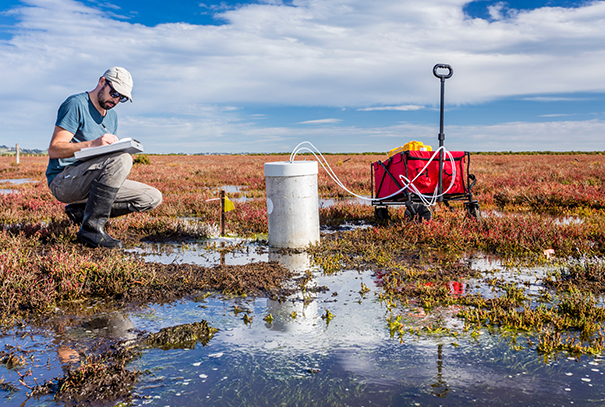

At the construction stage of new renewables facilities, for example, risks of pollution exist from both pre-existing site conditions, e.g., should piling contractors mobilise contaminated perched groundwater, or new sources, e.g., a diesel leak from a generator. There is also the potential for habitat and biodiversity damage, particularly when construction is taking place in environmentally-sensitive areas.

This continues into operations with examples of potential issues including odour, digestate leak or fire at anaerobic digestion facilities, odour and air pollution from biomass and energy-from-waste facilities, transmission fluid leaks from solar farms, and negative impacts on habitat and biodiversity from wind farms and hydropower facilities, e.g., to bird and fish migration patterns.

There are also risks that arise from the fact the renewables sector is still emerging with technology changing quickly. The decommissioning risks for early and subsumed technologies are yet to be tested but will have to be wrestled with as the sector develops and grows.

The consequences of an environmental impact event

The management of environmental impact liability (EIL) risks is therefore as vital for renewable energy businesses as any other and must take into account consequences that include business interruption, statutory liabilities and clean-up costs, tort liabilities, legal costs and reputation damage.

It is also important to remember that relying on existing Professional Indemnity policies and/or the limited pollution cover in Public Liability policies is not sufficient to protect against the range EIL risks that projects are exposed to.

Specific EIL insurance is therefore an effective and important part of environmental risk management; it may even be a contractual requirement for some projects. It can protect against loss of profit when business activities are interrupted by pollution/contamination, as well as property investment income, such as loss of rent, to protect landlords and lenders/investors. This can be combined with contingency plans showing a robust and demonstrable management and mitigation of risks.

Reputational risk can also be mitigated by showing the company has considered and put in place measures to respond to EIL events. The ability to respond proactively to an incident and effectively manage the ensuing communications and public relations issues are further important factors for companies and some policies can extend to include crisis management and emergency response costs.

Finally, EIL insurance can help to facilitate transactions and loans/investments by transferring known and unknown EIL risks in an open and transparent way for a known cost to an environmental insurer.

Gallagher is one of the UK’s leading EIL insurance brokers, offering a full range of environmental risk and insurance services from advice through to negotiation and placement of specialist financial risk protection solutions.

Get in touch to find out how we can help you.