Author: Darren Ross

In March 2022, a change was made to the Ogden discount rate in Northern Ireland*, which will affect the total award amount payable in personal injury claims and could therefore have an impact on your insurance cover and premiums.

In the event of a personal injury (PI) claim, the amount received by the claimant can vary greatly, not only because of the type and severity of the injury they receive, but also due to the Ogden discount rate used to determine claims awards for major personal injury claims.

What is the Ogden discount rate?

The Ogden discount rate (also known as the personal injury rate) is a method of awards calculation for major personal injury claims. The higher the discount rate, the lower the claims settlement. Insurers need to factor this rate into their pricing and so changes in the rate can also affect insurance premiums.

How does it work?

A claimant receiving damages will generally receive a lump sum payment when the claim is settled, to cover future financial loss, such as loss of earnings and cost of care. However, the true future ‘value’ of the damages awarded will depend on the amount expected to be earned from investing the lump sum when it is received. In order to work out how much to deduct from a claims payment to account for interest on the sum provided, the insurer uses the discount rate.

The intention is to put the claimant in the same financial position they would have been in had they not been injured, without undercompensating or overcompensating them.

The more generous the assumption on investment returns, the higher the discount rate, and the lower the amount of a claims payment. While a precise calculation is impossible, the Ogden discount rate is an agreed methodology used by courts across the various jurisdictions within the UK.

Regional variations

Historically, the discount rate applied UK-wide, and any changes to the rate would be implemented in all jurisdictions. However, in recent years, this has changed, with one rate for England and Wales, another for Scotland, and another for Northern Ireland. Currently, the discount rate in Northern Ireland is significantly out of step with that of the other jurisdictions.

The Department of Justice in Northern Ireland believed that the discount rate should be reduced on the basis that it cannot be assumed that long-term investments will grow at the same rates as before. So, in May 2021, a much lower discount rate of minus 1.75% was applied to the calculation of damages in Northern Ireland, and in March 2022, this was revised upwards marginally to minus 1.5%**.

Claims award scenarios

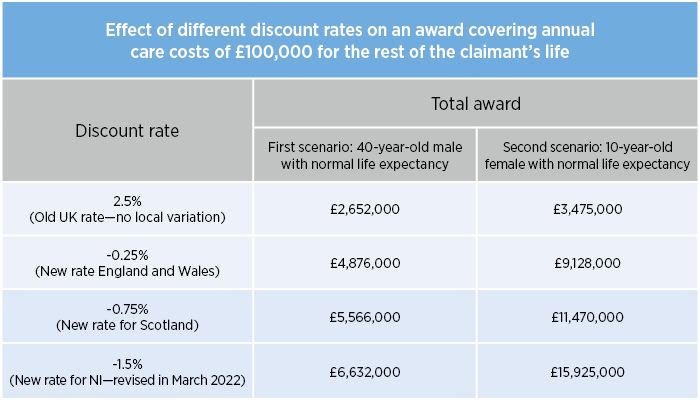

The following model reflects an award for a serious personal injury claim subject to different discount rates, and is based on two claimant scenarios, both with an annual lifetime care cost of £100,000 per annum.

What does this mean for insurance cover?

Because the discount rate in Northern Ireland is significantly lower than in the rest of the UK, levels of claims awards will be greater in comparison. In the first scenario, the pay-out is over £1.5 million above a public liability indemnity limit of £5 million. In the second scenario, the pay-out could be almost £6 million above an employer’s liability indemnity limit of £10 million. This could result in an organisation being significantly underinsured, which could potentially have disastrous financial consequences in the event of a liability claim.

It may also restrict the availability of cover as some insurers exit the personal injury market in Northern Ireland due to the increased level of claims awards they would be expected to pay-out. This has already happened with at least one insurer.

In conclusion, changes to the Ogden discount rate can affect three important factors: claims awards, insurance cover and premiums. Because the rate is reviewed periodically, it is important to ensure your cover remains adequate, and this is where the expertise of a broker can be vital.

How can Gallagher help?

Gallagher is here to act as your trusted risk management partner all year round—not just when your insurance policies need to be renewed. If you would like specialist advice on your public and employers’ liability insurance, please, get in touch with our team so that we can help ensure you have adequate cover that would respond as you expect it to in the event of a personal injury claim.