In this article we look at the four most integral issues the global insurance market is facing. Plus, we look at the key risks that your business should be aware of in 2020, such as environmental responsibility, securing your supply chain, and avoiding social engineering risks.

The current market

According to a report from Swiss Re1, global growth has continued to slow, and it is expected that interest rates will remain low for a long period of time. The global economy is less resilient than it was in 2007, which means that the spectre of negative interest rates is looming for some countries, including the US. President Donald Trump has not hidden his preference for low rates2. However, for businesses across a range of sectors, this would have severe consequences for profitability3. There would be particular repercussions for the banking and insurance sectors, which could have a further knock on effect on the ability for companies to do business. While generally positive for consumers on account of access to cheap loans, on the whole, negative rates can dent market confidence.

For the global insurance market, currently in a ‘hard market’ cycle, which sees premiums rise and insurers being more selective of the risks (and clients) that they choose to underwrite, insurers are being forced to realign their product mix and investment activities as they seek to shore up reserves and as others seek to force a return to profitability.

How insurers need to evolve

A hard market requires more work from insurers to ensure that their clients have access to the right levels and types of cover. One of the key requirements for insurers is the need to meet expanding customer expectations; their insurance needs are growing and businesses expect more than a standard insurance package.

A study from Deloitte4 revealed that 62% of those polled believed that new, non-traditional products are crucial for attracting customers, including cyber response support, security and household services. Currently, there may be a gap between what clients expect and the service they receive, and rapid response to queries and fast quotes are one area which needs improvement. Cyber is one area which can generate an opportunity for this, as businesses look to their insurer not only for great products but also genuine advice on risk, and cover that they can trust.

To achieve this however, insurance companies need to attract and retain the right talent. To do this, they need to show a commitment to innovation, a willingness to utilise new technology and a dedication to accountability. Technology isn’t the only factor though, human and cultural factors are just as important.

Responding to regulation

The unprecedented pace of technological change has led to the need for new regulations. At present, we have seen gaps where regulation requirements cannot be defined as quickly as insurers can innovate. This can be problematic, as there is a chance that instead of being dynamic, regulators could just ban technologies that they do not understand. There will always be a tension between innovation and regulation, but the forward-thinking insurer will work to engage with regulators so that they can evolve the sector together.

What should your business be looking to do?

The digital revolution shows no signs of slowing down, so if your business hasn’t already it should be looking to map and mitigate cyber exposures. Financial crime is changing, and fraud such as social engineering and identity theft show no signs of abating with 62% of small businesses experiencing a phishing or social engineering attack5. While these crimes cannot always be prevented, it’s important that your staff are educated on what signs to look for and when to escalate their concerns.

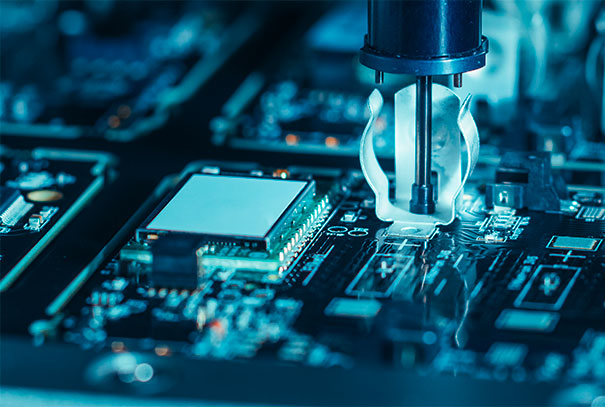

Artificial Intelligence (AI) and block chain technology are transforming how businesses operate, from improved customer service, to revolutionising how patients’ medical data is accessed. It is worth taking the time to assess how new technologies can fit into your business plan, as early adopters are sure to reap rewards.

Businesses should also be taking the time to ensure they are accountable for their actions. Integrity is more important to consumers than ever before, especially when it comes to the environment. Not only are your customers more likely to ostracise you if you fail to justify your carbon footprint, but also regulation is moving towards heavier fines for those that don’t make active changes. Four out of ten customers now prioritise food and drink that has a minimal impact on the environment; even if your business is not in this sector, this trend could still impact you as 62% of people polled by Accenture wanted companies that display clear, authentic ethical values6.

Reputation is important too. A recent survey showed that 62% of customers won’t trust a company that has behaved unethically towards employees and suppliers7. Most companies accept this but don’t realise their reputation is not just about senior leadership or those in your employ - it extends throughout your supply chain. A supplier could be involved in a ‘Me-too’, child labour or employee safety crisis which could impact you through association. Plausible denial isn’t enough, customers expect you to actively assess those you choose to do business with and to make an ethical choice.

Ensure you fully understand your supply chain, take steps to minimise potential risks accordingly, and have a plan in place in case your business gets caught up in a crisis.

1. www.swissre.com/dam/jcr:60421a3b-f246-4718-8374-f4170d52b492/global-economic-and-insurance-outlook-2021.pdf

2. www.nytimes.com/2019/09/11/business/economy/trump-fed-negative-interest-rates.html

3. www.ft.com/content/7efcedb4-ea25-11e9-85f4-d00e5018f061

4. www2.deloitte.com/content/campaigns/uk/insurancetrends/insurancetrends/insurancetrends.html

5. www.cybintsolutions.com/cyber-security-facts-stats/

6. fairtrade.org.uk/Media-Centre/Blog/2019/May/Shoppers-are-demanding-sustainable-options-are-companies-getting-on-board

7. www.saiglobal.com/hub/blog/5-reputational-risk-predictions-for-2019