UK business has undergone unprecedented change over the last two years, and whilst Covid-19 has been a priority headline in most boardrooms it isn’t the only item on the agenda. Other significant pressures in the last two years have included Brexit, a hard insurance market and more demands on businesses to look at their non-financial output.

Our Directors Briefing brought together a panel of industry specialists; Simon Hart of RSM UK, Jonathan Deverill of DAC Beachcroft and Rik Horne of Gallagher. Together they provided their views on what’s coming up in our reimagined future and the considerations for boardrooms across the UK.

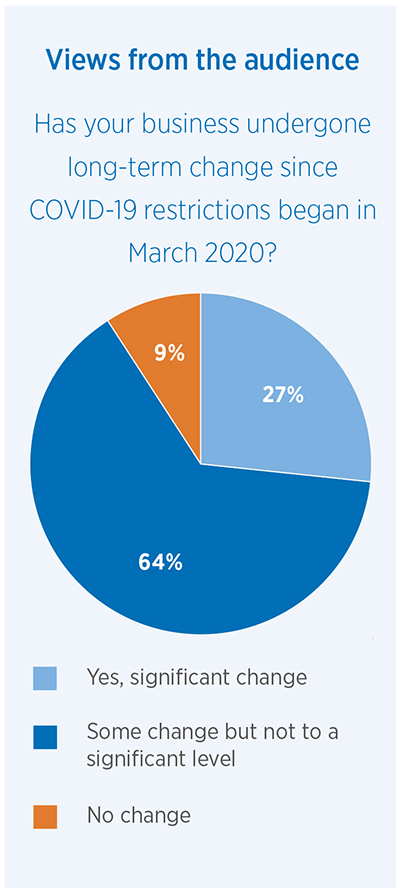

Evident throughout the discussion was the marker that recent events are forcing change; and that this change is largely positive, bringing permanent transformation to UK business and a temperament of innovation to boardrooms across the country.

Environmental, Social and Governance (ESG)

The increasing significance on ESG is seeing UK business on the start of a cultural shift, with greater focus being placed on non-financial goals as well as traditional financial ones. In the wake of COP26 last year it’s not surprising that ESG was a key topic from all three panel members. What was once a ‘nice to have’ is fast becoming a key business challenge for many companies.

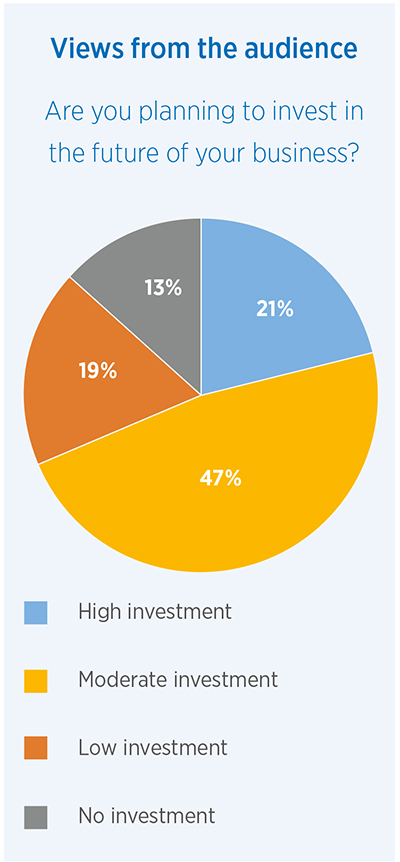

Jonathan raised the question; “is COP26 the starting line for the next decade?” Is this now the point where businesses take their responsibility more heavily and invest in the future? What is clear is that we have seen a shift from talking about ESG to actually taking action; and it’s this action that is causing investors to sit up and take notice of investment opportunities that fit their own ESG agenda. Action is also key in retaining employees as they place increasing value on working for an employer with a responsible and reputable brand.

But are we doing enough? Simon presented the scale of change required if the UK is to reach the target for net zero by 2050 – a far cry from the current trend line created from our efforts from 1965 to 2019.

So how will this scale of change occur; will we possibly see government incentivising, or businesses being penalised, for their action or inaction to drive the change to net zero?

It was interesting to see that in the balance of how to prioritise the bottom line or ESG, that the steps businesses have been taking to reduce emissions to date aren’t having a negative impact on GDP, suggesting perhaps we can have the best of both worlds.

Rik rounded up the discussion confirming the proactive steps UK businesses are taking in adapting business models and processes. For many, the commitment to ESG is starting to take shape in the form of changing fleets to electric vehicles and converting to renewable energy sources such as installing their own solar power. Changes we are sure to see more of during the year.

The Global Market

Simon led the discussion with insights into the global economy. After much ambiguity and many extended deadlines, Brexit finally landed in the midst of the pandemic causing a perfect storm for uncertainty and disruption in supply chains, labour markets and our import & export profile. To some degree it appears that the pandemic may have masked or delayed some of the effects of Brexit and more may still be yet to come. In many countries the progress on the pandemic is not as advanced as the UK so we are yet to see the end of the disruption from the pandemic.

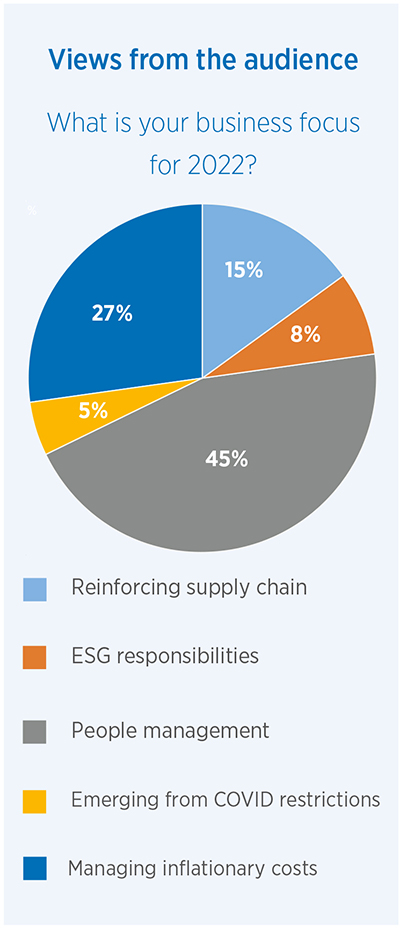

The short term outlook (2022-2023) is certainly challenging, dominated by supply chain disruptions; labour, energy and production issues; commodity prices rising and slowing fiscal and monetary accommodation which in some cases is tightening.

Looking at GDP offers a degree of good news with levels largely back to pre-pandemic in most sectors. Unsurprisingly the notable outliers were the strong performance in the health sector whilst GDP in hospitality is yet to recover and remains below all other sectors.

When we look at our import and export profile we still see signs of disruption; our exports to the EU are recovering to pre-Brexit levels but our imports remain low, prompting a question from the audience – could we see the start of a ‘buy British’ movement again?

As supply chains remain challenging and businesses take advantage of stockpiling the key equipment and materials they can get, Rik posed the reminder that this could affect insurance cover and businesses need to ask themselves if they are adequately covered for what they hold? Equally, with longer wait times for replacement parts, Rik encouraged businesses to query if their business interruption indemnity periods are sufficient for the current market? Underinsurance is a big concern which is continually being driven by the challenges we face in the global marketplace and due diligence should be paid to avoid inadequate cover.

Business change & innovation

Once again we’re seeing necessity as the mother of invention and we find ourselves at the beginning of a seismic shift in how we work. Jonathan opened the discussion with a thought provoking comment “imagine if the pandemic had happened in 1985”.

Changes in ways of working and use of technology have advanced at an incredible pace over the last two years. Not only through working from home, but also with conduct such as virtual court hearings which just 3 years ago would have been thought impossible. With vaccine uptake increasing across the world, which of these measures will go as we return to normal and which will we adopt on a permanent basis?

Rik raised the concern of the agile behaviour of cyber criminals and how they are tapping into our move to work from home and targeting smaller businesses who may not have the IT security infrastructure to stop their advances. To get cyber cover, most businesses now need to put in place stronger minimum standards and we anticipate cyber to remain a battleground for the future.

Jonathan raised the possibility of a ‘roaring twenties’ for M&A activity. The combination of pent-up demand and reserves of savings (from both business and individuals) through the pandemic makes for a potentially great year for those on the acquisition trail and for those businesses who are looking to be acquired. Indeed, 2022 has started with a couple of multibillion pound mergers being announced and lots of talk of deals for this year as people look to make change after reflecting on their businesses over the last two years.

Simon confirmed that government spending in green energy and infrastructure is helping to fuel investment opportunities for industries and businesses alike.

People management

The way we employ people and take care of our workforce has changed almost beyond comparison since 2020. What was once an exception is becoming our 'new normal' and working from home is no longer limited to those solely with desk-based jobs. The pandemic has forced our nation to slow down and take stock; this is leading to the coining of new phrases highlighted by Jonathan, such as ‘hybrid working’, ‘the great resignation’ and ‘employee value proposition’ as companies look beyond basic remuneration packages and benefits, and employees seek environments where they are treated as an individual and have their wellbeing taken into account. Employers are now more than ever having to tap into the wants and needs of their workforce in a bid to retain their talent.

Simon discussed how economic factors are exacerbating this with pay growth and inflationary pressures, a challenge employees and employers will face over the coming year. Savings built up in the pandemic are starting to be used and with energy price rising in April and two more interest rate increases predicted by RSM, these pressures are only increasing.

Another side of the debate discussed by both Rik and Simon is the availability of your workforce. Do you rely on workers from the EU or other countries? And how is that impacting the recovery this year? Simon shared research from ONS and MigrantWatch UK which reveals a higher rate of job vacancies in sectors such as manufacturing, transport, construction and hospitality. Sectors who are typically resourced by a higher percentage of workforce from the EU.

How does this impact the insurance market?

The insurance market has hardened since the millennium and additional pressure has been added by the effects of Brexit and the pandemic. £1.3bn was paid in business interruption claims as a result of lockdown and covid restrictions1. This is money the insurance industry never anticipated paying out – it was written in a softer market and has resulted in significant losses for insurers.

Evident throughout the panel discussion is that we’re experiencing a rate of change never seen before. Some of these changes, whilst positive, could alter risk profiles or come with an increased claim cost; for example, with the adoption of electric vehicles we’re seeing an increased repair cost compared to petrol or diesel fleets.

Rik ended his insights with a glimmer of hope that we may be starting to see some early signs which indicate we’re coming to the end of the hard market, but nothing for certain yet.

Underpinning the discussion around our reimagined future was a note of caution from Rik to ensure whatever is happening in your business, businesses must work with their broker and continually assess whether their cover is reflective of their businesses’ current operating practices.

The discussion was rounded off with a thought-provocation from Simon; “a 200 year old oak tree is worthless in today’s society until it is cut down and used for timber. Is GDP the appropriate measure of output in today’s climate centric generation?”

Our full Directors Briefing ‘Reimagining the future for UK Business’ can be viewed on demand on here.

1. https://www.insuranceage.co.uk/insight/7922536/covid-bi-claims-payments-now-at-ps13bn

Gallagher is a risk management, insurance and HR/benefits consultancy and will be sharing their views in that capacity. This webinar is not intended to give legal or financial advice, and, accordingly, should not be relied upon for such. This should not be regarded as a comprehensive statement of the law and/or market practice in this area. In preparing this webinar we have relied on information sourced from third parties and we make no claims as to the completeness or accuracy of the information contained herein. It reflects our understanding as at the date of the webinar but you will recognise that matters concerning COVID-19 are fast changing across the world. You should not act upon information nor determine not to act, without first seeking specific specialist advice. Our advice to our clients is as an insurance broker and is provided subject to specific terms and conditions, the terms of which take precedence over any representations in this webinar. No third party to whom this is passed can rely on it. We and our officers, employees or agents shall not be responsible for any loss whatsoever arising from the recipient’s reliance upon any information we provide herein and exclude liability for the content to fullest extent permitted by law. Should you require advice about your specific arrangements or circumstances, please get in touch with Gallagher.