With a post COVID recovery in sight and an ever changing working environment, there are so many more options available to employees. It is clear that some employers are responding to this and reflecting it in their total reward offering. ‘Appealing to a diverse workforce with different preferences’ has been in the top three benefit challenges for organisations for the past three years.

Diverse workforces are impacting how benefits are viewed particularly when it comes to Financial Wellbeing. Organisations are realising they need to be offering the same to all levels, with less emphasis on service or status based benefit approaches, and shift towards a more values based rewards approach.

The biggest shift we are seeing is pension related, with auto enrolment obligations contributing to the changing pension landscape. Since April 2019 a minimum contribution of 8% is required, which includes a minimum employer contribution of 3%. Gallagher’s 2021 Benefits Strategy & Benchmarking Report shows that 87.7% of organisations offer retirement savings in excess of the current statutory minimum, up by just under three 3% compared to last year. We are also seeing more organisations adopting an Environmental, Social and Governance (ESG) Strategy, so it follows that of those organisation, 28% have applied this to their pension fund investment approach, and related communications to employees.

The Executive Pensions landscape continues to evolve, with the additional restrictions to the Lifetime Allowance, and also the Annual Allowance in recent years, having an impact on an increasing number of higher earners. An ever-growing number of employers take the view that this is a matter the employee’s responsibility, so are not taking measures to compensate affected individuals for their losses. In view of the large number of employees being impacted by the Lifetime and Annual Allowances changes, it is surprising how few organisations provide any form of financial education or advice to employees. However, we are seeing an upward trend in the overall provision of financial education compared to last year. With the most effective type of financial support being Group Advice and Individual Advice.

Risk benefits protect employees against the contingencies of life and are typically purchased as insured benefits. It is common across all sectors to provide some form of life insurance, with 84% of respondent organisations offering Life Assurance or death in service benefits. Income Protection, also known as Permanent Health Insurance or Long-Term Disability cover, is found in just under half of organisations. 74% of those who offer this benefit offer it to all employees, which is up on last year again reflecting the trend to harmonise benefits eligibility. 18% have eligibility based on job category or level, reducing over the last two years and in line with trends towards single status benefits. Company funded Critical illness is being offered by an increasingly larger number of participants – 19.8% this year compared to 19.8% last year and 17.2% in 2019.

The prevalence of savings plans, whether cash or share based, is strikingly low. Those employers which do provide such plans tend to rely on tax authority approved share plans, such as the US Employee Stock Purchase Plan, which permits employees to purchase shares at a discount and the UK Sharesave or Share Incentive Plans.

Big strides have also been made in the equalisation of gender allowances for maternity and paternity pay, which is having a positive impact financially. This shows an emphasis from employers on family friendly benefits. There has been a move away from statutory only maternity and paternity over the last few years, with paid paternity becoming the norm. Organisation are also providing more than 2 weeks paid leave is up with 41% of father’s being offered shared parental leave on the same basis as maternity.

All figures stated are taken from the Gallagher, Benefits Strategy & Benchmarking Survey 2021

Pursuing ‘better’ is an ongoing journey. Employers—of all shapes and sizes, in all parts of the world—are acutely aware that people’s expectations have changed. They expect better from the organizations, companies and brands they invest in. And nowhere is an individual’s investment—and their expectation for better-- more apparent than the employer they choose to work for.

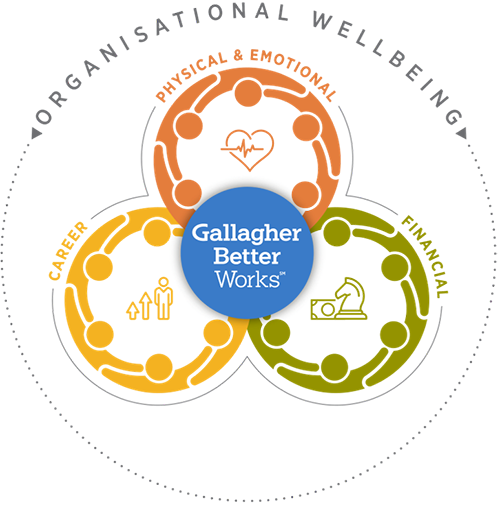

Now more than ever, employers have an opportunity to deliver a better employee experience. Building a workplace that works better means helping your employees succeed by supporting their investment in themselves, their communities and their organization’s success. Gallagher Better WorksSM is a comprehensive approach to your people strategy that aligns the diverse expectations of your employees with your overall business goals. Using data-driven insights and strategy, Gallagher Better WorksSM empowers your organization to competitively recruit, retain and retire the most vital talent through intentional, sustainable investments in your people’s physical, emotional, financial and career wellbeing.