- ”Increasing cost of benefits within tight budgets” ranks second, followed by ”communication” in third place

- Employers are focusing on creating fair and equal workplaces to attract and retain talent

- Menopause remains a hidden workplace taboo - only around one in five (22.8%) have formal policies in place for women experiencing symptoms

- Two in five (43.8%) organisations fail to provide any form of financial advice amidst cost of living crisis

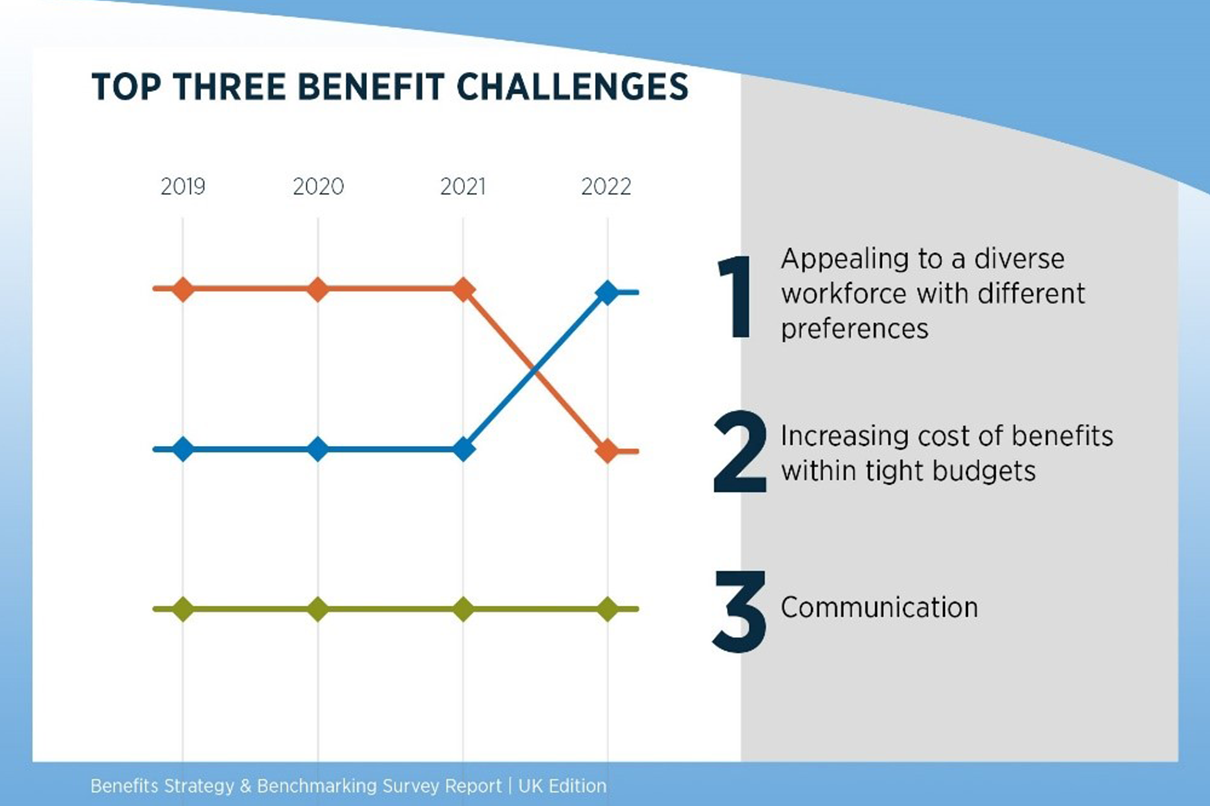

New research from Gallagher, a global leader in insurance brokerage, risk management, and consulting services, reveals that “appealing to a diverse workforce with different preferences” is the top challenge U.K. organisations are facing. “Increasing cost of benefits within tight budgets” ranks second, followed by “communication” in third place. The top three benefits challenges identified have remained the same the last three years - although this year, first and second have swapped places - putting “appealing to a diverse workforce” on top.

Of those employers who are planning changes, 79.1% will be enhancing benefits, an increase compared to last year (70.7%). Only 5.2% are looking to remove benefits, even in these difficult cost-crippling times - which shows that benefits are a valued part of the employment package. Data also reveals that 23.5% are going to change their delivery method and the same percentage are looking into changing their benefit provider.

Creating a fairer and more equal organisation

The research revealed the majority of employers haven’t implemented the right policies and tools needed to support women in the workplace who are experiencing the menopause – with only around one in five (22.8%) firms with formal policies in place. These findings reinforce the need to treat menopause like any other important workplace topic such as bullying. Where support for women during menopause exists, the type of help being offered ranges from flexible working policies (61.5%), employee forums/support groups (53.8%) and training for managers (42.3%). What’s clear is that if we want to create diverse and inclusive workplaces, employers need to do more to break down the stigma surrounding menopause.

Steve Threader, Managing Director, Reward and Benefit Consulting at Gallagher’s Benefits and HR Consulting Division in the U.K., said: “The connection between employee wellbeing and organisational wellbeing has become more significant. It’s encouraging to see that the desire to create flexibility is trending across the country, with 47.8% of employers wanting to improve it, in order to extend individual choice and to better support those who need it the most.”

Enhancing flexibility and diversity within organisations makes it easier to address employees’ needs as individuals and creates a greater Employee Value Proposition (EVP). For example, organisations are responding by providing additional family-friendly benefits so parents can opt to raise their children how they wish to, or grow their families in different ways. Employees’ family lifestyle choices are no longer a barrier to them receiving parental benefits. For example, 46.5% of employers offer enhanced shared parental leave on the same basis as maternity, an increase from 2021.

The rise in equal practices is transforming benefit plans, and we can expect to see firms using data to leverage communication tools more effectively and adopting best practices to compete for and retain talent - whilst strengthening their culture.

Keeping pace in light of tight budgets

The report findings come as economic growth slows and uncertainty soars – meaning this could be the biggest threat to employees’ mental health we’ve seen in recent years, even in light of the pandemic. In view of the large number of people being impacted by the cost of living squeeze, we were surprised that 43.8% of firms are failing to provide any form of financial education or advice to employees. The decision by the U.K. Government to cap domestic energy bills is positive, but are there also steps that employers can take to help employees navigate the months ahead as the cost of living crisis deepens?

The most forward-looking organisations are assisting their people to plan their retirement saving efficiently, and 23.2% say they are now offering access to an online solution (compared to just 20.9% last year). In addition, individual advice has slightly increased to 22.3% from 21.8% in 2021.

The Bank of England’s rise in interest rates to 3% is another blow to U.K. households already reeling from record levels of inflation.

Just under two months ago, Gallagher’s research2 revealed the stark reality of the U.K. spiraling towards a national debt crisis. Approximately one quarter of U.K. adults can’t afford to pay their debt payments some months or not at all. The bleakest numbers are for the under 35s - where 39% can’t pay some months. In London, where approximately one-third are unable to pay off some of their debts. This is also a huge concern given the cost of borrowing is rising aggressively.

“Recognising that inflation-busting pay rises are simply not possible for most organisations, there are other ways they can help to alleviate the stress and worry facing employees who are concerned about debt and their personal finances,” said Threader. “Financial wellbeing is ultimately about employees feeling that they have confidence, control and capacity in their finances. Companies providing money-saving benefits and practical tools to support their people – while communicating them effectively – will help employees through the cost-of-living crisis and those struggling with debt.”

Lack of internal communication can be a costly mistake

Gallagher’s data shows 73% of organisations are looking to improve internal communication – but as many as two thirds (68.6%) do not have a pre-defined benefits communication budget. Among those surveyed who had a communication budget, most allocated less than £10,000 per year. The use of a discount portal is one of the top (33.9%) methods used to communicate, followed by 17% using mental health/wellbeing apps.

“Although internal communication seems to be overlooked, our research shows 73% of the leaders surveyed realise its importance and the overall positive effect it has on the company - but they need to invest their time and money in its development properly. After all, an engaged workforce is happier, more productive and has a better understanding of the organisation’s strategy,” said Threader. “Communication isn’t just talking, it’s about connecting with individuals, bringing everyone with you on the same journey, so that the team works well together to deliver commercial success.“